If I had a rupee for every time someone said to me, “Don’t invest in markets now, they are very expensive, wait for a crash!” I wouldn’t need to work for life. The reality is that nobody can predict market movements with consistent accuracy as it is difficult for any investor to time the markets. So investors can mostly be right about their view based on sheer luck. It is no different from a broken clock being right twice a day.

Why You Should Continue to Invest, Even at Market Highs

The longer the investor waits, the higher are the probability of good returns

But let’s assume an investor still decides to park their money when markets are at their peak and the very next month, markets crash. A lot of questions & uncertainty come to mind with investors trying to look for a way forward. Historical data suggests that one of the last things to do is panic selling.

It is to be noted that we have assumed a crash to be more than -20 per cent and a correction to be more than -10 per cent fall in the index compared to its previous peak.

Patience is name of the game

“The stock market is a device to transfer money from the impatient to the patient.”

Warren Buffett

An important thing to note is that, for markets to provide high returns in the long term, it has to frequently reach new peaks. As can be shown in the chart below, in the case of Sensex’s 40+ years of history, we have 508 months of data and it was at All-Time Highs (ATH) for 121 of those months. These peaks were followed by a crash (i.e. fall > 20 per cent, just to remind you of our assumption above) only 9 times. So, historically, the probability of a market crash following a peak has been low (~7.5 per cent).

Exhibit 1: Historical Sensex PRI performance since inception

Source/Disclaimer: www.bseindia.com; S&P BSE SENSEX price returns index data in INR. Data as of close of 27-Apr-1979 – 31-Jul-2021.

In the event when markets do crash (fall > 20 per cent), the average time taken for Sensex to recover to its previous peak is ~2.5 years (31 months to be precise). However, the longest time taken was 5 years (60 months) from Aug-94 to Aug-99 (largely attributed to Asian financial crises) while the shortest time taken was 10 months from Sep-90 to July-91. So in most cases, an investor who invested at the peak of the market just before a market crash is likely to recover the invested amount in ~2-3 years. But if one has the patience to stay invested, the rewards far outweigh the risks.

Exhibit 2: Every crash (>20 per cent) since inception and months taken to recover

Source/Disclaimer: www.bseindia.com; S&P BSE SENSEX price returns index data in INR. Data as of close of 28-Feb-1979 – 30-Nov-2020.

To help visualise this better, let’s take an example. As shown in the chart below, during the global financial crises of 2008, Nifty 50 TRI had crashed 54 per cent in one year compared to its previous peak. This means that an investment of ₹1 lakh, would’ve been reduced to Rs 47,438. However, in about three years (Oct 2010), the investor would’ve recovered from losses.

If he had managed to wait a little longer, than in 10 years (i.e. Dec 2017) the value would’ve been almost double the invested amount (at Rs 1,92,749) at 7 per cent CAGR. Refer to the below chart for a better understanding. Now investing in equity mutual fund, the 7 per cent CAGR looks sub-par; however, remember the assumption investing just before the Global Financial Crisis at the end of Dec 2007.

Exhibit 3: Value of ₹1 lakh invested before Global Financial Crises

Source/Disclaimer: www.niftyindices.com; Nifty 50 total returns index performance data in INR. Data as of close of 31-Dec-2007 – 29-Dec-2017.

Investing just before every crash of >20 per cent & correction of >10 per cent since 1979

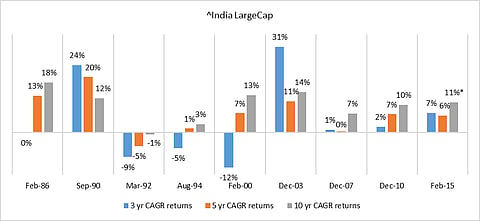

To give a better perspective of the previous example, we have extended the study to include all the previous crashes since 1979. We continue with our assumption that the investor invests only at the market peak just before a crash. We will then calculate the CAGR returns for 3/5/10 years to help understand historical returns for such investors. A simulation ‘India LargeCap’ was run which connects performance of S&P BSE Sensex PR Index from April 1979 to June 1999 & Nifty 50 Total Returns Index from July-1999 to present. It is done to capture the longer performance history of India’s stock market.

The outcome of each historical crash (fall > 20 per cent) is summarised in the below chart. Patience and time are an investor’s biggest assets. When one moves from 3 to 5 to 10 years, returns (CAGR) tend to get better. As time increases, the variability in returns tends to reduce. Median CAGR returns for 10 year period is 10 per cent compared to 7 per cent for 5 years and only 1 per cent for 3 years. Since the last two decades (i.e. from 2000 to 2020), there has been only a single incident in a 3 year period when returns were negative and there were no negative returns for any 5/10 year period. For 10 year period, returns were double-digit 4 out of 5 times.

Exhibit 4: 3/5/10 year returns post investing just before a crash (>20%)

Disclaimer/Source: MOAMC Research, www.niftyindices.com, www.bseindia.com; Performance Data as of the close of 03-Apr-1979 – 31-July-2021 * Indicates CAGR returns from Feb-15 to July-21, ^ denotes custom index. Returns are simulated using monthly Sensex PRI data from April 1979 - June 1999 & Nifty 50 TRI data from July 1999 – July 2021; All performance data in INR.

There are some important factors to consider here. During the first two decades (i.e. during the ‘80s and ‘90s), Indian investors were very new to equity investing. Hence, markets were highly inefficient and less liquid which lead to high variability in returns. With increasing participation from retail as well as institutional investors, Indian markets have come a long way from being less efficient to what it is today. Active participation of domestic and foreign institutional investors are the key to increasing the efficiency of India’s capital markets.

Investing just before every fall of >10 per cent since 1979

To cover a wider possibility, let’s assume that post your investment at all-time highs, markets fall by more than 10 per cent. In that case too, the median returns for all the 3/5/10 year periods are between 12 -13 per cent. However, if we look at corrections since the year 2000, 3-year returns were negative only once while 5 and 10-year returns were always positive.

Exhibit 5: 3/5/10 year returns post investing just before a fall of >10%

Disclaimer/Source: MOAMC Research, www.niftyindices.com, www.bseindia.com; Performance Data as of close of 03-Apr-1979 – 31-July-2021 * Indicates CAGR returns from Feb-15 to April-21, ^ denotes custom index. Returns are simulated using monthly Sensex PRI data from April 1979 - June 1999 & Nifty 50 TRI data from July 1999 – July 2021; All performance data in INR.

Similar to what we saw earlier, the variability in returns is high during the ‘80s and ‘90s. However, during the last two decades (i.e. during 2000-2020) we experienced relatively lesser volatility. Also, the average time taken for a correction (fall >10 per cent) to recover to its previous peak is ~1.5 years (18 months).

So to sum it up, markets are at all-time highs quite often and the chances of a crash post a peak is low. Hence there is no point in keeping cash idle as inflation will erode its value over time. Even when the coincidence does happen and an investor ends up investing at the exact time before a crash, then patience is its biggest asset. Historically speaking, as mentioned above, markets have recovered to their previous peak in a couple of years. The longer the investor waits, the higher are the probability of good returns.

The author is Head - Passive Funds, Motilal Oswal Asset Management Company

DISCLAIMER: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.