The ubiquitous health insurance has evolved over the years and it is no more a straight-forward solution when it comes to buying a policy. Just like a pizza, which has a base and toppings can be added to suit one’s taste; health insurance allows one to add a top-up or a super top-up policy to the base cover. What this means is that you can do much more with a health insurance policy. There are other merits of adding a top-up—these are cost effective and add value to your overall health cover, which can help you in case of a medical emergency.

A healthy topping

If you do not want to increase your base cover and pay a higher premium.

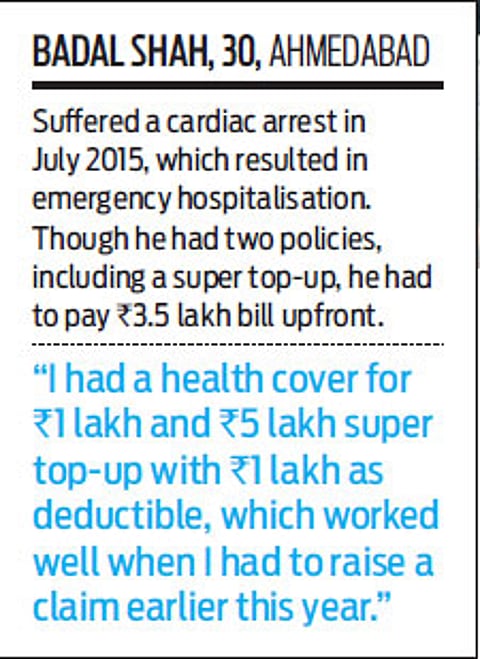

Ahmedabad-based 30-year-old Badal Shah’s world came crashing down in July this year, when he suffered a heart attack. “It was an emergency and I had to be rushed into surgery, where they put two stents on me,” he recounts. The entire procedure cost him Rs.3.5 lakh and a week of hospitalisation. “Thankfully, I had a top-up plan, which ensured that I did not get a second attack after seeing the hospital bill,” he tells jokingly. The importance of health insurance cannot be undermined and, in a lot of ways, its absence can put you in a situation much worse than one can imagine.

A typical health insurance policy covers for health-related expenses and is useful in case of emergencies. What it basically does is to provide a financial coverage for medical and hospitalisation expenses, in case of an illness, disease or accident. The basic health insurance policy covers for hospitalisation including surgeries, nursing care, consultation fees, diagnostic tests and hospital accommodation. Although one can take a health insurance cover for a higher sum assured, it increases the cost of buying such a policy as the premium goes up.

Enter top-ups

“I had a health insurance policy that was taken 12 years ago for Rs.1 lakh cover. To this, I added Rs.5 lakh top-up insurance from Apollo Munich last year,” recounts Shah. The move worked for him when he was diagnosed of a heart attack, needing immediate surgery. Today, he is in good health and is thankful for the insurance policies he had purchased, which otherwise could have dented his finances. The role of top-ups can only be appreciated when one actually gets to experience the policy’s benefits.

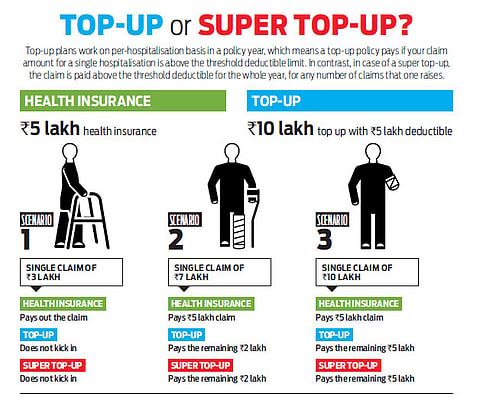

To provide a higher insurance cover at a lower price, insurers have devised the top-up plan. Says Antony Jacob, CEO, Apollo Munich Health Insurance: “Top-up health insurance plans (also known as catastrophe plans) offer the insured an additional coverage, which is beyond the ‘threshold limit’ known as deductible.” What this means, in effect, is that if a policyholder has a Rs.5 lakh base health cover and adds a top-up plan for Rs.10 lakh, the topup will pay for the claim only when the claim is above the deductible of Rs.5 lakh. Most often, when you take a top-up plan, the deductible is equivalent to the insurance cover on the base policy.

The most important benefit of top-ups is the affordability. These policies are a smart way to increase the scope of health insurance at a marginally higher cost. The insurance cover of the base policy becomes the threshold beyond which the policy pays for the claim. The threshold is nothing but deductible, which is the portion of the claim amount that is not covered by the insurer and has to be paid by you before the benefits of the policy can kick in. So, if you already have a health insurance policy, the deductible limit can be paid by the base policy and anything above that by the top-up cover.

However, the limitation with top-ups is that one can make a claim only once a year on this policy. “A top-up cover will pay only if one’s claim amount (bill for a single hospitalisation) is above the threshold within a single year,” explains Jacob. To provide an alternative, insurers have come up with a super top-up plan, which is similar to the top-up in terms of functioning, with one big difference—it allows more than a single claim in a year.

Anuj Gulati, CEO and managing director, Religare Health Insurance, says: “In case of top-up plans, a deductible applies on every claim during the policy year, however, for super top-up plans; the deductible is levied on cumulative claims during the aforementioned period. Therefore, super top-up plans provide greater derived value for the consumer in case of multiple claims during the policy period.” This changes the equation for those who, for some unforeseen reason, land up having more than one hospitalisation claim in a year.

Advantage super top-up

While both the top-ups act as a cushion and come into action when you have exhausted the existing cover, a super top-up policy is an

improved version of top-up policies, wherein it takes into consideration the total number of bills or multiple claims in a year, and not just the one instance. Somesh Chandra, chief operating officer and chief quality officer, Max Bupa, says: “The advantage with a super top-up plan is the deductible limit, which gets applied cumulatively, considering all claims put together in that particular policy year. One can choose to take this top-up cover under individual as well as floater policies, where its utility works out the best.

The joint cover that a family gets under a floater plan is one way to ensure the financial implications of more than one family member being hospitalised are not too severe. Ideally, those who are covered by a group health insurance policy can avail of the super top-up to cover themselves beyond the maximum limit of the existing plan, by paying a nominal additonal premium. “Also, in times of job change or if the employer decides to discontinue the health insurance benefit or decreases the sum insured limit, a super top-up plan provides the much-needed cushion,” explains Jacob. But, this is definitely a plan that anyone who has a basic health insurance cover must consider for the relative low cost and high benefits such policies have.

To understand how these two variants work, you need to know the various possibilities that may arise necessitating a claim. These five scenarios give a fair idea on how each type of policy works, and can be used to plan what type of top-up one must take to be adequately insured at an optimal cost.

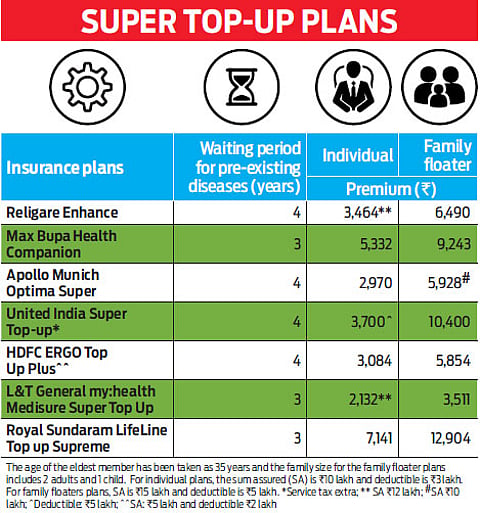

As expected, there are some limitations with top-ups. Some of them may not cover pre- and posthospitalisation expenses. Likewise, the waiting period to cover preexisting diseases varies and can take a few years before you may be eligible to benefit from these policies. The super top-up does score over plain top-ups, but do ensure that you add these policies to your existing cover after understanding when they will come into effect. While one may argue that the lightening does not strike at the same place twice, you cannot take such chances with your health. So, going by the scenarios illustrated above, super top-ups definitely score over top-up plans.