Indian Energy Exchange's (IEX) 2024 started on a positive note, as the company reported an over 14 per cent rise in volume for the month of December last year. The surge comes as the robust industrial activity in the country pushes energy demand to record highs. While the company builds on the momentum, a dark cloud in the form of a big regulatory change is hovering over its growth prospects in 2024.

Indian Energy Exchange's Growth Under Dark Clouds Due To Proposed Regulatory Changes

Despite robust growth in the past few years, Indian Energy Exchange is bracing for a possible regulatory change in 2024 which could change the dominant position it has in the market

The year 2023 for investors in the Indian power sector could not have ended on a better note. The BSE Power Index posted more than 35 per cent returns in 2023 while the Nifty Energy Index posted gains of over 27 per cent. Power generation and distribution have seen a dramatic surge in the last few months owing to high electricity demand across the country. Amidst this buoyant atmosphere, India’s largest energy exchange, IEX, has also managed to make a comeback in 2023 after a dismal 2022. IEX shares gained 19 per cent to reach Rs 168. But analysts are cautious about the prospects of the company going forward.

With energy markers booming and India’s ambition to establish a South Asia power market gaining steam, the importance of energy trade is expected to increase in the years to come. But it is this ambition which has prompted the government to propose market coupling, which will change how the Indian exchange market works. This has worried the largest exchange and the investors in its scrip.

The debate over whether the country should go for market coupling to streamline the sector was all the rage earlier in the year when the Centre first introduced the proposal. Despite the opposition of some players, the plan continued to gather steam throughout the year. Citing senior officials, Financial Express recently reported that the implementation of the plan can be completed as soon as the end of the financial year 2024. If the move goes as planned within the next three months, analysts worry about the impact on IEX, which stands to lose the most due to its position in the market.

Rethinking Energy Exchanges

The idea of Energy Exchanges took off in the late 2000s when IEX and Power Exchange India Limited (PEIL) launched their operations in 2008. The energy exchanges entered the segment five years after the Electricity Act liberalised the power sector and recognised electricity trading as a separate activity. The idea was simple, the platforms would help take the surplus electricity to the regions which suffered from deficit in production.

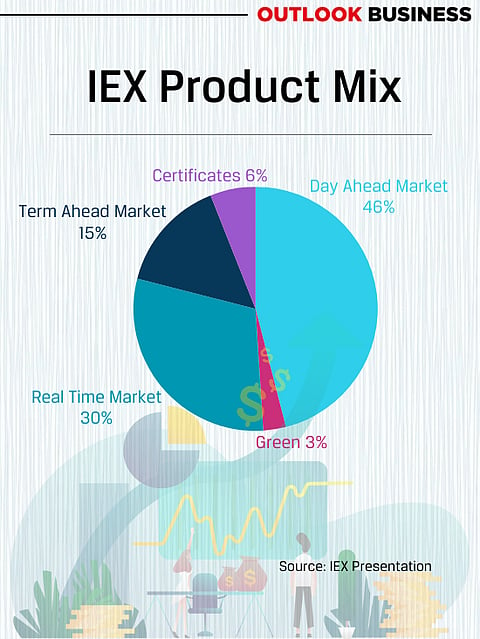

Providing a single platform for trading power, the idea slowly gained traction and IEX reached Rs 174 crore revenue by FY14. The volume growth in its segments such as day ahead market, where buyers can get electricity in time blocks of 15 minutes which are delivered in the next 24 hours, posted significant growth from just 6 BU in FY10 to 50 BU in FY20. As trading in short-term markets provides flexibility to the buyers over meeting dynamic requirements, DISCOMS and private players turn to them occasionally when supply in some parts is not able to meet demand.

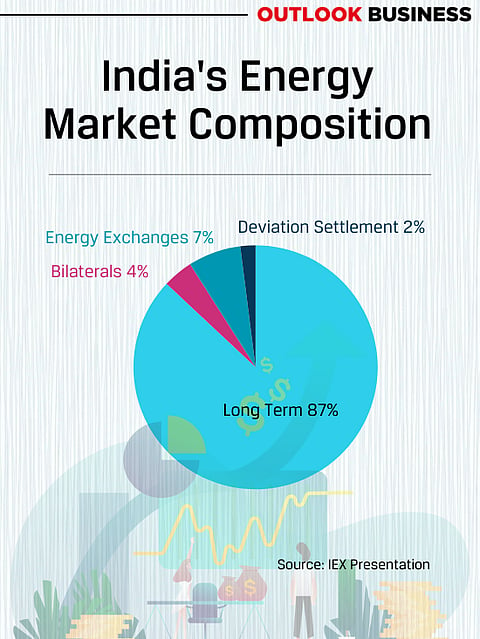

However, the share of power exchanges remains meagre in the total power market. As per the data, India’s power market is dominated by long term power purchase agreements (PPAs) with 87 per cent share in FY23 while short term trade had just 13 per cent share. Within this, exchanges made up for 7 per cent share while bilaterals and deviation settlements had 4 and 2 per cent shares respectively.

It is this market the government has been looking to change. Instead of just relying on long term PPAs, it is pushing for the increasing role of short-term trade on exchanges. To facilitate the market, the regulator Central Electricity Regulation Commission (CERC) was asked in June to work on implementing the proposal of market coupling, a measure which would collect all the bids from the power exchanges and give a uniform price. Hitesh Chaniyara, Executive Director of Smart Utilities at PwC India, opines, “Globally market coupling has in general resulted in positive outcomes by combining distributed markets. However, in the Indian context, it aims at increase in market liquidity and uniform pricing in the power market.”

CERC had earlier predicted that the share of long-term power contracts would shrink to 50-60 per cent. The proposal of market coupling to streamline the markets has received significant attention from players in the sector. While PEIL, which has a small share in the overall power trading market, welcomed the move, IEX came out in opposition to the proposal. With over 95 per cent share in the DAM, a move to restructure the market and reduce the role of the exchanges to just bid collection would threaten its position. Afterall, price discovery is one of the most important features of any exchange which incentivises investment in diverse technological products.

Uncertain Future

Investors have clearly identified the threat to IEX’s prospects if the market coupling proposal goes ahead as planned. The scrip had delivered strong returns around the time of the pandemic when its business was boosted due to robust demand. Between December 2019 and 2021, it surged from Rs 46 to Rs 295, giving returns of over 500 per cent.

Since 2022, it has climbed down to below Rs 200 due to moderation in trading volume as supply witnessed some stress and demand shot up in the country. However, a big hit to the price came in June 2023 when the market coupling proposal was circulated by the regulator. Its share price fell by over 17 per cent within 2 days.

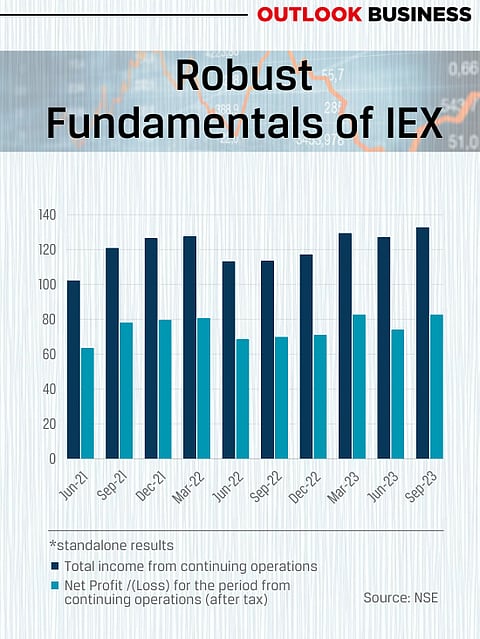

Brokerage firms and analysts note that the fundamentals of the company remain strong, but the looming threat of market coupling is weighing down on the firm significantly. Since FY20, the revenue of IEX has surged from Rs 297 crore to Rs 474 crore. Its profit after tax has also shown strong growth, rising from Rs 177 crore to Rs 292 crore.

But for some, the proposal of market coupling isn’t just a dent to its growth prospects, it represents an existential threat. Consultancy firm Eninrac said in a note on the proposal of market coupling, “With the implementation of market coupling, the traditional role of power exchanges as intermediaries may diminish, possibly leading to their reduced relevance or even obsolescence.”

Agreeing with the possibility of a big impact on the company, Dhirender Mishra, Senior manager of Growth Advisory at Aranca, argues that regulatory uncertainty has dragged the company’s stocks down in 2023. He adds, “In case the CERC announces the implementation of market coupling, the company’s share might get impacted significantly.”

A threat of this magnitude would certainly worry investors, which was evident in the last earnings call of the company. With several questions on the proposal on market coupling and the road ahead in the near future, the leadership of the company attempted to reassure the investors. No official clarity on the plan to implement market coupling has been cited by the company to allay some concerns.

Commenting on the process of compiling comments by CERC, Satyanarayan Goel, Chairman and Managing Director of the company, said during the Q2 earnings call held recently, “The process of finalisation of regulation itself may take one year time and after that implementation of coupling is getting a software, customizing the software for Indian conditions, and putting in place the clearing and settlement mechanism. So, all those things, it may take anything between one and a half to two years’ time for implementing coupling after that.”

The company believes that CERC has taken a neutral view on the issue and there is no certainty that plan would eventually go through. But even if it does, some analysts appear to be confident that the IEX will continue to have an edge in the market due to its lead in different products. Jay Patel, Research Head at Investmentors, suggests that the company holds good potential from a long-term perspective. “At the moment, there is little understanding of how the new regulations would work. But what sets IEX apart is the diverse set of products it has and good presence in the renewables segment. Looking at the company from a 5-year perspective, I believe its current lead in the market puts it in a position to sustain growth.”

In the last few financial years, the green energy market has received significant attention from the company. Separate from its day ahead market, it has introduced green day ahead market to capitalise on the growing renewables space. The company has also expanded the renewable certificates business. Its total green market saw a 5 per cent year on year growth in FY23 while energy certificates distribution remained stagnant at 6 BU. In a bid to cater to buyers looking for stability, the firm has also planned to introduce long duration contracts which would extend up to 11 months. The maximum duration for contracts on the exchange is 90 days currently.

But as the large portion of revenue still comes from the traditional source of DAM and other real time markets, the big question mark remains on what the government decides on the proposal of market coupling. The year 2024 is expected to provide definite answers to the uncertainties surrounding the company. But until then, little remains in the hand of India’s largest energy exchange.