Established in 1986 as a subsidiary of HDFC, GRUH Finance is a leading housing finance company (HFC) and is recognised by the National Housing Bank (NHB). It provides loans for purchase, construction and extension of homes.

Niche focus pays off

Huge demand is foreseen for EWS and LIG segments offering ample opportunity for GRUH Finance to grow

GRUH focuses on providing home loans to families in the self-employed category where formal income proofs are not easily available. Apart from extending home loans, GRUH offers loans for purchase and construction of nonresidential properties (NRP) and also offers mortgage loans against existing residential and commercial properties. Developer loans, too, are offered but on a selective basis.

GRUH also offers home loans under the Rural Housing Fund (RHF) scheme of NHB wherein loans are given in rural areas for select categories such as backward classes, minority community, women owners and families with annual income of less than Rs.2 lakh. GRUH has a network of 171 retail offices across eight states.

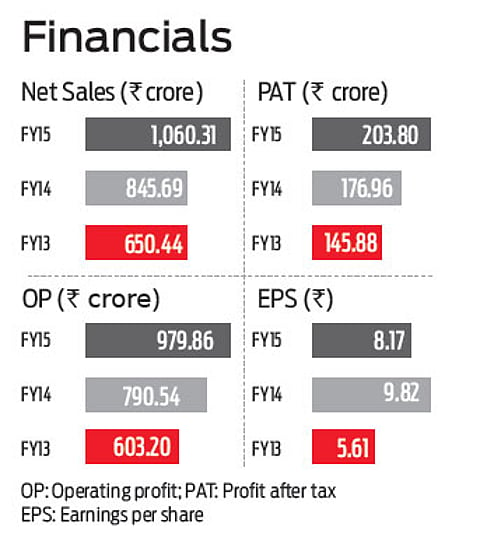

Strong financial performance

GRUH’s net sales and net profit clocked a compounded annual growth rate (CAGR) of 27.75 per cent and 24.20 per cent, respectively, over FY 2010-15. The CAGR loan book growth was 29 per cent over FY 2010-15. It was made possible due to GRUH’s presence in the affordable housing segment in rural areas, which provides pricing power on the asset side along with cost of funding at par with large HFCs, and impeccable asset quality. The net NPAs as on September 30, 2015, stand at Rs.19.62 crore or 0.20 per cent of the loan book.

Expanding opportunity

Given the strong demand and shortage of housing in urban and rural areas, players like GRUH Finance have ample opportunities to grow. Most of the shortage is seen in the economically weaker sections (EWSs) and low income groups (LIGs). In the ‘Housing for All by 2022’ scheme, the centre is trying to bridge the affordability gap. To make it more inclusive, the centre has also raised the income ceiling for EWSs and LIGs. The company’s scrip has given around 18 per cent annual return since January 2010. Those looking to invest in the stock can do so with a long-term view.

The story first appeared in Outlook Money December issue