The CGO complex in Delhi, next to Jawaharlal Nehru Stadium off Lodhi road, houses several central government and some PSU offices. The complex can be pretty intimidating. So, when I visited Neeraj Kumar Gupta, secretary, Department of Investment and Public Asset Management (DIPAM) to understand the thinking behind the much awaited Bharat 22 ETF, it took a while to reach his office on a floor which was being renovated. Thankfully, the interaction was smooth and he was very candid about his take on this new offering.

Betting on the India story

The launch of Bharat 22 ETF will benefit several investors, especially those who are looking for stable returns

“The broad divestment policy is looking to achieve divestment target through minority stake sale, strategic sale, listing of CPSEs, consolidation of oil sector, and listing of insurance companies,” he said. Having tasted success with the CPSE, this route for strategic disinvestment was favoured by the government for several reasons, but primarily to engage retail investors to take part in this investment opportunity that was being offered to them. “ETF management costs are low, relatively less risky, the investments are transparent, one can trade in real time, and there is liquidity,” he explained.

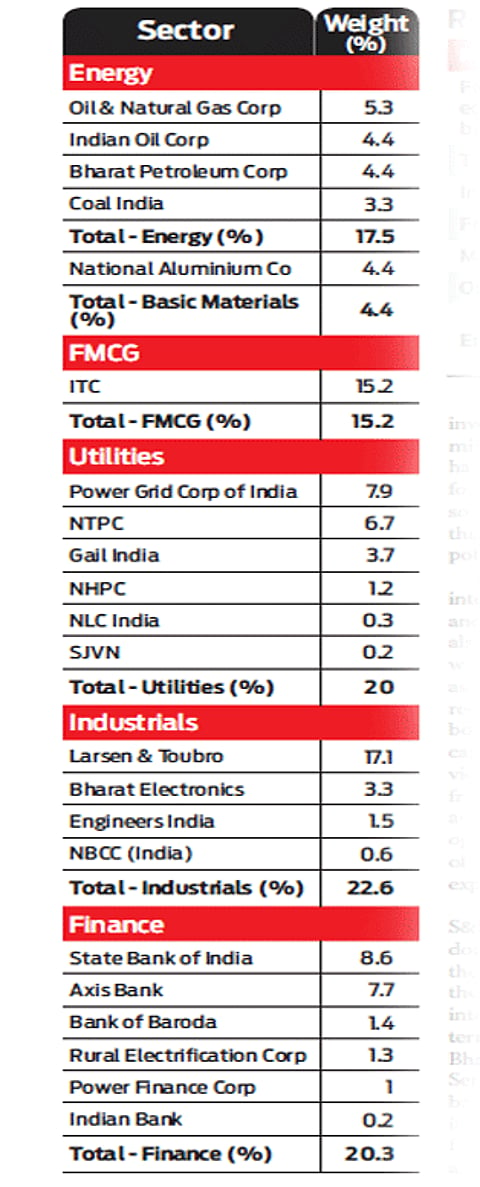

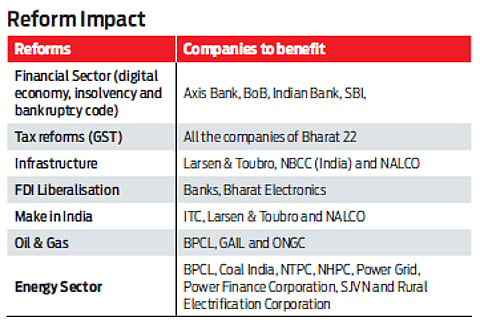

The ETF will be managed by ICICI Prudential AMC and the index was created by Asia Index Private Limited, which is a joint venture between the BSE and S&P Global. The composition of Bharat 22 is very different from the earlier CPSE ETF. “Bharat 22 is well-diversified with investments across six sectors—basic materials, energy, finance, FMCG, industrials, and utilities,” says Gupta. The focus on constituting this ETF has been done taking into account the retail investor need for stable return on investment in companies that have a proven track record, with a long history of existence.

The mix of allocation across sectors is such that it takes into account safe, cyclical, and growth prospects. So, FMCG takes care of the safety net, energy and metals will benefit from cyclical nature of the economy. Further, the caps on allocation to sectors and companies means, there is very little room for discretion in allocation. Moreover, the fund will be balanced annually in March, which is again favourable for investors so that the basic allocation mix is somewhat maintained. “We have looked at creating an avenue for investors to take advantage of some of the best companies where the government operates with grown potential,” adds Gupta.

In all fairness, the thought gone into creating this product is sound and convincing. The role of DIPAM is also clearly stated, as the department will help in managing the financial aspects of CPSUs such as capital restructuring, leveraging of assets, bonus policy, dividend policy, and capital expenditure. “My department views all aspects of our actions from an investor’s perspective. Our aim is to provide investors with the opportunity from the value unlocking of PSUs from such a strategic route,” explains Gupta.

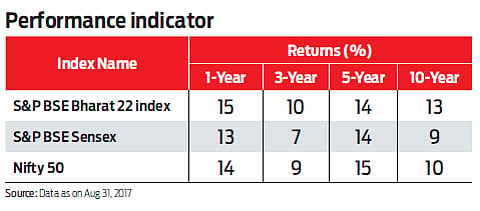

With near 90 per cent of the S&P BSE Bharat 22 constituents dominated by large-cap stocks, there is little room for slackness in the performance. If one digs deeper into the performance of the index, in terms of dividend yield, the S&P BSE Bharat 22 index scores over the BSE Sensex over different time periods based on historical data. Likewise, if you look at the 22 companies that form the index, a majority of them are those in which several established mutual funds are already investing, which validates their presence in this ETF as well.

As we were winding up the discussion, I asked Gupta if he saw room for more such ETF offerings and he replied with a smile: “let us take one step at a time. Bharat 22 offers good opportunity and prospects to investors and for now that is the focus.” By the time you read this, the fund offering must be on or would have just got over. Going by the past experience with the initial launch of the CPSE ETF, there is chance for the government to throw in a discount to market price of the underlying stocks and loyalty bonus to retail investors.

I don’t know where the idea of Bharat 22 came from, but if one has read The 22 Immutable Laws of Marketing by marketing and branding gurus, Al Ries and Jack Trout, there is a lot that an investor could gain by investing in this ETF which has been made from 22 magic companies. The biggest advantage of investing in a basket of PSUs is that you will not be in for surprises, because these are businesses that focus on areas in which they operate, with little room for divergence into new areas or segments.