Mutual Funds For Your Long-Term Goal

We all know that retirement is inevitable. After a certain number of years on the job, most of us will retire. Some will take new work which are now available for retirees while some will pursue new venture or their old passion which were unattended because of vagaries of professional life. In any case, the regular flow of money often reduces significantly. In such a situation, having sufficient corpus in the account becomes necessary. While pension funds, fix deposit, PF, PPF, and few Government schemes provide options to invest, none can beat mutual funds when it comes to retirement planning. So, let’s find out how mutual funds can help make your retirement financially secure.

Mutual funds investment options

Mutual funds offer investment options in equity, balanced, and debt schemes. Equity funds offer the best returns in the long run but fluctuates more in short term. Debt funds are almost consistent in returns but the returns are less than that of equity or balanced funds.

Why mutual funds?

Mutual fund industry offers many options based on the investment horizon and risk profile of the investors. Since retirement planning is a long-term goal, the best mutual funds for retirement planning are either equity funds or balanced funds. Equity funds have the potential to offer 12 per cent to 18 per cent pa returns, while balanced funds can offer return of around 8 per cent to 10 per cent pa. This is pretty good considering that the bank deposit or other saving schemes gives you around 6 per cent to 7.9 per cent pa return.

Moreover, it is very flexible. Unlike other saving assets, you can liquidate mutual funds anytime and the money will be deposited back to your account within two days.

How to invest in mutual funds?

You can invest in mutual funds in lump sum or monthly through systematic investment plan (also known as SIP). The advantage of SIP is that it automatically sets aside a fixed sum from your bank account every month and invests in mutual fund scheme that you have selected. Moreover, the salary is usually credited monthly in your bank account, and hence SIP offer a comfortable way to invest money.

Apart from monthly SIP, whenever you want to put excess fund into mutual fund, you can do it. In fact, it is advisable to put a portion of extra income that you earn from time to time such as bonus, variable pay, any other income from selling assets etc., into the mutual funds.

Show me the money

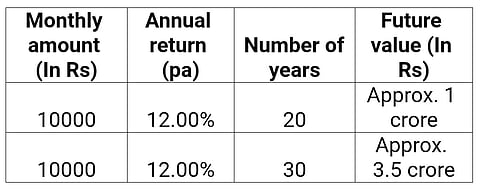

Here is a brief calculation which shows a regular stream under SIP over a long-term can build a big corpus for you.

Portfolio Rebalancing

While investing towards achieving your retirement goals, its vital to rebalance your portfolio from time to time in sync with the change in your risk appetite, return needs, and change in your retirement goal. For example, if you start at a young age then you have higher risk appetite so you can invest all your money in equity-oriented schemes, but gradually as you grow older and closes to your retirement, then the portfolio should be rebalanced accordingly, and money should be shifted from equity to debt schemes to lower the risk and ensure a stable return.

Things to keep in mind while investing in mutual funds for retirement

Do your study to select the right mutual funds. The most important point is to look at the 10 to 20 years CAGR of various mutual funds and choose the ones that have delivered better returns. This simple exercise will eliminate the wrong choices. Then you can start investment through SIP mode in the mutual fund of your choice. It is always better to select an investment advisor for selecting the best mutual fund scheme in sync with your financial goal.

The author is the Director of Wealth Management, JRK Group