Finding reasonably valued stocks under overheated market conditions isn’t easy, and spotting multi-baggers may look even more difficult.

The Secret of Picking Attractive Stocks when Markets are at All-Time Highs

Identifying the right stocks is not child’s play, but it is not impossible either. Here are some market classics

Identifying the right stocks for a portfolio is definitely not child’s play under the present scenario, but it’s not impossible either – as long as you follow some market classics.

Conventional market wisdom says you should focus on free cash flows rather than getting carried away by stock price movement, lofty management commentary and revenue and profit growth.

In plain English, Free Cash Flows to the Firm (FCFF) is excess cash generated by the business which is available to lenders and shareholders. If you want to identify the free cash flows accruing specifically to equity shareholders, you should refer to Free Cash Flow to Equity (FCFE).

While there can be multiple approaches to calculate FCFE, the most practical approach is as follows:

FCFF = Net income + depreciation - net changes in the working capital - capex

FCFE = FCFF - net debt

A step further will tell you how attractive these free cash flows are vis-à-vis the company’s current market cap.

FCFE Yield = FCFE/Market Cap

What types of companies typically generate low/negative FCFE?

- Businesses with high working capital requirements

- Companies incurring heavy capital expenditure

- Those having high/unsustainable level of debt on books

- Companies doing pricey acquisitions

- High growth companies that need to constantly reinvest to keep up pace

Depending on their capital allocation strategies, companies with higher FCFE often distribute excess cash amongst investors by way of dividends, buybacks or bonuses. That said, this practice can’t be treated as a norm and the decision of excess cash distribution/utilisation solely lies with the company managements.

Why does FCFE matter the most in today’s context?

According to Jerome H. Powell, Fed Chair, the total employment in the US has been short by 6 million as compared to February 2020 levels, whereas the household spending on durables is 20 per cent above the pre-pandemic levels.

The Fed has preferred to look through the pandemic-induced-supply-afflicted inflation, calling it transient.

Moreover, the future decisions of the Fed regarding interest rates will be guided by the shortfalls of employment from its maximum level rather than the deviations from its maximum level. In layman terms, unless the employment returns at least to the pre-pandemic levels, the Fed is unlikely to roll back its ultra-dovish monetary policy stance.

Thus, the Fed’s tightening process is expected to be gradual, and tapering is unlikely to throw any tantrums this time.

If we work with this hypothesis, inflation in the world’s largest economy may remain sticky and monetary policy stance dovish. This is a perfect recipe for the depreciation of the US dollar. A weaker US dollar will lead to strong emerging market moves. This seems to be the market’s interpretation of the Fed’s recent stance.

Indian markets have also been celebrating ever since Jerome Powell’s statements have come into the media.

This makes us believe that companies generating high FCFE yields are likely to remain in the limelight and attract investors’ attention as long as the interest rates remain low and cash flows grow at a decent pace.

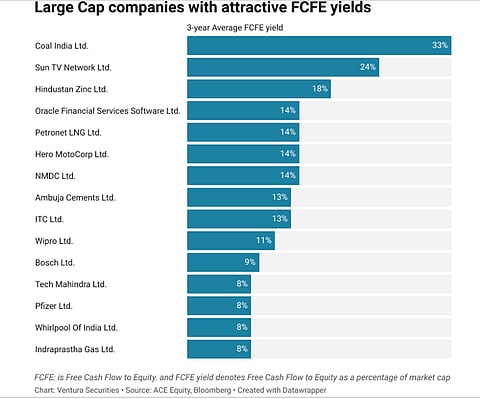

We evaluated BSE 500 companies to check how many of them have attractive FCFE yields.

For this purpose, we considered companies having at least three years of listing history—so no newly listed companies. We considered three-year average FCFE to even out one-off deviations, if any. Then we eliminated banking and financial stocks and further filtered out companies having negative FCFE yields.

We found that only 196 companies generated positive FCFE yields.

Some interesting observations are:

- PSU companies have attractive FCFE yields

- IT companies also have robust FCFE yields —irrespective of their market cap classification—i.e., large cap, mid cap or small cap

- Some of the bluest of the blue-chips generate negative FCFE yields

- A few companies that got battered due to their low ESG score are now available at lucrative FCFE yields. It remains interesting to see how long investors continue to shun them

- Amongst large cap companies, FMCG and auto companies have stable FCFE yields

So effectively, what does all this mean?

Companies with high FCFE which belong to growing sectors, such as IT, may continue to trade at higher multiples, as long as interest rates remain low. Any potential dollar weakness may require close monitoring though.

The key is to screen companies on FCFE yields in conjunction with other important stock selection parameters like management track record, ESG score, average growth rate of the industry they operate in, total addressable market, capex plans and the level of debt on the books, amongst others.

As they say, revenue is vanity, profit is sanity but cash is the king. Our version of this famous investment quote is Kyon ki Bhaiya Sabse Bada Rupaiya!

The author is Head of Research, Ventura Securities Ltd

DISCLAIMER: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.