The objective of this fund scheme is to provide investors with opportunities for long-term growth in capital through active management

Cushioned Growth

SBI Blue Chip is perfect for the current times, where investors are looking for stable returns.

of investments in a diversified basket of equity stocks. To achieve this objective, the fund selects companies with market capitalisation equal to or more than the least market capitalised stock of S&P BSE 100 Index.

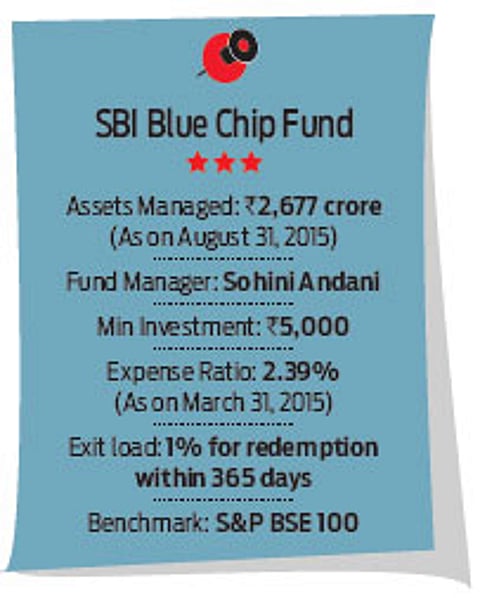

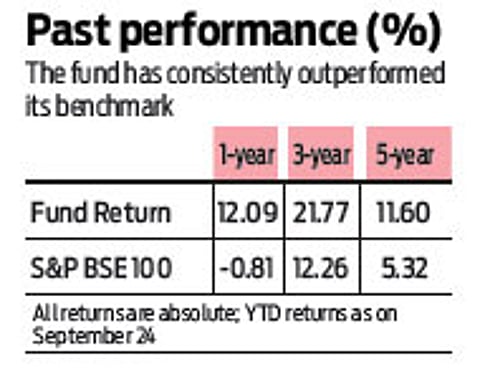

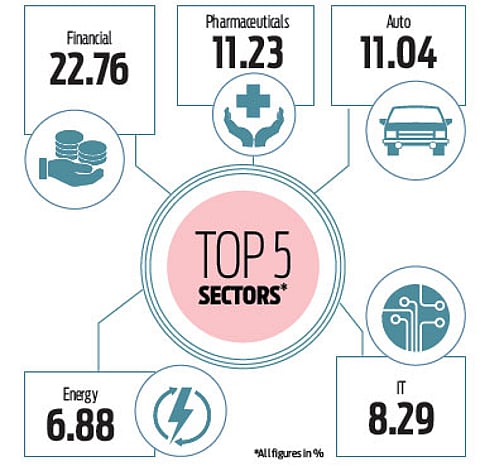

The fund is well-diversified at the stock and sector levels, and currently holds 52 stocks in its portfolio. The fund has performed consistently since 2011 and fared better than its benchmark, the S&P BSE 100. Its climb has been visible since Sohini Andani stepped in as fund manager in September 2010 (Read: True blue investment).

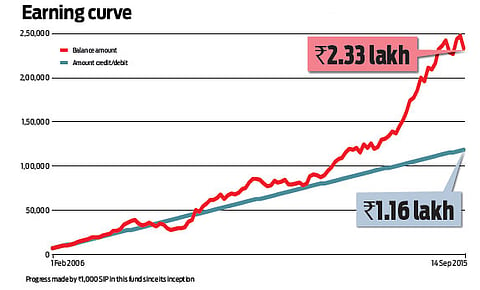

The average market capitalisation of the fund’s portfolio is Rs.70, 473 crore as of August 31, 2015. While this brings stability to the fund’s performance, the scheme varies its equity holdings between 85 and 95 per cent of the portfolio, redirecting allocations to debt and cash when markets seem overheated. Active fund management along with clarity on stock selection have helped the fund cope better in handling market volatilities, which was demonstrated in 2011 and 2013, and in more recent times. While the fund manages to check its downslide when the markets fall, it is also nimble-footed to step on the gas when the tide turns and posts strong numbers when markets gain.

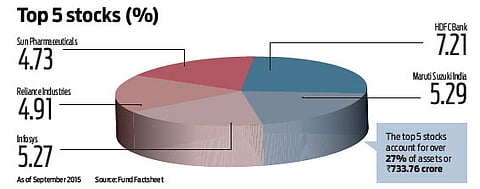

The fund is overweight on Automobiles and Healthcare, which has aided its performance.

Exposure to quality stocks like HDFC Bank, Maruti Suzuki and Infosys has meant it has stayed true to its objective. Even among the mid-caps, exposure to companies like Ramco Cements, Yes Bank, Pidilite and Motherson Sumi Systems speak volumes of the Bluechip orientation of this scheme. If you are looking for a fund that is not too volatile and gains over time, you should consider SBI Bluechip.