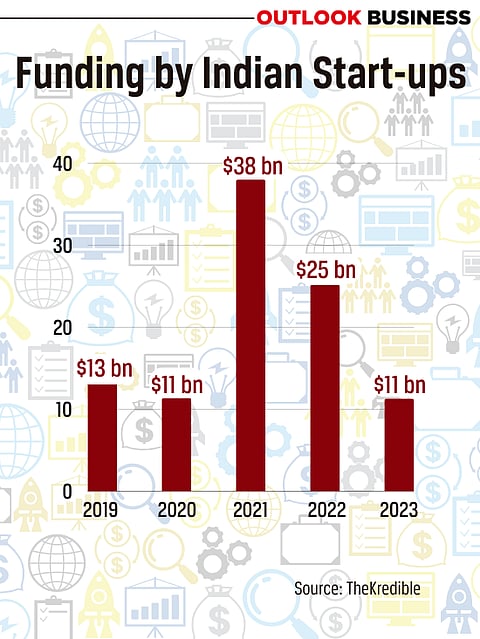

In the now long-drawn funding winter in the Indian start-up ecosystem, sleep does not come easily to founders. Especially now, when they are haunted by Income Tax notices.

Income Tax Notices Are Haunting Indian Start-Up Founders’ Dreams. The Government Can End The Nightmare

Unwarranted Income Tax notices are appearing at the doorsteps of Indian start-up founders, making the already nervous ecosystem queasy

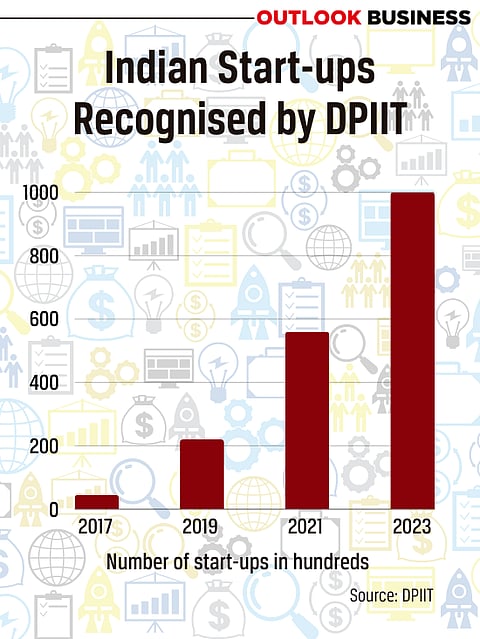

Several start-ups had been brooding about unwarranted Income Tax notices appearing at their doorsteps for a while. The brooding has since turned into an outcry so shrill that even the Department for Promotion of Industry and Internal Trade (DPIIT), the central government body under the Ministry of Commerce and Industry, has had to take note and take the concerns of the start-ups to the Ministry of Finance.

Trouble started for start-ups when days before the end of the financial year on March 31, 2024, they were served notices by the Income Tax department related to financial years 2021–22 and 2022–23. These notices asked companies to provide details about their investors within three to four days.

While the number of start-ups stressed out by the rising tide of Income Tax notices has not been estimated, many of them are believed to be in the finance-technology or fin-tech domain. Surprisingly for many start-ups, I-T notices reached them even though they were registered with the DPIIT.

A source who refused to be identified said one fin-tech start-up, which was registered with DPIIT, was asked to pay Rs 37 crore in taxes and a penalty on the Rs 40 crore it had raised from venture capitalists.

Tanya Prasad, chief investment officer at LegalPay, a Gurugram-based legal fin-tech firm, says, “In certain instances, despite the submission of all pertinent documents, start-ups have been subjected to tax demands. Further, should an affected start-up choose to appeal these tax demands, it is initially required to deposit 20 per cent of the total tax.”

A senior government official told Outlook Business on condition of anonymity that the DPIIT has already started helping some start-ups. “... [We] will try to streamline the system [of taxes] in the Budget if the government comes back,” the official said.

Mistake or Overreach?

The rules on taxing start-ups say if a company cannot satisfactorily explain the nature and sources of its funding, under Section 68 of the Income Tax Act, I-T authorities are allowed to tax both the capital raised and the income earned by a start-up in the relevant year. Such tax demands will not be made if the company provides a satisfactory explanation and submits necessary documentation.

But Saurrav Sood, who leads the International Tax and Transfer Pricing at advisory firm SW India, says tax officials are misusing provisions of Section 68. Sood says tax officers, in most cases, have invoked a provision that regarded share capital money from investors as unexplained cash credit. This then gets added to the income of the start-up, he says.

"This has been done in a very callous manner in spite of Section 68 having enough in-built safeguards to prevent such abuse,” Sood adds. He further says that the recent amendment to Section 56 (2) (vii-b) allows share valuation methods to be questioned. “Earlier, the provisions were restricted to residents only. With this amendment, any premium received by the start-ups which is beyond the valued prices will be added as income from other sources,” according to Sood.

On September 25, 2023, the Central Board of Direct Taxes (CBDT) amended Rule 11UA of Income Tax Rules, 1962 to change the manner in which the fair market value of unquoted equity shares and compulsory preference shares (CCPS) are calculated for the purposes of Section 56 (2) (vii-b) of the Income Tax Act of 1961 that levies tax on a company that has issued equity shares for more than their fair market value.

Tax experts say the amendment was made to target suspected cases of evasion or avoidance and not genuine cases where capital is received from credible investors, such as the ones registered with DPIIT and the Securities and Exchange Board of India (SEBI).

But off-late the Income Tax department has been issuing notices to various taxpayers asking them for details and documents pertaining to investors who are duly registered, says Rubal Bansal Maini, partner at Luthra and Luthra Law Offices India. “This is against the intention of the legislature and the government should take appropriate steps to protect the intention of the legislature by issuing some clarifications through circulars, notifications etc. or make clarificatory statements in this regard,” Maini says.

Need to Course Correct

Kishore Kunal, an Advocate-on-Record at the Supreme Court of India, says there are several tax disputes pending in courts where the Income Tax department has considered loans or share capital as unexplained cash credit. Going forward, Kunal suggests the government should make appropriate clarifications in provisions. “These tax disputes are centred on the allegation that identity and sources of funds have not been fully explained and ultimately, these are only resolved after intervention of courts. These provisions and their applicability to loans or share capital need to be appropriately clarified given that start-ups require funding frequently,” he adds.

Sood of SW India says there needs to be dialogue between tax authorities and the start-up community to make both sides understand the paperwork so that random provisions are not invoked. Further, he says, there should be rules restricting the sending of I-T notices to start-ups registered with DPIIT.

For start-ups, raising capital is one of their key challenges, says Ankit Jain, partner at chartered accountancy firm Ved Jain and Associates, adding that the government should help find ways to infuse more capital into start-ups by taking measures such as allowing them to raise debt-based funding.

India is the third-largest start-up ecosystem in the world, with over 112,718 DPIIT-registered start-ups spread across 763 districts of the country. The government, policymakers and thought leaders have all waxed eloquent about the potential of Indian start-ups. Start-ups in India are competing on the global stage. At this critical juncture, red-tape tripping start-ups could be a massive blow to the ecosystem.