Inquire about plastic furniture and one name that would be on top of the list in search engines is Nilkamal. In the last 25 years, the company has made a name for itself when it comes to wide array of plastic products. What further embellishes its credentials is the fact that Nilkamal is the world’s largest manufacturer of moulded furniture and also runs exclusive stores catering to home décor under the brand name @home.

In a comfortable setting

Market leadership and pricing power are some of the factors that make this stock an exciting prospect.

Nilkamal also has one subsidiary each in Sri Lanka and the UAE, which gives it the advantage of sub continental reach.

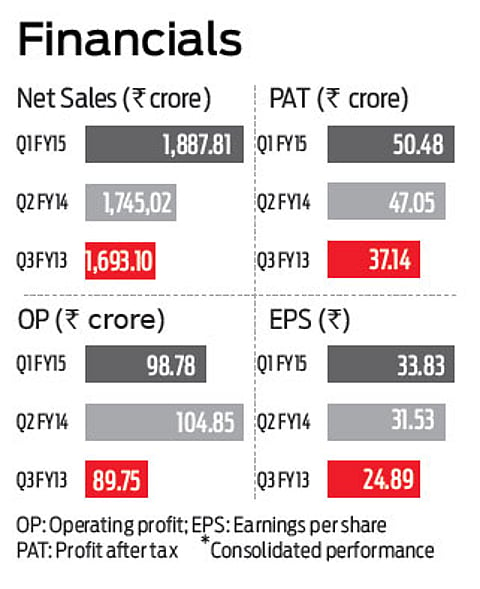

On firm footing Improvement in the overall economic climate, moderate oil prices and dipping interest rates are expected to further boost Nilkamal’s business. The fourth quarter results of FY15 were driven by modest growth in the industry due to which the company posted stable margins. Nilkamal’s earnings before interest, depreciation and tax (EBIDT) stood at Rs.50.61 crore during Q4 FY15, a rise of 20 per cent over the Q4 FY14 of Rs.42.35 crore, whereas PAT stood at Rs.50.48 crore in FY15, picking up from Rs.47.05 crore in FY14. Its plastics business registered a volume growth of 10 per cent and value growth of 12 per cent in FY15. The company had also reduced its debtto- equity ratio to around 0.68 times in FY14 from 0.92 times in FY13.

One spot of bother could be the fluctuating prices of raw material for polypropylene and polyethylene. Due to that, Q2 and Q3 of FY15 had a bearing on the company’s operations during the said period. However, Nilkamal’s focused attention on marketing and sales processes has led to higher margins in its different verticals and continuous improvement in the working capital cycle has helped perk up the company’s operational performance during Q4 FY15. Investors should ignore these short-term hiccups considering the scrip has given massive returns, of around 240 per cent, since January 2014.

Though unorganised market in the country still remains a huge threat, Nilkamal is in position to offset that considering its pan- Indian presence and outsourcing tie-ups. The company has set a turnover target of Rs.100 crore by the end of FY19 and interested investors can buy the stock with medium to long-term outlook.

This story was first published in June 2015 in Outlook Money Magazine.