World leaders have started their deliberations in Dubai over efforts to fight climate change. As Earth breached the 2-degree danger mark for the very first time in history, close attention is being paid to the meeting where leaders will review the achievements of the 2015 Paris Climate Agreement. Given the increasing scrutiny on failure to control climate change, Reuters reported France and US are expected to demand a halt on private financing for coal-based thermal power plants. As per India’s previously stated red lines, the country is opposed to any abrupt halt to construction of thermal capacity.

Q2 GDP Numbers Show Why India Has To Ignore The West On Thermal Power Plants At COP28

India's dependence on coal-based power plants is expected to be in focus at COP28

The Q2 GDP numbers released on Thursday show why the opposition has become a lot more important. India has managed to beat all the estimates of global and domestic analysts on the growth in GDP in the second quarter. At 7.6 per cent, the GDP growth rate showed robust economic activity amidst a widespread economic slowdown in western economies.

While the pressure on world to do more for fighting climate change has increased, India’s dependence on coal-based power plants has once again come into focus, especially in a year where these plants have made a roaring come back. After a decade of subdued environment in the capex for thermal plants and electricity generation, the energy sector seems to be at an inflection point. The Q2 GDP print revealed the reason.

Industrial Boost

After carrying the Indian economy growth for several quarters, services sector witnessed a slowdown. But despite the moderation in growth, Indian economy was able to impress due to the strong comeback of manufacturing and constructions sector.

The manufacturing sector posted a growth of 13.9 per cent in Q2FY24 as against a decline of 3.8 per cent in the last fiscal. The construction sector’s performance has been even more impressive, with a growth of 13.3 per cent on the back of an already high 5.7 per cent growth in Q2FY23. As per the calculations of Motilal Oswal Financial Services, the corporate sector has finally joined the investment party with a 3.3 per cent growth. This was the first quarter in 2023 when India Inc turned up for capex as per its estimates.

Moreover, governments across the country have already been heavy lifting the capex with a record capital outlay. India Ratings calculated that in the first half, capex by union and state governments increased by 26 per cent year on year.

Given this environment, electricity demand in the country is expected to continue setting new highs. In August, the demand had reached 236 Giga Watts, and the government expects the growth to continue. Core sector growth for last month hints that the industrial boost visible in the data is not going to slow down anytime soon. The data showed that the core sector grew by 12.1 per cent yoy, a rise from the 9.2 per cent growth seen in September. Utilities, which include electricity, also reflected the rising demand in the country as the sector grew by 10.1 per cent in the previous quarter.

The numbers explain why the sentiment around thermal plants seems to have shifted among policymakers. Afterall, India still meets over 70 per cent of its power demand from coal-based power plants. While renewables are slowly gaining traction, the momentum of infra sector shows why thermal plants are here to stay, which is expected to divide the COP28 forum once again.

Warming Up To Thermal

At an industry stakeholder meeting held last week, Union Power Minister RK Singh pushed the players to not count out thermal energy sources. Pushing for capex in the sector, Singh asserted, “Power demand of the country has increased at an unprecedented rate due to rapid growth of the economy. India needs 24x7 availability of power for its economic growth; and we are not going to compromise on availability of power for our growth. This power cannot be achieved by renewable energy sources alone. Since nuclear capacity cannot be added at a rapid pace, we have to add coal-based thermal capacity for meeting our energy needs.”

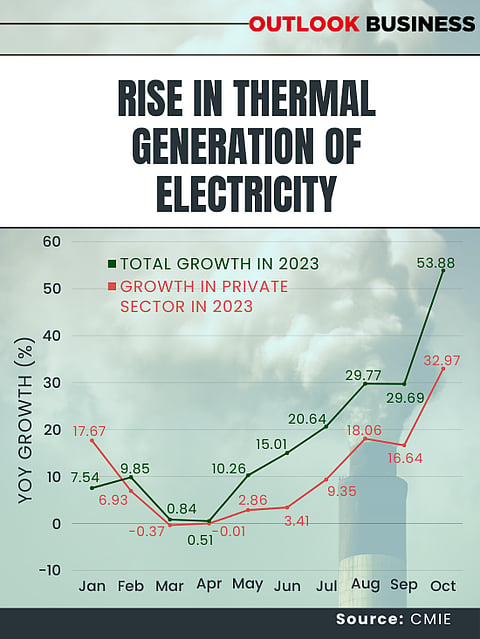

The government has cleared its plans to add 55-60 Giga Watt (GW) in Thermal Capacity in the next few years. In what was looking like a sluggish year for the thermal generation, things shifted rapidly in the second half. Looking at the data for January to June, the year-on-year growth rate for thermal electricity generation lagged behind. It even slipped into negative territory for two months, owing to low growth in energy requirement in the year.

However, the second half saw a turnaround in both electricity demand and generation, which aligns with the revival in capex. Notably, an interesting trend observable in the data is along with central and state sector, private players have also ramped up generation of electricity through thermal sources. The government has been urging the private sector to increase its investment in the segment. Between May and October, yoy growth in generation by private players rallied in double digits, which has not been seen in the last five years.

Bhanu Patni, Associate Director at India Ratings and Research, says, “The erratic weather behavior has also led to the variability in yoy demand for power. As a result, we have seen even high-cost thermal power plants operating on imported coal also being run at high PLFs. The All India average PLFs for thermal power plants would likely continue to increase till nee thermal/hydro/nuclear capacities come on stream or meaningful advancement in storage of renewable power happens.”

As a result of the warming up of the sector, the plant load factor (PLF) of coal power plants is expected to improve to 65 per cent, as per CRISIL ratings. In a note, Ankit Hakhu, Director at CRISIL Ratings, said, “A good portion of the incremental generation will be met by existing coal-based power plants. This will prove beneficial for thermal PLFs, which are likely to improve by 100 basis points (bps) to over 65 per cent in fiscal 2024.”

The firm expects the cash flow from operations of coal-based plants covered by it to improve by 20 per cent this fiscal.

As per a report of Business Standard, a meeting of state power ministers in Delhi discussed the setting up of new coal-based power plants. The buoyed sentiment on expansion of the thermal sector and the electricity demand shows that government has realised the need for betting on thermal power to make sure India sustains its growth.

No Jitters

India might have to assert its position of not imposing any blanket restriction once again at the climate summit while west rallies against thermal sources. However, investors on the bourses are enjoying the rising role of thermal plants.

The trajectory of power index has been of a rollercoaster this year. Starting from 4,376, the index soon crashed owing to the underperformance of its constituents. The index roughly took nine months to reach the level at which it started the year.

However, a sustained rally in the last two months has taken the index 12 per cent above its January level. What makes the rally in power stocks more impressive is how it has outperformed several indices which have generally attracted investors' interest.

In the last one month, the power index has surged by over 12 per cent as compared to 10 per cent for the capital goods index and 4.22 per cent for bankex. A similar story has also played out in Nifty where the energy index has managed to script a comeback in the second half of the year.

Commenting on the indices’ strong performance recently, Subadip Mitra, Executive Director at Nuvama Institutional Equities, says, “The power index has moved in line with the power shortage, especially peak deficit, which is now visible starting from April-May 23 and has led to higher Capex announcements across power generation, including renewables and thermal as well as power transmission, leading to beneficiaries across the power, generation transmission and the equipment supplying industrials companies.”

NTPC, whose weightage accounts for nearly 1/5th of the BSE power index, has increased the thermal capex pipeline to 11 GW from the earlier 7GW owing to surging demand across the country. The company had also announced a Rs 15,530 crore plan for Lara Super thermal power plant project in August this year. For JSW Energy, a private player in the segment, deemed PLF increased by over 6 per cent to 85 per cent in the second quarter, as compared to the previous fiscal. A similar increase in the operation of thermal plants was also seen in Adani Power where the PLF increased to 58.3 per cent in the last quarter as compared to 39.2 per cent in the previous fiscal.

The increasing pace in thermal operations has sparked a rally in both power generation and equipment manufacturer companies. BHEL has seen its shares surge by over 112 per cent this year due to the hopes for surging capex in the sector.

Amidst the COP28 summit where the world is figuring out the way to save its bid to counter climate change, thermal is reigning supreme in India. Private sector is ramping up generation, states are thinking about opening new thermal plants and Centre has clearly bet on coal-based power for some time to come. With the dynamic needs of Indian manufacturing sector for power in the coming years, the country is expected to bet on thermal power plants for the time being.