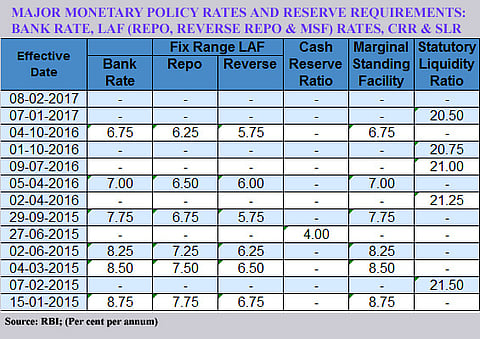

While the Reserve Bank of India (RBI) left the rates unchanged in its monetary policy review on Wednesday, governor Urjit Patel emphasised that there was scope for banks to cut rates further.

RBI Policy Meet: Look Beyond Fixed Deposits to Beat Low Interest Rates

Insulate your portfolio against a dent on returns by betting on more remunerative alternatives

Moreover, even as the RBI shifted its stance to neutral from accommodative, the policy statement also pointed out that demonetisation-induced easy liquidity with banks, which had prompted several banks to slash rates, is likely to continue till early months of the next financial year.

Now, lower rates have spelt relief for borrowers, but depositors have been left high and dry as correspondingly, fixed deposit rates too have been reduced. What this means is that individuals looking for ‘stable’ fixed income options, will have to scout for more remunerative alternatives.

But first a few words of caution – since the inflation too is declining, you are not worse off compared to times when fixed deposits offered returns as high as 9.75% . “The latest inflation figure is 3.41%, which used to be around 12% at the tail-end of 2013. Therefore the real rate of return is positive inspite of fixed income rates coming down,” points out Vivek Rege, CEO and Founder, VRA Wealth Advisors.

Yet, softer rates have naturally triggered anxiety among many conservative investors, particularly senior citizens who have seen their regular income dwindle.

Explore debt mutual funds

Investors who wish to avoid fluctuation risk associated with equities can turn to debt mutual funds. However, while these funds offer relatively stable returns, the element of volatility risk cannot be wished away completely.

For instance, some industry-watchers feel RBI's shift in stance from accommodative to neutral signals end of rate cut cycle. The 10-year g-sec yields rose 31 basis points post the policy announcement. Bond yields and prices have an inverse relationship.

So, if you want to invest in instruments that fetch higher returns than FD rates, you will have to be prepared to stomach some risks. “They should consider moving into short-term debt funds which aim to preserve your capital and generate moderate to stable returns. These funds typically invest in AA+ and above rated bonds and CDs of Banks and currently offer yields of 8-9%,” Kunal Bajaj, founder and CEO, Clearfunds.com, an online direct mutual fund advisor. He advises against investing in long-term debt funds now, given the volatility that has arisen due to the uncertainty around RBI's stance.

Vivek Rege recommends accrual funds that invest in highly rated papers. “Look at accrual funds with exit load of less than and which have invested at least 85% in AAA and AA securities. This should offer a better yield due to diversification and economies of scale and ease of investing and dis-investing,” he says.

If you are willing to take on even higher risks, you can also look at debt-oriented balanced funds that invest largely in debt, with a small portion in equities. They have to potential to yield twin benefits of lower volatility when compared to equity or equity-oriented balanced funds and higher returns vis-a-vis fixed deposits.

Also, avoid gilt funds, which fall under the debt fund category, at the moment. “Firstly, these funds hold very long duration bonds, and are a pure play on interest rates which may be subject to some volatility over shorter periods,” points out Bajaj. Besides, their returns at present will not meet your requirements. “The yields on Gilt funds are already below 7%. This does not meet the objective of generating moderate returns for the investor and also leaves little room for pricing gains on the investments, as interest rates are already low,” he adds.

Tread carefully with other fixed income tools

Short-term debt schemes apart, company fixed deposits and bonds that tend to fetch offer higher-than-FD returns also promise fixed returns. However, you need to be mindful of the credit rating while investing in such instruments. Typically, lower the credit rating, higher will the interest rate. This also means that the risk of default is higher. “In hunger for yield, do not settle for sub-optimal deposits or securities because they offer higher yield or interest. Focus on real return which is positive,” says Rege, adding that return of capital should be more important than return on capital for risk-averse investors.