Half of our country’s population hasn’t placed 25 candles on their birthday cake yet. Our country is slated to be the youngest by 2020 with an average age of 29 years (37 for China, 48 for Japan), as per the projections of United Nations. A bulk of the current workforce is also formed by young Indians, who are under 35 years of age. Being the ones attaining highest educational qualifications of all generations so far and the first ones to tap their fingers on computers, their investment habits are tad different from previous generations.

Investing For Young Indians

Consider diversified asset spread including equity for long term goals, debt for emergency funds and liquid assets

Since their education aspirations have been high, they are encumbered with immense student loans and even unemployment in select economies facing the wrath of recession. Author and economist Jeremy Rifkin, rightly refers to them as the renter generation pointing, “25 years from now, car sharing will be the norm and car ownership an anomaly.” Though a small set of the under 35 are also the youngest billionaires (Mark Zuckerberg and Dustin Moskovitz, co-founders of Facebook were born in 1984), many others rue about unmet career expectations and low satisfaction as they seek work life balance.

Even as the current set of octogenarians in the country switched from telegrams to public and later private telephones, and aging parents evolved to mobile phones, while the youth took to smart phones and internet telephony, the investment habits are still stuck in the telegram era.

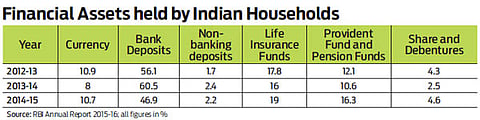

Nearly half of the country’s annual household savings, 47 per cent to be precise, are invested in fixed deposits, as per the RBI Annual Report 2015-16. Though the bank FD pie is shrinking, the numbers aren’t proportionate with the steep fall in interest rates from 14.5 per cent in 2000 to 6.5 per cent currently.

The socially-active generation has steeply enhanced monthly spends compared with other generations as they embellish their own life bogging down to peer pressure where everyone is telling you about their foreign vacations, parties et al. Hence, mirroring the investment recipe followed by forefathers could prove to be a disaster for this generation, who have fewer responsibilities, high disposable income and a longer investment horizon for prime goals, such as marriage and retirement.

My advice

Playing the conservative investment card could leave them dry. To cite an example, PPF currently offers 7.9 per cent while the average consumer price index (CPI) inflation for the calendar year 2016 was 5.1 per cent. Hence, the net return, works out to a meagre 2.9 per cent. To ensure they don’t outlive their savings and leave goals unfulfilled, an edge of equity is required.

Over the past 10 years, equity has been the top performing asset class offering five times average returns of 13.7 per cent vis-à-vis 7.66 per cent clocked by short-term debt and 8.03 per cent offered by long-term debt instruments. From 1979 to 2006, Sensex has risen from 100 to 10,000. Further, between 2006 and 2016, the BSE Sensex has grown from 10,000 to 28,000 giving a CAGR return of 17 per cent post tax (since there is no long term tax on capital gains). Based on our estimates, Sensex is expected to scale up 1000 times of the base value by the end of the FY 2025-26.

Wondering what difference a difference of 5.5 per cent can make? Let’s take the example of siblings Sachit and Archit opting for different modes to save. While Sachit opts for traditional PPF, Archit goes for tax-saving mutual funds. The difference after 15 years of investing similar amount of Rs 1.5 lakh annually in both is that Sachit had saved Rs 29 lakh in his PPF account while Archit’s savings catapulted to Rs 61 lakh through tax-saving mutual funds. Archit also isn’t restricted by the 15-year lock-in that Sachit faces in PPF as his funds have the lowest lockin of three years.

This generation should consider age-appropriate diversified asset spread including equity for long-term goals, debt for emergency funds and liquid assets and a limited exposure to real-estate and gold. An ideal mix for those in 20s would be an aggressive 85-100 per cent in equities, 15 per cent in debt and 5 per cent in gold or alternate investment seeking higher growth during the early years. As they age, they can taper down the proportion of equity over the years to reach 65-85 per cent equity, 35-15 per cent debt between 45 to 60 years to preserve the savings and finally 0-35 per cent equity against 65-100 per cent debt during the retirement period as they withdraw for monthly needs.

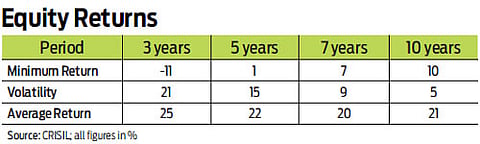

While they keep shuffling jobs in search for greener pastures, the strategy wouldn’t work when it comes to equities, as equity investments have a tendency to reduce volatility when held for a longer time frame. As seen in the table, the minimum returns improve and volatility plummets when stocks or equivalent investments are held for a longer duration. Long-term savings can be parked in stocks and equity-linked mutual funds. The risk-averse can consider a mix of equity and debt instead of shunning equities completely.

There is a new retirement planning option by way of the New Pension Scheme (NPS), where one can now invest up to 75 per cent in equity (up to a certain age) and opt for auto reduction in the equity exposure as one nears retirement. This can be explored instead of PPF as it also offers additional tax benefit on income up to Rs 50,000. As they are also strongly influencing the investment decisions of their parents, it is time for this generation handhold them into the world of smart investing.

Motilal Oswal, Chairman & Managing Director, MOFSL