Roopesh Kumar Yadav, a 37-year-old central government employee based in Meerut, is not associated with the city’s famed sports equipment manufacturing industry, which has supplied its sought-after willows to many a celebrated cricketer. Yet, Meerut’s legendary status as the Sports City of India has lent its flavour to his investment approach. He believes in accumulating the ones and twos while not losing sight of the occasional sixer to push up total gains. “I have been investing in an equity mutual fund since June through an SIP of `4,000 per month. Recently, I also directed an additional savings of `20,000 to this fund to boost my corpus,” explains Yadav. Why settle for a 280-odd score when 350-plus is the new normal seems to be his mantra. “My PF is unlikely to grow into a sizeable corpus as it does not fetch lucrative returns. Moreover, interest rates offered by post office and bank deposits are also quite low. Equity funds are my best bet to create a large enough retirement fund,” he reasons.

Small is the Next Big Thing

First-time investors from smaller cities are showing greater appetite for MFs, but is the trend here to stay?

Aiming Big

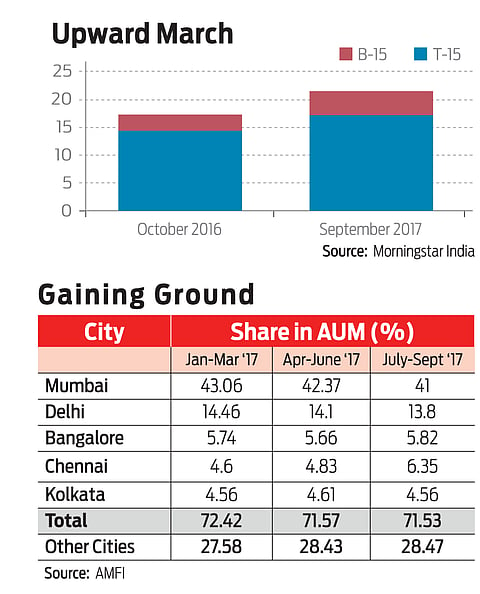

Yadav represents the growing tribe of retail investors from the not-so-big cities who are increasingly relying on mutual funds to realise their dreams. As per data from mutual fund research firm Morningstar India, investors from B-15 cities – the ones beyond the list of top 15 cities – accounted for 17.7 per cent of the overall industry assets under management (AUM) as of September 2017, up from 17 per cent in October 2016 (See: Upward March).

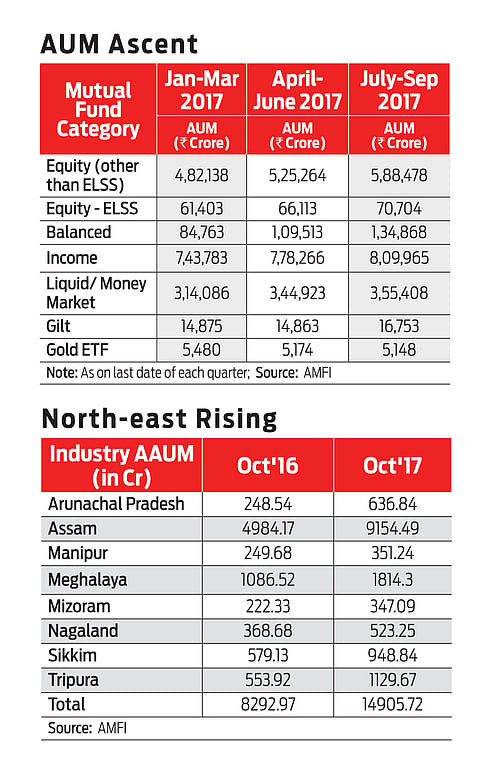

A close look at the Association of Mutual Funds in India (AMFI) data on AUM by geographies (see: Gaining ground) reveals that the share of top five cities—Mumbai, Delhi, Chennai, Bengaluru, and Kolkata—has dipped slightly from 72.42 per cent in January-March 2017 to 71.57 per cent in the subsequent quarter, and further to 71.53 per cent during July-September 2017. Correspondingly, the contribution from the other cities has risen during the period.

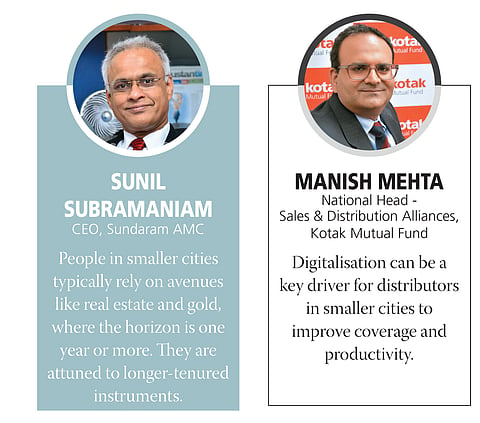

“We are seeing a strong interest from retail investors in smaller cities. What we are witnessing is a structural change in investors’ mindsets. There is a clear shift away from physical assets and towards financial instruments,” asserts Sundeep Sikka, Executive Director and CEO, Reliance Nippon Life AMC, which has recorded considerable interest from the North-eastern states too. The total AUM from the region shot up nearly 80 per cent to cross `14,905 crore in October 2017 (See: North-east rising) compared to the year ago period. “We continue to see good traction from smaller cities. For the period March-September 2017, we witnessed a 40 per cent growth in overall AUM and more than 50 per cent in equity,” adds Manish Mehta, National Head - Sales and Distribution Alliances, Kotak Mutual Fund. However, he believes that the decline in share of larger cities could also be attributed towards the quarter-end redemptions by institutional investors.

Name: Alamelu Vishwanathan Sundaram

Age: 60

Location: Coimbatore

Investment Rationale: Building a corpus for post-retirement requirements and grandchildren’s secure future.

DeMo the Catalyst?

Sikka attributes this trend to multiple factors. “The trend started with Jan Dhan accounts when a large number of people gained access to bank accounts. Next, with demonetisation, money flowed into these accounts,” he notes. Sundaram AMC CEO Sunil Subramaniam concurs with Sikka on demonetisation’s role as a catalyst. “It hurt real estate and gold, besides prompting banks to ease interest rates as they were flush with liquidity. Mutual funds offer much higher returns, attracting more retail investors,” he says. SEBI rules for distribution in B-15 cities have helped as well. “We can now offer attractive incentives to distributors to source new investors from smaller cities. The industry’s ad campaign too has played a role,” suggests Subramaniam.

Mutual fund distributors based in such

Name: Roopesh Kumar Yadav

Age: 37

Location: Meerut

Investment Rationale: Creating an adequate retirement kitty, as he feels his provident fund is not capable of yielding the desired performance.

cities back these views. “I manage to convert more enquiries into actual investments these days—it has gone up 25-30 per cent since demonetisation,” informs Sachin Uddhav Chumble, partner, WealthGuru Financial Services, a Nashik-based mutual fund distribution firm. “Now that the cash lying in their house is parked in their bank accounts, they want the money to earn returns.” While acknowledging the role of demonetisation, Jamnagar-based mutual fund distributor Raj Jivrajani of Money Matrix Advisors also credits factors other than the disruptive event for the trend. “Interest rates offered by banks are down. So, people have realised that mutual funds can provide better returns. Also, awareness levels have risen in the last two years,” says Jivrajani. Chumble is confident that these new investors are aware of the market risks involved. “Most of them are recurring deposit investors who can see that SIPs are better option even if they yield 9-10 per cent returns,” he adds. Technology has played a pivotal role in deepening mutual fund penetration, ensuring ease of communication and execution. “What investors look for is a mobile-friendly platform to execute their transactions. Language is not a huge barrier, as people are conversant with English as the language of transactions. However, the next level to be unlocked would be that of region-specific portals and communication channels,” says Kunal Bajaj, founder and CEO, Clearfunds.

The Long-term-SIP Fix

It cannot be ruled out that many have jumped on to the bandwagon purely due to the bull run. Many investors do recognise the risks and also the importance of systematic investment over the long term. “We have observed that people in

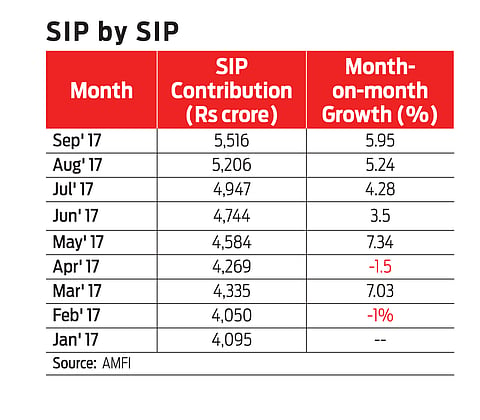

smaller cities typically rely on avenues like real estate, gold, National Savings Certificate (NSC) and Kisan Vikas Patra, where the horizon is one year or more. They are, therefore, attuned to longer-tenured instruments,” explains Subramaniam. What’s more, many seem to prefer the SIP mode for investing in mutual funds, which is not surprising given the overall SIP inflows recorded (See: SIP by SIP).

First-time mutual fund investor Bathinda-based Hitesh Pant, 35, falls in this category. He started investing in equity mutual funds through the SIP route since July this year to build an education corpus for his four-year-old daughter by the time she turns 17. “Since funding her higher education is a long-term goal, I don’t intend to redeem my investments in the near future even if the market cycle turns,” he clarifies.

The goals of the newer crop of first-time mutual fund investors may be as varied as their age-groups, professions, and locations, but there seems to be unanimity in their vehicle of choice for achieving them—SIPs. Take the case of Coimbatore resident Alamelu Vishwanathan Sundaram, 60, for instance. A retired school teacher, she stepped into the world of mutual funds in August with a monthly SIP of `3,000. “I want to create a savings fund for my post-retirement needs, in addition to creating wealth for my grandchildren,” she says. Nashik-based banker Rajesh Arun Bara, 32, zeroed in on an ELSS for a far simpler purpose—tax-planning. “I have started a monthly SIP of `4,000 in a tax-saving fund since April. Compared to other instruments, an equity scheme is likely to fetch higher returns,” says Bara.

This is the common thread that runs across all four first-time investors—the realisation that

even if markets turn choppy, their investments are likely to yield better returns when compared to bank fixed deposits or post office schemes. “Interest rates are very low at present and even PPF rate has been slashed. After tax, the returns will not add any value to my portfolio. ELSS is a more remunerative option even if returns plummet to say 9-10 per cent in case of a market crash,” reckons Bara.

Asset management companies acknowledge the durable nature of such inflows, which largely come in through the SIP route. “The ticket size is small, but the quality of inflow is quite good. Even if the market cycle were to turn, these investors are likely to stay invested,” says Sikka. According to him, it is the high networth investors with large chunks of money who tend to make panic withdrawals. “For smaller investors directing `2,000 per month into the funds, such downturns do not matter,” he affirms.

Put simply, the future looks bright, according to industry-watchers and players. “While it will be interesting to see the impact if there is a sharp correction in the market, there are enough reasons to believe that increasing awareness and maturity of investors coupled with a sizeable SIP book should result in investors staying put,” says Kaustubh Belapurkar, director-manager research, Morningstar India.

Name: Hitesh Pant

Age: 35

Location: Bathinda

Investment Rationale: Creating a fund for his daughter’s education when she turns 17; is prepared to stay invested in equities over the long term

Not Just Equities

While equity mutual fund SIPs feature in the list of most-discussed topics, debt funds’ legion of loyalists too has grown in size (See: AUM’s Ascent). “A lot of money is also coming into debt funds. With FD rates hovering around 6 per cent, many are moving towards debt mutual funds,” says Sikka. Jivrajani’s experience with his clients sounds similar. “Investors are not making blanket investments in equities. Given that bank deposit rates are down, they realise that debt mutual funds will offer better returns,” he explains.

A Note of Caution

Clearly, smaller cities’ share in the industry’s AUM has seen an expansion, but they have a long way to go before they make a noticeable dent in the larger cities’ dominant position. “Large cities will continue to play a pivotal role in the overall industry. Incremental wealth creation in large cities will continue to remain strong,” says Mehta. Bajaj echoes his sentiments. “The interest has grown, but bulk of the business is still sourced from larger cities,” he points out. Also, it is tempting to believe that retail investors across cities have matured into seasoned equity investors mindful of the risk-reward trade-off, but their resolve can be truly tested only during a market collapse. “While small town investors are aware of the risks, they would do well to shun the greed that typically takes root during a bull run,” cautions Pankaj Mathpal, CEO, Optima Money Managers. Bear your risk appetite in mind instead of blindly investing in schemes that yields eye-catching returns. “Start with less-risky schemes like large-cap equity funds and balanced funds rather than small and mid-cap equity funds,” advises Mathpal. Finally, ensure that you link your investments to goals, identify schemes that have a reliable track record and commit to equities only if you are willing to stay invested over a period of at least five to seven years.