The September quarter earnings season is underway and the results so far are on the expected lines. The earnings growth was driven by sectors such as banking, financial services and insurance (BFSI), auto, and capital goods however the IT companies failed to impress markets.

Higher Margins Help India Inc Post Higher Profits On Muted Volume Growth In Sept Quarter

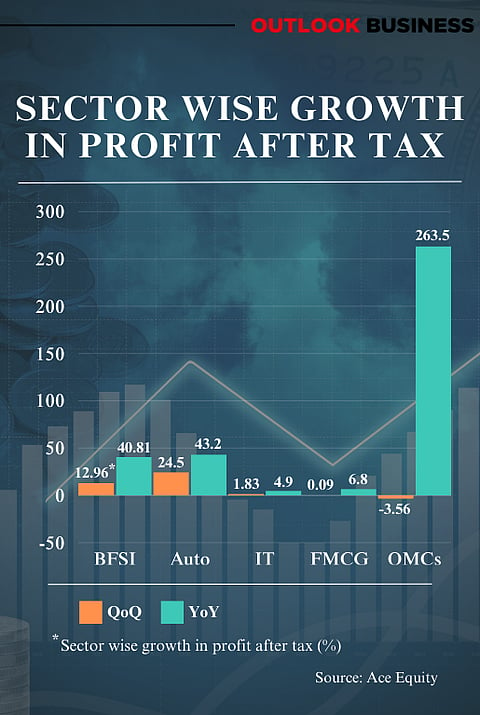

In the September quarter FY24, BFSI, Auto and Oil & Gas sectors dominated the earnings season with significant growth in profits as well as revenue. On the other hand, sectors like FMCG and IT failed to impress markets with muted growth in both top and bottomline numbers.

According to an analysis of 218 companies from NSE 500, aggregate profit after tax (PAT) has increased 51.8 per cent year-on-year (YoY) in the September quarter, while combined total revenue grew 6.5 per cent YoY. The companies’ EBITDA (earnings before interest, taxes, depreciation, and amortization) increased 43.6 per cent YoY in the September quarter. These companies constitute 60-70 per cent results in broader weight terms.

On a sequential basis, aggregate PAT surged 5.72 per cent, EBITDA grew 7 per cent, and aggregate revenue increased by 3.6 per cent.

Kranthi Bathini of WealthMills Securities says that despite the muted growth in revenue there has been a significant growth in profitability on the back of improvement in margins and lower input costs across sectors.

Bathini added that losses in one sector lead to gains in other related sectors. For instance, the slowdown in metal prices has benefitted other sectors such as Auto & auto components, engineering, construction, capital goods, and infrastructure.

Excluding the BFSI sector, combined total revenue has remained flat while combined profit after tax has grown by a whopping 59 per cent on a year-on-year basis.

Vinod Nair Head of Research at Geojit Financial Services says that the Q2 results are better than the forecasts. “The surprise witnessed in Q1 performance is being echoed healthier, with a slight upswing in volume outlook and a rapid expansion in operating margin. Though the total demand is at a moderate growth, revenue growth is at the lower double digits, the overall volume growth is steady owing to the blend of both domestic and outsourced demand,” he said.

“The dip in global inflation including prices of crude, metals, chemicals, and food has not only benefited Indian corporates but has also significantly augmented their EBITDA margin. Additionally, the spillover of productivity to the bottom line is led by the lean balance sheet position of the corporates,” Nair added.

Tanvi Kanchan, Head of Corporate Strategy at Anand Rathi Shares and Stock Brokers said that the banking and financial companies have performed exceptionally well both in terms of growth and profitability. On the other hand, the IT sector has remained muted with mid-single digit growth and is expected to remain so in the next quarter as well. FMCG companies have also witnessed growth in mid-single digits but are likely to improve going ahead.

BFSI, Auto Key Drivers Of Growth

The BSFI sector clocked a growth of 32.9 per cent YoY in aggregate revenue, aggregate profit after tax surged 40.8 per cent, and EBITDA 48 per cent.

Banks’ earnings growth has largely stood in line, owing to steady loan growth and robust asset quality despite pressure on the margins. Asset quality has improved while SMA (special mention account) and restructured pool have remained in control, according to a report by Motilal Oswal Financial Services.

In NBFCs (non-banking financial companies), demand momentum has remained strong so far in personal utility vehicles and commercial vehicles. “While lower-ticket housing demand has been buoyant, a weakness has been observed in affordable housing below ticket size of Rs 30 lakhs,” the report added.

Good credit growth from both private and household sources also helped the growth in the finance sector, said Nair.

According to Kanchan, auto, infra, and consumer durables, performed decently in terms of growth as well as maintained or marginally improved profitability.

The automobile and ancillaries witnessed revenue from operations growth of 15.7 per YoY while profit after tax increased 43.2 per cent YoY. Compared to the June 2023 quarter, revenue from operations rose 9.9 per cent and profits increased 24.5 per cent.

Infrastructure companies reported 20.3 per cent YoY growth in aggregate revenue from operations and 49.5 per cent growth in net profit. On a quarter-on-quarter basis, the sector witnessed a 6.21 per cent growth in revenue from operations and a 13.6 per cent growth in net profit

IT Sector Remains Muted With Single-Digit Growth

During the July-September quarter, the combined revenue of 24 IT companies including the large caps like TCS, Infosys, and Wipro, grew 6.8% YoY, and combined PAT witnessed single-digit growth of 4.9 per cent.

On a quarter-on-quarter basis, combined revenue rose 1.09 per cent and the PAT increased 1.8 per cent.

Large caps including TCS, Infosys, and HCLT reported record-high TCV (total contract value) of deal wins, on the back of a strong flow of mega deals, driven by cost optimization initiatives of clients.

“The decline underlies weak volumes and muted near-term outlook for discretionary demand revival. Attrition rates continued a sharp descent. Companies are pulling back on fresher hiring targets. The focus is on redeploying existing talent wherever projects are available, given the headwind from delays and pauses in certain projects/programs,” Kotak Institutional Equities said in a note.

According to Kotak IE, companies are a lot more aggressive in controlling costs compared to the beginning of the year stance. “Costs are being aligned to actual demand as the anticipated quick recovery did not materialize. Companies flexed a few levers to defend margins. These include raising utilization rates, increasing productivity measures, lowering the average cost of resources, further cutting Subcon costs (sufficiently optimized by now), and managing SG&A,” it added.

Piyush Pandey, VP – Institutional Equity Research at YES Securities said, “IT sector’s performance has remained muted during the July-September quarter of FY24 and revenue growth has been barely 1 per cent on the sequential basis due to delay in the ramp-up of recently signed deals and lower discretionary tech spending. However, Tier-2 IT companies have performed well compared to the large-cap companies.”

“Notably, deal booking remained robust for most IT companies,” he said.

Pandey added that net headcount declined across companies due to reduced intake of freshers and backfilling of attrition but there have been no significant layoffs.

FMCG Suffers On Low Volume, Heightened Competition

In the FMCG sector, the combined revenue of nine Nifty 500 companies grew 4.1 per cent YoY, and PAT rose 6.8 per cent YoY. The combined revenue of Hindustan Unilever Ltd (Rs 15,623 crore) and ITC Ltd (Rs 19,270 crore) constituted around 73 per cent of total revenue of Rs 47,597.6 crore.

According to analysts at Motilal Oswal, ITC’s other FMCG business excluding cigarettes, showed subdued demand and also faced high competition from local and regional players like other large FMCG companies, in the backdrop of commodity price deflation.

Hindustan Unilever witnessed only 2 per cent growth in volumes as regional players outperformed larger companies during the quarter. Rural demand remained subdued, with volumes continuing to decline marginally on a two-year basis. Analysts expect rural sentiment to improve during the festive season.

Oil & Gas companies did not report meaningful growth being large sectors but showed significant improvement in growth.

Four major oil marketing companies (OMCs) including Reliance Industries, reported a 6.8 per cent YoY decline in combined revenue from operations while profit after tax jumped 263 per cent. On a sequential basis, combined revenue from operations declined 1.63 per cent and profits fell 3.5 per cent.

Growth in the profitability of OMCs came on the back of a strong refining business, which was partially offset by a decline in marketing margins. Last year, OMCs suffered losses due to high crude oil prices as retail selling prices of petrol/diesel remained unchanged.

Among other sectors, chemicals continued to underperform with negative growth in both sales and profitability. Healthcare companies including Dr Reddy’s Torrent Pharma, Cipla, etc showed high single-digit growth but shown better profitability and improved margins.

According to Nair, a slowdown is witnessed in the telecom sector due to high capex and stables like Agri due to high inflation costs and low demand from rural demand.