During the pandemic, Pharmeasy was the go-to destination for Mumbai’s Priti Khakkar for all things medical. She would use it to order medicines for her family, rapid RTPCR COVID-testing kits for her parents in another part of town and even book diagnostics tests.

Health-tech start-ups mull converging with healthcare incumbents to get a clean bill of health

The fillip they received during and after the pandemic notwithstanding, these start-ups must now expand their businesses across multiple domains and partner with leading healthcare giants to build a patient-centric ecosystem.

Today, though, she has fallen back to her earlier habit of calling the local pharmacy to send her blood pressure and diabetes medicines, often at a discounted rate, and consult physicians in person. “The personal connect makes all the difference,” she said.

India’s health-tech startups, which found a new lease of life post the Covid-19 pandemic, are reading the writing on the way. They have realised that one way of staying in the pink of fiscal health is by converging with incumbent healthcare giants. This collaboration will help them expand their business across multiple domains as they attempt to build sustainable business models, industry watchers told Outlook Start-Up.

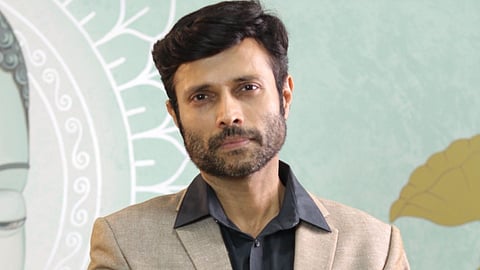

“Convergence for sure is the way forward; not every hospital will have their own medical software; most of them will have to work with existing players – like it or not there is going to be convergence,” Dr Arun Kalyanasundaram, Director, Promed Hospital said. At the same time, most startups have tech platforms that can be linked to hospitals’ existing network so that patients get all the support they want on the go.

The incumbent healthcare facilities are also pushed to collaborate and align themselves with the paradigm shift. “Hospitals need a technology layer or software like middleware. Hence, a lot of B2B adoption is likely this year and the next,” said W Health Ventures Principal Namit Chugh.

Having realised this, Wellness Forever has set up pharmacies in hospitals, which tune into its digital platform for inventory management. “If a medicine is unavailable in a particular pharmacy, our system alerts the team about the nearest Wellness Forever pharmacy where they can get it from,” said the company’s senior VP-Pharma, Sudhakar Sharma, “ensuring that we maintain ‘Continuity of Service’ throughout.”

Patients Pushing The Cart

This cohabitation business model is being driven by patients and their changing expectations of healthcare. For long they had little control over their medical records and data, but the disruption in healthcare is rapidly changing that.

“The patient of the future is going to be completely different and more demanding with the kind of access to information they have. Today, they have a lot of self-awareness thanks to the wearables, digital devices and apps they use,” said Antony Prashant, life-sciences and healthcare consulting leader and partner at Deloitte.

Doctors in incumbent hospitals also acknowledged the increasing control in the hands of patients. The revolution in healthcare is making the system more patient-centric, where they should be able to access healthcare and healthcare technologies in a more patient-friendly way.

With such an approach, more customers push hospitals to adopt new technology requiring them to adapt or perish, Dr Kalyanasundaram noted. Hence, hospitals are increasingly eager to partner with health-tech startups to digitise or automate their clinal workflows. After all, it is easier to work with startups who can plug the gaps in their digital structure, than build it up from scratch.

Attract, Address, Repeat

The early wave of tech-driven innovations in India’s healthcare was witnessed around 2014 mostly in areas like tele-consultation, diagnostics and e-pharmacy offerings. To capitalise on this growing interest, startups started adding a technology-enabled layer to connect with the existing physical infrastructure such as brick-and-mortar pharmacies and clinics, with the likes of Practo, Tata 1mg and MediBuddy leading this digital transformation.

However, these services, especially consultation, saw a low repeat rate and dimmed path to profitability before the pandemic since people were not used to online or teleconsultations. MedPay’s Chandra said that while the pandemic pushed up the repeat rate for these services, the post-pandemic correction brought down the adoption again, as people preferred to consult doctors in person, something that users like Kakkar admit.

To speed up their path to profitability, some startups laid off employees. At least 1,000 employees were shown the door by top startups including Pristyn Care, Practo, MediBuddy and Mojocare, as per layoff-tracking platform Layoffs.fyi. But this stop-gap move could not address their key concern—business optimisation.

With their fingers on the pulse of evolving trends, they realised that banking on a single service was imprudent, even if it provided ease and convenience for the users. They had to move into multiple domains such as e-pharmacies, providing online booking of appointments and teleconsultations, suggesting elective surgeries at the right pricing, and even assistance with insurance claims.

W Health Ventures’ Chugh explained that while most of these startups began with something along these lines as their core service, they must now provide affiliated offerings as part of the evolutionary curve. Building business over multiple domains is the best way to increase their order repeat rate and do justice to the growing customer acquisition costs.

Fortunately, they can learn from their peers in fintech and e-commerce who faced a similar challenge, post-pandemic. “Startups follow a foot-in-door approach by first offering a single tech product and getting it right. They then enter multiple services by expanding their portfolio and building different monetisation pools,” said Anurag Begwani, an investor at Bessemer Venture Partners.

Profitability And Drying Funds

For at least a decade now, top valued health-tech startups including Tata 1mg, Practo and MediBuddy have been trying to solve a multitude of problems in the healthcare sector such as unifying patient data, connecting and taking online the deeply fragmented brick-and-mortar pharmacies and facilitating tele-consultations, to name a few.

However, profitability seems to be elusive for most since barely three companies – Molbio Diagnostics, CitiusTech and Innovaccer Analytics – out of the 15 have registered a net profit in green for FY23 or FY22, as per data from PrivateCircle.

What has compounded this challenge for health-tech startups is the steady drop in funding at all stages–seed, early and late, which had reached a peak of $3.7 billion in 2021. Cut to 2023, and this sector raised just a little over $700 million, less than half of what it managed to raise in 2022, as per data from private equity platform Tracxn.

While the slowdown in funding has afflicted most startup sectors, this drop was more pronounced in the health-tech space. Industry players attributed this to a prolonged incubation time in the sector.

“Redefining healthcare solutions often requires a decade or more,” said Bessemer’s Anurag. The venture capital (VC) firm has invested in at least half a dozen Indian health-tech startups including Pharmeasy, Nova Benefits and MediBuddy (formerly DocsApp).

Startup founders also agreed that building a scalable company means juggling tech-first initiatives with an offline model with oscillating adoption rates, leading to complex stakeholder dynamics. Moreover, this is traditionally a high-cost venture with opaque revenue-generating opportunities.

“Healthcare needs a long time to become profitable. It takes at least a decade to crack healthcare in India,” said Ravi Chandra M, Co-Founder and CEO, MedPay. This is compounded by issues like adhering to stringent regulatory compliance as well as data privacy and security guardrails.

What makes this journey even more challenging is that there are restrictions on advertising, mapping varying customer journeys, simplifying complex content and balancing it with data sensitivity.

Technology intervention in healthcare is in its nascent stage with a majority of users still choosing offline or traditional methods of health-related interactions. Startups in this sector can move towards profitability only after adoption picks up at scale, bringing down the need for incentivisation and related costs, added Chandra.

Another founder pointed out that investors often choose to put their money in a sector that doesn’t have such a long gestation period so that they can showcase faster yields to their LPs. “If investors don’t have an inclination towards any specific sector in their thesis, then they may prefer another sector,” said Arpit Paliwal, Director of HRS Navigation.

Government’s Role in a Connected Health Infrastructure

While the Union government’s Ayushman Bharat Digital Mission (ABDM) initiative has taken off gradually, Chugh expects Ayushman Bharat Health Accounts (ABHA) to become mandatory like Aadhaar over time. This can be the succour the health-tech start-up sector has been waiting for.

The Union government is attempting to build a UPI-like common health interface for all citizens through its ABDM initiative. Through this, it aims to build a network of Verified Health Facilities, Verified Healthcare Professionals and ABHA.

To date, the initiative has witnessed the creation of 58 crore ABHAs, digitisation of 35.5 crore health records and verification of 2.39 lakh healthcare facilities and 2.94 lakh healthcare professionals. Until the ABDM takes off effectively, health-tech startups have an uphill task ahead to bring all the stakeholders together by partnering with incumbents across various domains.

Till then, having a symbiotic relationship with larger healthcare companies will help these health-tech startups to keep the lights burning.