ICICI Pru Balanced Fund

Perfecting a balanced pose

A peek into a two decade old fund, which stodgily follows its investment objective

Assets managed: Rs 2,831 crore (As on May 31, 2016)

Fund managers: Manish Banthia, S. Naren and Yogesh Bhatt

Min investment: Rs 5,000

Expense ratio: 2.31% (As on May 31, 2016)

Exit load: 1% for redemption within 365 days

Benchmark: Crisil Balanced Fund Aggressive

One of the most soughtafter features by investors in a mutual fund scheme is stability in the fund’s performance. ICICI Prudential Balanced Fund is a good bet if you are looking for investments that are less volatile, which do well when the markets surge, and manage to cushion losses when the markets fall.

This is a hybrid scheme which invests money in both equity and debt instruments, which is periodically balanced to maintain an approximate 30:70 debt to equity ratio.

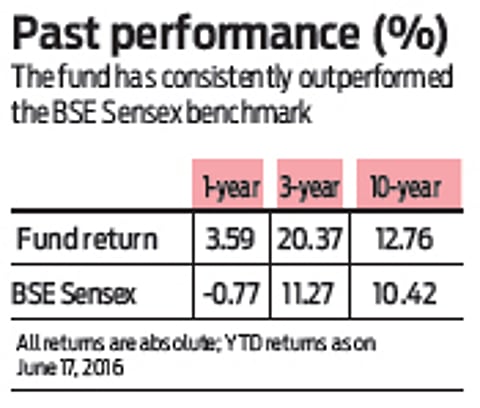

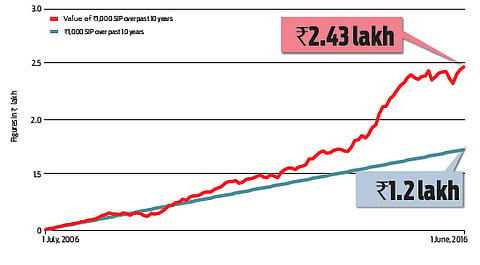

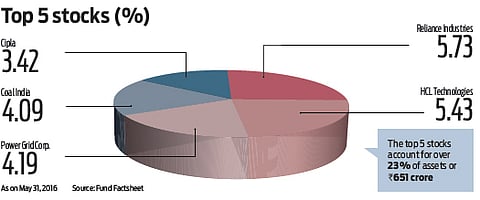

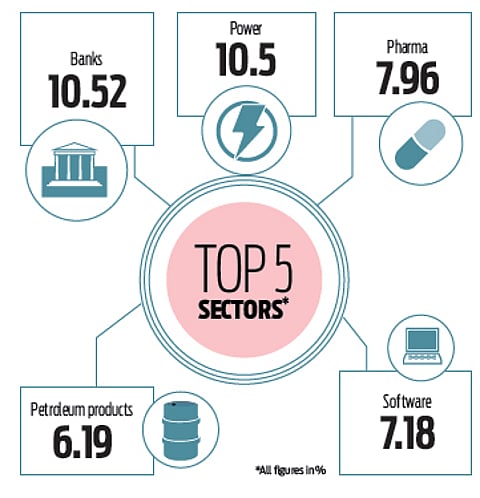

Within the equity allocation, the fund is well-diversified across market capitalisation and sectors, making it function like a multi-cap fund. A portfolio of about 40 stocks also adds to the diversification. The debt allocation has investments in quality debt instruments, which has helped in the performance of this fund scheme over time. Since its inception in 1999, the fund has posted a CAGR of about 14.5 per cent, which is commendable and matches several equity funds.

The inherent structure of the fund ensures that the downside is wellmanaged when the markets tank. For instance, in 2011, the fund lost 9 per cent, which was one of the lowest among its peers. Likewise, during 2013, the fund posted close to 12 per cent return, when several other funds were struggling. The overall performance has been good with the fund manager’s ability to take right sector calls by placing bets where he sees future value. On the debt front, investments are in gilts, certificates of deposit, commercial papers and corporate debentures—which offer diversification with duration calls taken to manage the prevailing interest rate scenario favourably. This is a good fund for those starting out, which is why you find a mention to this scheme in our OLM Elite ‘Beginner’ category.