'Resilient,' is perhaps the most widely used term among market experts on Dalal Street in 2023 when describing the Indian equity market. Despite the benchmark indices reaching unprecedented levels, the truly remarkable aspect of the Indian markets lay in their performance relative to global counterparts.

Year Ender 2023: A Closer Look At The Year's Most Disappointing Investments

Amidst the skyward surge of markets in 2023, a select few stocks missed their cue on D-Street. Here is a closer look at the Year's top underperformers

However, in the face of global headwinds and the sweeping influence of macroeconomic factors, some market segments succumbed to the bearish embrace, disrupting the soaring uptrends. Here are the top worst-performing stocks of 2023.

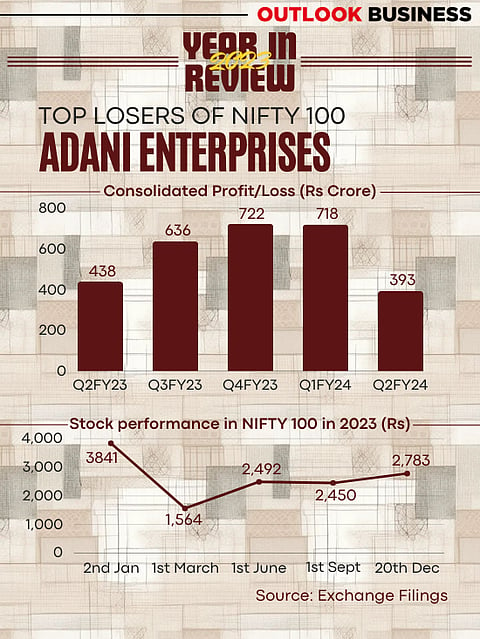

1. The Adani Chessmen

Out of the 10 publicly listed companies under the Adani empire, a prevailing bearish sentiment has seized a majority of its publicly listed companies, witnessing a decline in share values for over half of the portfolio firms. From Adani Wilmar to Adani Green Energy, the looming impact of the Hindenburg report continues to cast a shadow over Adani's stocks. A standout among the portfolio, Adani Total Gas, has experienced a staggering 70 per cent downfall year-to-date, emerging as the most significant loser.

Even the flagship company of the empire, Adani Enterprises, has lost a quarter of its share value.

Further compounding the losses, Adani Energy Solutions and Adani Wilmar also faced substantial setbacks, with their share prices plummeting by approximately 58 per cent and 40 per cent, respectively. Analysts attribute this downturn primarily to the controversial Hindenburg report, which has led to a significant erosion in the total market value of all 10 listed Adani companies, "from Rs 19.6 lakh crore at the end of 2022 to Rs 13.6 lakh crore presently", said Dr. Ravi Singh, an independent market expert.

2. UPL Ltd.

The shares of the Indian Agrochemical MNC witnessed a downfall of more than 18 per cent. UPL Ltd. reported a consolidated net loss of Rs 189 crore in Q2FY24, compared to a profit of Rs 814 crore in the same quarter last year and a profit of Rs166 crore in Q1FY24. The company attributed the decline in figures to the price pressure and global channel destocking. Moreover, high-cost inventory liquidation also adversely impacted the contribution margin.

Analysts link the subdued figures to soft global demand, given the company's extensive presence in over 100 countries. Despite this, analysts express a cautiously optimistic outlook for the coming year. Vaibhav Kaushik, Research Analyst at GCL Broking, notes, "The stock appears poised for an upward trajectory with the rising global demand for agri-chemicals."

3. Vedanta

In 2023, the Indian multinational mining company faced intensified pressure as certain domestic and global rating agencies downgraded the bonds associated with its subsidiaries. Vedanta has also encountered significant challenges in cash flow and liquidity. On top of it, the company incurred a net loss of Rs 915 crore for the quarter ending in September.

Even the company's demerger plan failed to garner the interest of the D-Street, witnessing a year-to-date decline of nearly 20 per cent.

"Moody's downgrade of Vedanta Resources Ltd.'s corporate family rating, driven by increased debt restructuring risks and a lack of refinancing clarity, has positioned the stock among the worst performers this year," Singh noted.

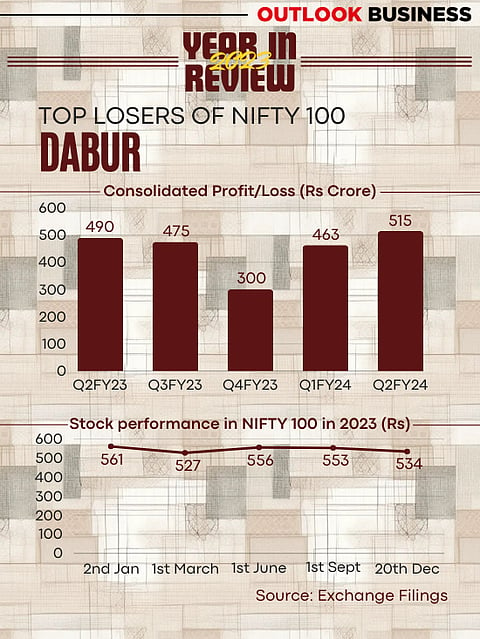

4. Dabur

The economic growth following a K-shaped trajectory has resulted in a disarray of the demand structure. While urban demand displayed a degree of resilience and strength, rural demand has been significantly affected, mainly due to inflationary pressures. The FMCG sector emerged as one of the prominent sectors bearing the brunt of the diminished demand.

On a YTD basis, Dabur experienced a decline exceeding 5 per cent. Although a single-digit decrease may not be particularly remarkable, it is noteworthy that despite benchmark indices reaching their all-time highs this year, shares of Dabur did not register positive gains.

According to analysts, in addition to subdued rural demand, investor confidence in the stock has been adversely affected by recent lawsuits against its US subsidiaries, leading to a decline in its market value.

5. SBI Cards and Payment Services

SBI Cards and Payment Services experienced a nearly 4 per cent decline on a year-to-date (YTD) basis on the National Stock Exchange. While the company exhibited a robust upward trend in the middle of the year, the recent move by the RBI in the unsecured lending space has turned the earlier optimism into a strong downtrend. In Q2FY24, the company achieved a net profit of Rs 602 crore, marking a year-on-year (YoY) increase of almost 15 percent. But heightened competition may be emerging from other NBFCs, startups, and fintech companies.

"The company's underperformance in 2023 is linked to a decrease in market share, driven by the RBI's strict regulations on non-secured loans," Kaushik said.