India’s trade deficit hitting a 13-year-low in February has made economists lower their estimate of the country’s current account deficit (CAD). But a lower trade deficit may not directly benefit the rupee immediately. This is because the inclusion of Indian government bonds in the JP Morgan Bond Index in June will expose the country’s foreign exchange market to global volatilities.

Why Big Dip In India’s Trade Deficit May Not Boost The Rupee This Time

A decline in India’s trade deficit has made economists revise CAD estimates. But hopes for a revival of the rupee may not be realised right away

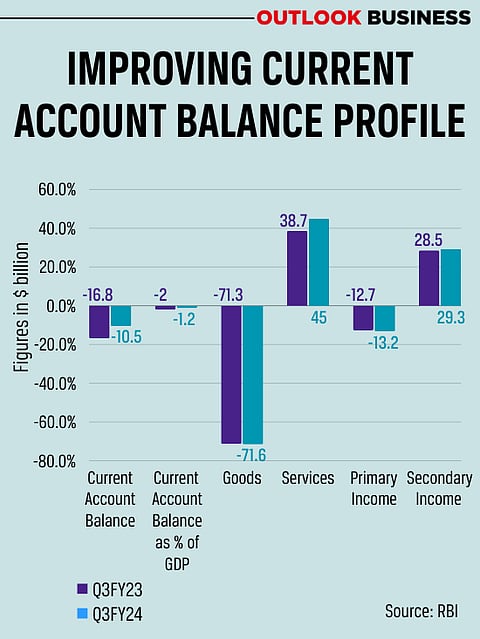

India saw its trade deficit fall from $4.2 billion in January to $2 billion in February. As a result, economists lowered estimates of the country’s CAD from 1.2 per cent of gross domestic product (GDP) to 0.8 per cent of GDP. The moderation in CAD, economists say, is because of record-high services exports.

“Services demand has remained healthy despite global headwinds. The trend continues to be strong with the latest high frequency indicators. Global services PMI [purchasing manager’s index] touched a seven month-high of 52.4 in February 2024 with the push emanating from both developed as well as emerging markets,” say economists Sunil Kumar Sinha and Paras Jasrai of India Ratings & Research.

Typically, when CAD goes down — which means when there is a decline in the amount of money a country spends to import products against the amount it is earning by exporting goods and services — the currency appreciates against the US dollar, because of a reduction in the need for foreign financing.

But according to Reserve Bank of India (RBI) Governor Shaktikanta Das, moderating CAD may not lead to an appreciation of the rupee this time.

This is because once Indian government bonds are included in the JP Morgan Bond Index, around $20–30 billion may flow into the Indian foreign exchange market. “Depending on how these flows come in, the onus would be on the central bank to ensure that liquidity and volatility are both managed. This is so as there can be some volatility in the rupee,” says Madan Sabnavis, chief economist at Bank of Baroda.

Speaking to the media after the Monetary Policy Committee (MPC) meeting in April, the RBI governor said the central bank is committed to ensure that the exchange rate of the rupee is market determined. “Our prime focus [is] to build a strong umbrella, a strong buffer in the form of forex buffers for when the cycle turns or for when it rains heavily.”

One hopes, India’s historically high forex reserves of $645.5 billion may help cushion against fluctuations.

Union finance secretary TV Somanathan told Outlook Business in February that the inclusion of the government’s bonds in the JP Morgan Bond Index will be a mixed blessing for the economy.

“Whatever is the weight of India in that index, they [global investors] put that much money against that fund. But how much you put in an emerging market fund is affected by how much you put in other funds. That is a variable which is often arbitrarily affected by global events,” he had said.

Thus, expecting the rupee to appreciate owing to the moderation in CAD may be premature. The rupee plunged to an all-time low of 83.45 per dollar towards the end of March, primarily due to an increase in demand for the dollar from importers and domestic oil companies. Market participants now expect the rupee to stay in the range of 82.80–83.50 per dollar in the medium term buoyed by strong domestic macroeconomic factors.

Madhavi Arora, economist at Emkay Global, says the rupee’s movement ahead will not be linear, and expects it to range between 82.50 and 84.25 to the dollar in the June quarter. While the rupee could have an appreciation bias amid low CAD, it will be policymakers who will play a decisive role in the currency’s direction, she says.