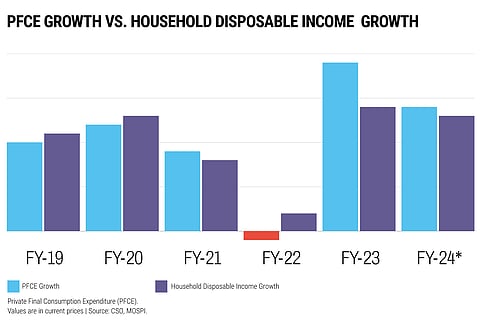

The first signs of financial strain began with the pandemic in 2020 as households’ expenditure on consumption started to outpace their growth in disposable income

Are Indians Borrowing More Than They Can Repay? What the Data Shows

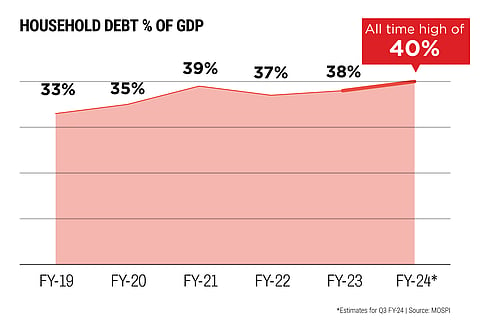

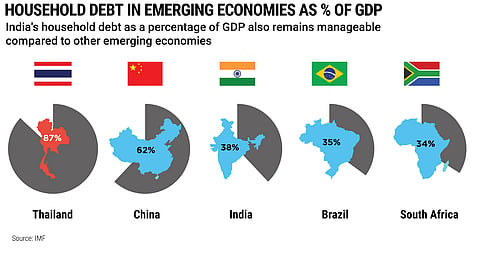

Household debt in India is on the rise. In a sign of increasing strain on savings, financial liabilities of households surged to an all-time high of 40% of gross domestic product (GDP) in the third quarter of 2023–24, driven by a rise in unsecured lending and home loans, and prompting calls for closer scrutiny

Household debt hit a record high in FY24, reflecting a change in consumer behaviour to take on a higher leverage

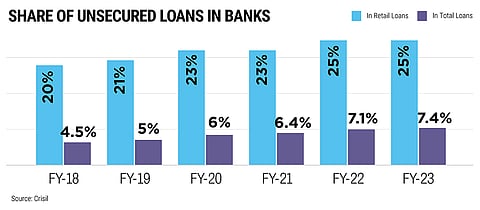

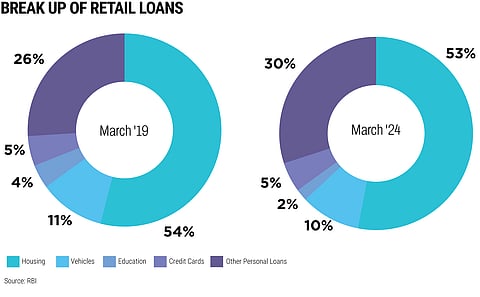

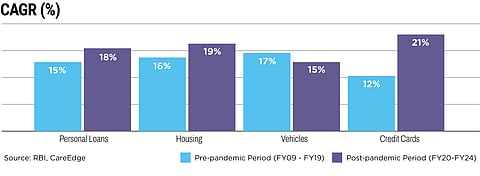

A closer look shows that unsecured retail loans, including credit card usage, went up in the post-pandemic period. Driving this surge was the rise in fintech companies that provide personal loans to younger borrowers through simplified processes and faster approvals

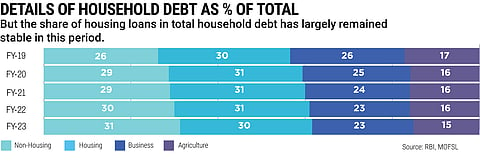

The growing reliance on borrowing may not be an immediate concern as home loans continue to be the dominant driver of household debt, but monitoring unsecured lending from fintech and non-banking financial companies is crucial

Home loans are secured and more productive as debt is invested in appreciating assets. The demand for home loans has also remained stable and non-speculative, lowering the risk of a housing bubble

Research: Kush Sharma, Graphics: Shriya Bhatia