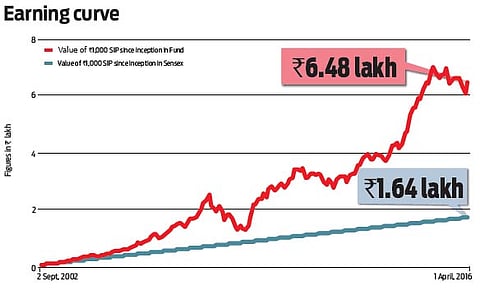

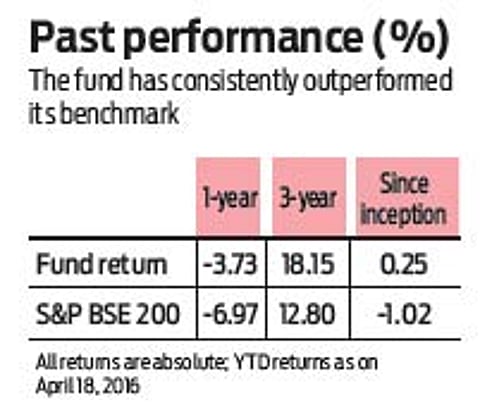

Since its inception in August 2002, this fund has delivered an annualised return of nearly 22.45 per cent. The fund maintains a high exposure to large caps, which helps it do well both during the bull and bear phase of the markets. This approach to selecting less volatile large-cap stocks adds stability to the portfolio and the fund’s returns. At the same time, during a raging Past performance (%) bull run the returns may not seem to be up to what its peers earn. The fund manager follows a growth at-a-reasonable-price style, which helps it post consistent returns over its benchmark, a hallmark of this scheme.

Leading from front

Guaranteed safety and not flashy gains make Birla Sun Life Frontline Equity a must-have

Where the fund scores the most is in its ability at containing downsides which was demonstrated in 2009, 20

11 and 2013, when it lost less than the benchmark indices. Further, a consistent fund management team has only meant that there are no surprises when it comes to performance. A well-diversified portfolio running into over 70 stocks, with no restrictions to allocation, allows the fund manager to bet on stock selection, which has worked favourably.

Further, timely exposure to cyclical sectors has made the fund ride the gains—case in point, the exposure to banking and energy sectors, which collectively account for about 44 per cent of the portfolio. Quality stocks like HDFC Bank, Infosys, ITC, Reliance Industries and ICICI Bank, among others, stand testimony to the fund’s superior performance. Although it has had a few misses, it has benefited from the right selection made over the years. All these factors make this fund suitable for investors with a moderate risk appetite to consider making it a part of their portfolio. The same reasons make this fund find place in the OLM Elite’s ‘Ultracool’ category.

Top 5 stocks (%)

The top 5 stocks account for over 23% of assets or Rs 2,457 crore.

Source: Fund Factsheet

- Reliance Industries - 3.77 %

- ICICI Bank - 3.19%

- ITC - 3.83%

- HDFC Bank - 6.38%

- Infosys - 6.11%

Top 5 sectors (%)

- Financial - 26.83%

- Energy - 12.25%

- Technology - 12.05%

- Healthcare - 7.64%

- FMCG - 7.29%