ESOPs have been a significant component of the compensation for the employees of start-ups. Currently, ESOPs are first taxed at the time of allotment of shares upon exercise as perquisites. This usually leads to cash flow problems as the employee does not receive cash till the shares are sold but is required to pay the tax when shares are allotted.

Budget 2020: Pockets Of Hope And Gloom - What Is In Store For You?

For quite some time, start-ups have been clamoring for deferring the taxable event to the time the shares are sold and the individual receives the cash. The finance minister has proposed this welcome change to assist start-ups to hire the correct talent without the related hardship by deferring the point of tax payment. The Finance Bill has proposed to defer the point of tax deduction/ payment on the shares allotted under ESOPs to the future date which will be the earliest of the following three events : (i) upon of completion of five years from the end of the financial year (FY) in which the shares are allotted under ESOPs, (ii) upon the employee leaving the employment or (iii) upon the sale of such shares. The tax will have to be deducted or paid within 14 days of the earliest of these three events. Furthermore, the tax will be payable at the rates applicable to the original year in which the shares were allotted. Corresponding amendments have been carried out in the relevant sections pertaining to advance tax, self -assessment tax and notice of demand.

This is a welcome change and will help start-ups in attracting and retaining good talent without the cashflow hardship at the initial stage.

Optional Tax Regime For All Taxpayers:

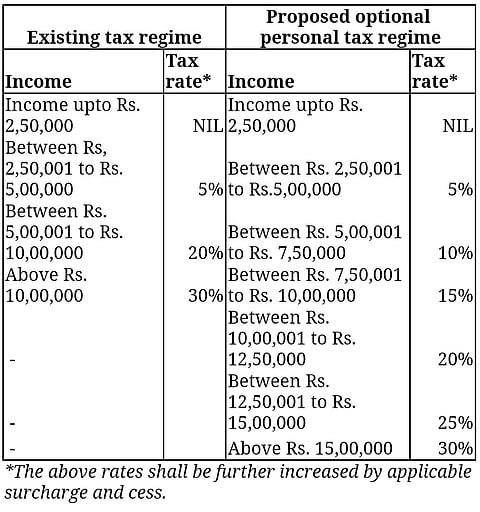

A new optional personal tax regime is proposed to be rolled out by slashing the existing tax rates and rejigging income tax slabs. The changes are as follows:

This will particularly benefit those class of taxpayers who are currently not availing a plethora of tax exemptions/deductions or losses being set off from different heads of income. Many young employees may find it beneficial and practically easy to opt for the changed regime.

NRIs/PIOs

The budget has proposed significant changes in the residency rules for individuals, especially pertaining to Indian citizens and Persons of Indian Origin (PIOs) living abroad. Under the existing regulations, Indian citizens and PIOs being outside India are currently permitted to visit and stay in India for a period upto 181 days during a FY and still retain their Non Resident (NR) status in India, if their aggregate stay in the preceding four FYs does not exceed 365 days. The maximum period in the relevant FY is now proposed to be reduced to from 181 days to 119 days in a FY beginning with FY 2020-21. This means that their ability to stay in India will be curtailed if they wish to retain their NR status. Several individuals who are used to coming to India frequently may now be impacted adversely as frequent visits can change their tax residency and trigger consequent tax implications in India.

Another important change is that an Indian citizen will now be deemed to be tax-resident in India if such a person is not liable to tax in any other country by reason of domicile/ residency in the other country or other criteria of similar nature. The deeming provisions would apply even if such a person could otherwise qualify to be NR in India. This could potentially trigger global taxation for individuals who will no longer be considered as NR in India for tax purposes. What is still not clear is whether this will also impact Indian citizens who are resident in a country which under its own laws does not impose tax on individuals. While clarifications will be welcome in this regard, this change could increase reporting requirements for such NRI/PIO who may otherwise not be required to file tax returns in India as Residents.

Investors

The past few weeks had seen a lot of hype and expectations with respect to investment income. However, the Budget turned out to be a dampener for the investor class. On the one hand, there was no change in the taxability of Long-Term Capital Gains (LTCG), which continue to be taxed. There was also some expectation for bringing parity in the various classes of long term assets, e.g. increasing the 12 month period to 24 months to simplify the tax provisions around Capital Gains. However, no such change has been announced.

On the other hand, there would be additional tax on dividend income. While companies are happy with the Dividend Distribution Tax (DDT) being abolished, investors are now required to pay tax on both dividends from shares and units of MFs. The dividend exemption of Rs 10 lakh on listed shares is now proposed to be removed, and the dividend income will be taxable at normal slab rates instead of the concessional rate of 10 per cent. However, if the investor has any interest expense against any loan taken for such investments, he would be entitled to claim a related deduction for such interest, limited to 20 per cent of such dividend income.

The author is Partner- Personal tax, PwC India with inputs from Shaishav Shah, Associate Director, PwC