If you ask me today in which sector would I like to invest? I would, in turn, ask, show me a sector which has all the following ingredients: disruption, digitisation, technology, consumption, retail, national presence, and more importantly, access to real billion customers.

So, what’s the sector I am talking about? It’s an age old business that we all know as banking. But there is no denying that, for all its potential, over the past five years, banks have proved to be the biggest wealth destroyers. Yes, I am talking about public sector banks (PSBs).

Although in the Bull Run of 2003-2007, PSBs were the biggest wealth creators. Post 2008, they expanded, opened a lot of branches, added many new accounts, upgraded their technology but yet destroyed wealth mainly because of mismanagement, greed, corruption and government interference. The concept was never wrong, but it was sloppy execution and dubious intent that, at the end, did them in. In the end, private sector banks made the most of the failures of PSBs. They understood the forthcoming growth opportunities; saw millions of unbanked people in urban, semi-urban and rural areas, mushrooming demand from corporate. With a tight control on disbursement, professional management, technology, flexible services, zilch political interferences, private sector banks have proved to be the biggest wealth creator for the past five to 10 years. In fact, I believe for the next five, ten or 20 years, too, private sector banks will call the shots.

Various reports suggest that India’s banking industry could become the fifth largest banking sector globally by 2020 and the third largest by 2025. In the next 5-10 years, the sector is expected to create up to two million new jobs driven by the efforts of the RBI and the government to provide access to financial services to people in rural areas. Total banking assets in India is expected to cross $28.5 trillion in FY25. Retail banking will be immensely benefited from the Indian demographic dividend. Mortgages would grow fast and likely to cross Rs.40 trillion by 2020. Branches and ATMs will need to grow 2X and 5X, respectively, to serve the huge addition to bankable population. Low cost branch network with smaller sized branches will be adopted.

The shift from cash to a cashless economy, that is currently taking place, will drive growth in many a sector. Banks are likely to emerge as the biggest beneficiary from this disruption as people, who previously went to private moneylenders and small NBFCs for their needs, can now use the network of well-established banks for their home, tractor and personal loans. This would bring in the much needed credit offtake for the banking industry as a whole.

Sitting pretty

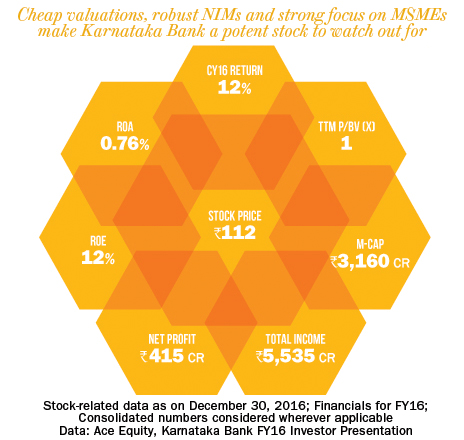

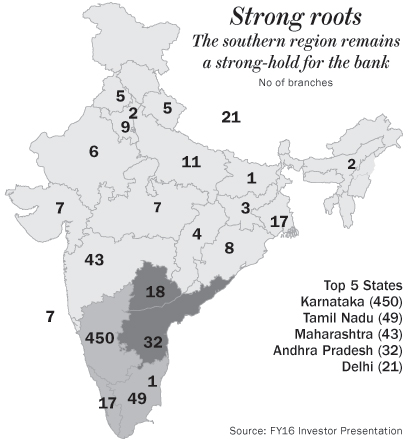

I have invested in Karnataka Bank (KBL) as it is the most technology savvy private sector bank available at PSB valuations. In fact, KBL was the first bank to adopt the Infosys’ flagship product ‘Finacle’. The Mangaluru-based bank, incorporated in 1924, today, has a pan-India presence with 733 branches and 1,297 ATMs. The bank has strategically expanded its presence across segments; metro (25%), urban (29%), semi-urban (24%) and rural (22%), reaching over 7.5 million customers.

The bank has been awarded several awards for adoption of new technologies and for its outstanding performance in the MSME segment, which will be the main driver of future growth. The bank has entered into a co-financing agreement with Reliance Capital to provide loans for the MSME segment. It has also entered into alliance with Ashok Leyland, Tata Motors, BEML and TVS Motors for purchase of vehicles by micro and small enterprises. Advances in the MSME segment have grown significantly to Rs.8,131 crore in June 2016 against Rs.6,588 crore in June 2015.

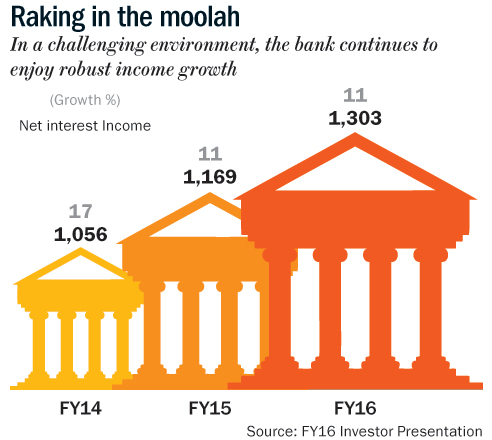

In the recent past, deteriorating asset quality has become the biggest challenge for banking industry which, in turn, has destroyed the balance sheet of many banks. KBL has also seen some of its some of corporate loans turn bad. But despite the challenging economic situation, KBL has shown improved performance and aggressively focusing on recoveries and strengthening its balance sheet. In Q2FY17, net interest income came in at Rs.397 crore, a growth of 29% (YoY)— among the best compared to its peers DCB, CUB and Federal Bank’s NII, which grew 27%, 25.45% and 19% respectively. KBL’s net interest margin, too, improved to 2.69% during the second quarter in line with its vision document, while that of DCB, CUB and Federal Bank’s have either remained stable or worsened.

KBL has clocked a total business of Rs.89,707 crore and has set a target to double its turnover by 2020. Even if absolute NPAs do not improve, remain at similar levels and the turnover does double by the stated period, the NPA ratios will drastically improve and make the balance sheet healthy. The recent rights issue has provided enough capital to meet Basel III norms. KBL also plans to take forward its digital banking initiatives in a big way and increase its branches to 1,000 locations and ATMs to 2,500 compared with its current network of 733 branches and 1297 ATMs.

The bank is targeting to have a NIM of over 3% by March 2020 with gross NPAs and net NPAs projected to be less than 1.5% and 0.6% respectively. More importantly, it plans to double its turnover to Rs.180,000 crore over the next three years. Going by KBL’s recent performance and change in the approach of management, we feel that it will achieve its target well ahead of its own projections. Incidentally, at the current market price, the stock is available at a price to book value (P/B) of 0.70x. Normally, banks with NIMs in excess of 3% with low NPAs gets valued at 2-3x P/B. With the improvement in the overall performance and focus on improving CASA, the prospects for KBL looks more than bright.

The writer has a position in the stock