If it sounds too good to be true, it probably is.

Markets Mania: The Multibagger Hype Is Hiding Bad Fundamentals

Millions of Indians have turned stock market investors in the last 3 years. Many have staked their life savings on the markets. But markets are moody creatures. And the companies they are investing in don’t have the strongest fundamentals

The maxim can be traced to at least as far back as the 15th Century. And one hopes that the wisdom contained therein informs the millions of Indians betting their life’s savings on the stock markets.

A record number of people have joined the stock markets in the last three years. Around 73 million demat accounts have opened during this period.

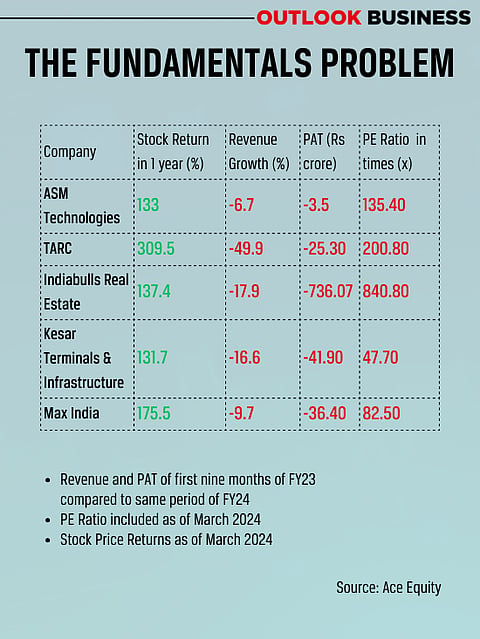

But many of these people have little or no idea of how the stock market functions, the parameters they should focus on or how the companies they are investing in are doing. An Outlook Business analysis of stocks that had turned multibagger — which means they gave returns of 100 per cent or more over the last year — showed that a sizeable number of companies that millions of people are investing in have strikingly poor fundamentals.

It all started in March 2020. The market crashed and Nifty fell to 7,511 points triggered by the Covid-19 pandemic. What followed was a unique one-way rally that took the benchmark Nifty50 index from 7,511 to an all-time-high of 22,529.25 on April 1, 2024. Small- and mid-cap indices outpaced benchmark indices. In 2023, the small-cap index surged 47 per cent and the mid-cap index surged 45 per cent. In the same year, the BSE Sensex went up 18.7 per cent, showing significantly lower growth than the small- and mid-cap indices.

Floundering Fundamentals

The Outlook Business analysis of 3,522 companies listed on the BSE found that 920 stocks had turned multibagger over the previous year. Of these, roughly one-third had seen a decline in revenue in the first nine months of the financial year that ended March 31, 2024, compared to the same time in financial year 2023. More than 18% of these companies reported losses in the first nine months of FY2024.

Take, for example, Alok Industries. This Reliance-backed textile manufacturing company posted a net loss of Rs 630.18 crore in three quarters of FY24, an 8 per cent increase in losses from Rs 582.19 crore in the same period last fiscal. Yet, the company’s stock surged 122% in FY24. Vodafone Idea, India’s third largest telecom services provider, reported a net loss of Rs 23,560.90 crore in three quarters of 2024, with its losses going up 3% from Rs 22,882.70 crore in the same period last fiscal, yet its stock price went up 127 per cent.

Add to that, 300 out of the 920 companies that had turned multibagger, roughly 32 per cent, reported a price-to-earnings ratio of 40 or above. Price-to-earnings is a financial metric that compares a company’s share price to its earnings per share. A high PE, that is 40 or above, means investors are buying stocks at 40 times the price of a company’s earnings. A high PE often indicates that a stock is overvalued.

Analysts say the rally in the stock markets is not driven by how companies have performed but by how investors hope they will soon. “Stock prices have rallied merely based on hope that the company will deliver good performances over the next few years,” says Kripashankar Maurya, assistant vice-president (research) of Choice Institutional Equities, a Mumbai-based broking firm. Maurya says despite the rally, if a company lacks solid fundamentals, and there isn’t a concrete plan on paper, the stock might just be overvalued. “Compared to companies with strong financials, these stocks will be heavily beaten,” he adds.

Many of these companies whose stocks turned multibagger this fiscal, had been doing poorly for a while. Nearly 80 percent of these 920 companies had a return on capital employed (ROCE) figure of 20% or less in the financial year that ended March 31, 2023. Around 13% of these companies had a debt-to-equity ratio of more than one, meaning these firms had liabilities more than their assets in FY2023. Yet, people had bought these stocks and were continuing to buy them in large numbers.

And Then There Was Froth…

That the rally in the stock markets was not in line with the fundamentals of some companies was pointed to by Madhabi Puri Buch, the chairperson of the Securities and Exchange Board of India (SEBI) — the country’s market regulator. Speaking at an event on March 12 this year, Buch said there is “froth” in the small- and mid-cap stocks.

She said the “off the charts” valuations in these market segments indicate price manipulation in the small and medium enterprises segment. The very next day, March 13, broader markets saw their biggest single-day decline in two years. The Nifty Smallcap 100 index fell 5.3 per cent. The Nifty Midcap 100 dropped 4.4 per cent.

But after this minor correction, the rally went on.

The rally points to the behavioural psychology of common investors, says Kranthi Bathini, director of equity strategy at the broking firm Wealthmills Securities. “Prices change the perception of the people. Often, people tend to chase the price of stock rather than its value.”

Tanvi Kanchan, who heads UAE business & strategy at Anand Rathi Shares and Stockbrokers, says the fundamentals are not catching up with the rally the market is witnessing. “The recent market rally happened because of multiple factors other than fundamentals. At these levels, some profit booking makes much more sense for investors who have got in the stock market during this rally period.”

A section of analysts says the boom in stock prices of companies with weak fundamentals, for now at least, is not overly concerning. Some of them are also cautioning against overregulation by SEBI after the regulator’s chair pointed to froth.

A regulator cannot resort to overregulation amid investor euphoria, says Vidisha Krishnan, a former SEBI official and currently a partner at MVKini, a law firm. “Investors have very few avenues apart from capital markets to get good returns. SEBI has so far done what a regulator should, but it must ensure that there isn’t ad hoc over-regulation.”

Krishnan says over-regulation will lead to protectionism which will drive people away from the markets and consequently markets will lose depth.

The bull run is on for now. Thousands of people are jumping into the stock market every day hoping to grow their hard-earned money. But multibaggers are the crown jewels of the markets. If even a section of these stocks is overvalued, it raises apprehensions of a bubble, and millions may be at risk. For when a bubble grows too big, it bursts.