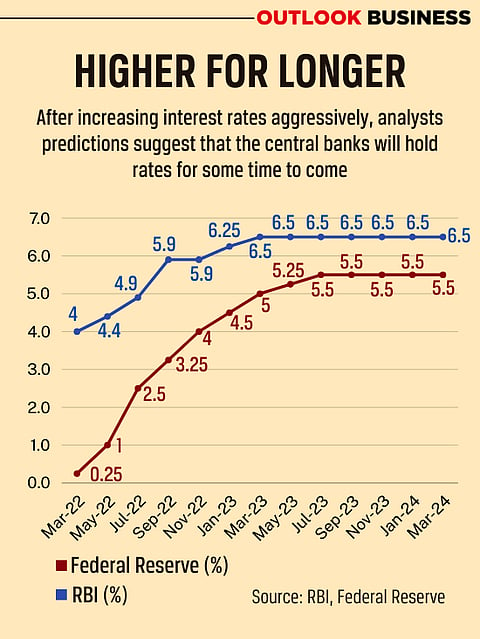

At the start of 2024, economists and market observers were firm in their belief that the year would bring a much-awaited decline in interest rates. The base case was simple: Central banks across the world will start cutting rates aggressively as inflation cools. All eyes were on the Federal Reserve which hiked its interest rates aggressively two years ago in hopes of controlling skyrocketing inflation.

How Fed’s Higher-for-Longer Strategy May Affect Indian Markets, Companies and the Central Bank

Developments in April have forced global and domestic analysts to revise their predictions of an aggressive easing of interest rates across the United States and India. With higher-for-longer now a consensus, will it change the calculations of the Indian central bank, markets and companies?

Four months later, the picture changed dramatically. The CME FedWatch tool—a tool that acts as a barometer for the market’s expectation of potential changes to the fed funds target rate—put the probability of a rate cut in the June Federal Open Market Committee (FOMC) at 98.5 per cent in January this year. On April 23, this probability shifted to 83.46 per cent for no rate cuts at the meeting scheduled in June.

The United States’ central bank is not the only central bank from which the expectation of an easing of monetary policy receded. Global investment bank Morgan Stanley said in a note earlier this year that the Reserve Bank of India (RBI) will not cut rates at all in the financial year ending March 31, 2025.

“We believe that improving productivity growth, rising investment rate and inflation tracking above the target of 4 per cent, alongside a higher terminal Fed funds rate, warrant higher real rates,” the Morgan Stanley report had said.

Equity markets are disappointed with this change in sentiment. India’s benchmark index Sensex fell below 72,500 before retracing back due to domestic investors' buying over the last month. The Nasdaq in the US has seen a 3.91 per cent drop in the same period. Things, evidently, have not gone according to plan.

The Trouble with Everything Rallying

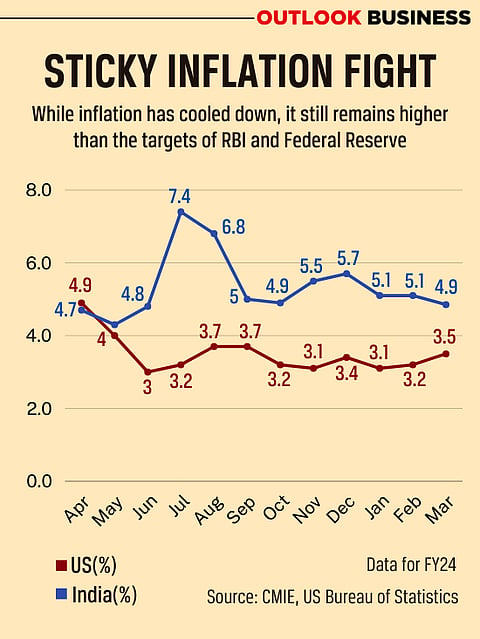

In India, the RBI is probably relieved at inflation remaining in the 4–6 per cent zone. In March, the Consumer Price Index (CPI) inflation was at 4.85 per cent, lower than 5.09 per cent recorded in February. But this is still above the 4 per cent target of the central bank.

The United States saw CPI inflation rise to 3.5 per cent from 3.2 per cent in March. The Personal Consumption Expenditure (PCE) index inflation, which the Fed targets, was at 2.7 per cent in March. This is above the 2 per cent target.

What has become increasingly clear is that both central banks are growing increasingly cautious about the last mile of the disinflation battle.

Suman Chowdhary, chief economist and head of research at Acuite Ratings and Research, says inflation is proving to be sticky. “For both the central banks, the last mile of this disinflation fight is proving to be challenging. This has made predicting the trajectory of rate cuts difficult,” he says. According to Chowdhary, the problem for the central banks is exacerbated by the fact that commodity prices are also witnessing a rally.

From equity to commodity markets, everything is in a rally. Gold prices have gone up 14 per cent in India. Copper prices have seen a 14.4 per cent rise and aluminium prices have surged by 9 per cent.

Brent crude prices have gone up by 10 per cent this year after restrictions imposed on supply from countries part of the Organization for Economic Co-operation and Development (OECD) and tensions in West Asia. Goldman Sachs has predicted that oil prices will move in the range of $70–100 per barrel this year. It is currently priced at $83 per barrel.

This has led central banks to keep rates high for longer. Jereme Powell, the chief of the Federal Reserve, said in April that the central bank will have no problem in holding the rates higher for longer. “Recent data have clearly not given us greater confidence [that inflation is coming under control]. Instead indicate that it is likely to take longer than expected to achieve that confidence,” he said.

Only a month before making this statement, Powell had said at a US Senate hearing that the Fed was not far from gaining the confidence needed to cut interest rates. A month of disappointing data print seems to have changed the outlook. This changing calculation has implications for India.

A Higher-for-Longer Reality

Chowdhary says the markets had started pricing in the rate cuts in November last year. “I think the market got too excited about the possibility of rate cuts. The anticipated timeline looked premature,” he adds.

With hope of rate cuts fading, there has been an increase in bond yields in the United States. In the beginning of April, the 10-year government bond yield stood at 4.3 per cent, which has since increased to 4.6 per cent. This is a significant leap from 3.9 per cent at the start of 2024.

The firming up of bond yields has resulted in an outflow of foreign funds from Indian markets in April. Between April 1 and April 26, foreign investors withdrew Rs 6,304 crore from equity markets. Market observers say investors are now making decisions accepting the reality that the rates will stay higher longer.

In a note on the market’s performance recently, Dr VK Vijayakumar, chief investment strategist at Geojit Financial Services, said, “The major negative in the market continues to be the sustained selling by FIIs [Foreign Institutional Investor(s)], triggered by the high bond yields in the US. This selling of FIIs, in both equity and debt, will continue to weigh on markets as long as the US bond yields remain high, which, in turn, will be decided by the US inflation numbers.”

If rates in the US remain high, market observers believe RBI will wait and watch. Brokerage firm Elara Capital said in a report on Monday that increasing upside risk to US inflation, firming up of commodity prices due to Chinese economic recovery and sticky food inflation in India have emerged as key risks for RBI. “In this backdrop, we expect the MPC [Monetary Policy Committee] to hold the policy repo rate through CY24 [cyclical year 2024] — expect first rate cut only by Q4FY25 versus prior expectation of Q3FY25.”

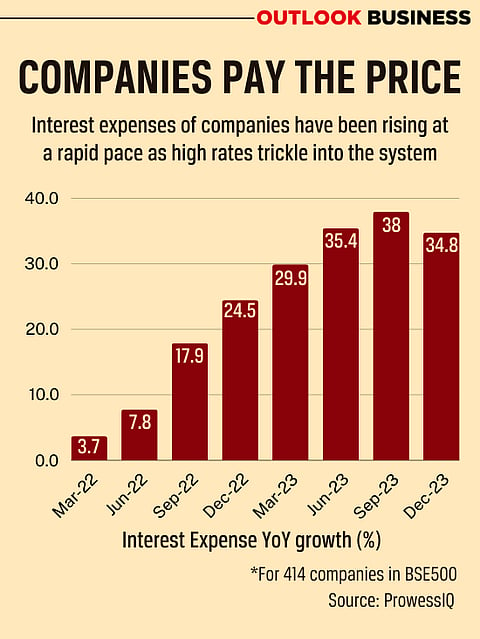

Indian companies will not be happy with interest rates staying high. An analysis of 414 companies in the BSE500 index using Prowess IQ data showed that interest expenses of the companies have surged in the last few quarters. From just three per cent year-on-year growth in aggregate interest expenses in the last quarter of the 2022 financial year, interest expenditure went up to 34.7 per cent in the third quarter of the 2024 financial year.

With companies already struggling to grow their revenues, and consequently having profit margins under strain, a rise in interest expenses is not good news. Market intelligence firm Crisil said in a note on Monday that India Inc.’s revenue growth moderated to 4–6 per cent in the fourth quarter of the 2024 financial year, the slowest since the economy started recovering from the pandemic-induced slowdown in September of 2024.

The recently concluded FOMC meeting reiterated the American central bank’s higher-for-longer stance. Indian markets, companies and the RBI are likely to be recalibrating their strategies to prepare for a reality which has caught many by surprise.