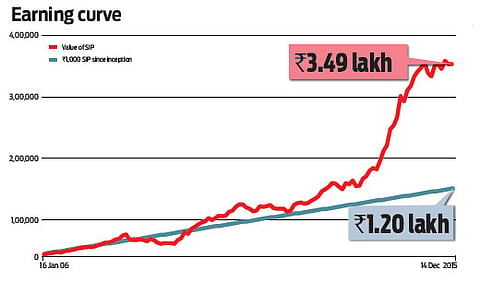

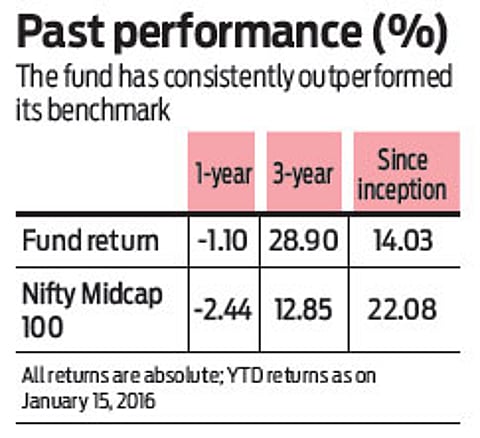

This fund seeks aggressive growth by focusing on small- and midcap companies. In its decade-old history, it has managed to outperform its benchmark index, the CNX Nifty Midcap 100, on six occasions after a not-so-good start in its initial years. Since 2011, it has managed to consistently outperform its benchmark.

Power-packed show

This fund’s consistent performance over its 10-year history makes it an all-weather pick

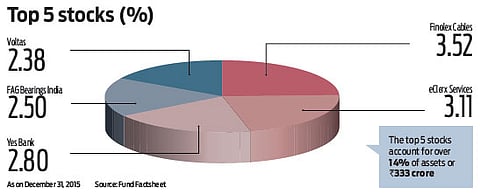

A relatively risky fund, it has exposure to small- and mid-cap stocks that are from outside the top 100 stocks in the CNX 500 index. The fund managers have the flexibility to invest in companies that are down the market cap curve, which has benefited it in its performance during rallies. Investments of this fund are made in quality companies like Finolex Cables, eClerx Services, Voltas, Yes Bank, FAG Bearings India and Navneet Education, among other companies that are in the mid and small-cap universe.

The investment approach of this fund is bottom-up, with the fund manager picking stocks that grow at a reasonable price. Despite being a small-cap focused fund, it has managed to steer itself well in the bear markets of 2011 and 2013. The way it manages to check its fall in bear phases is to hold on to cash at a higher percentage than its equity exposure, a trait that has made it a good choice among investors.

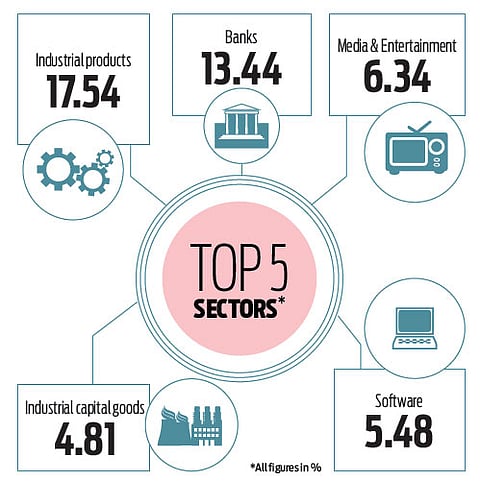

Expectedly, the portfolio is made of many stocks, going up to over 70 on most occasions, with individual stock allocation rarely going above 5 per cent. Also, the there is smart diversification by ensuring a healthy mix across favourable sectors. A higher tilt is towards companies in the banking and financial services space. Additionally, investments are also made in stocks within the cyclical themes, such as industrial products, cement, power, and oil and gas in its portfolio. This is a fund for someone who is seeking higher investment returns over a full market cycle and can stomach the associated risks with it.