Indians have been romancing gold since eternity. It’s evident from our festivals, weddings, sweets and even clothes. I remember when my cousin got married last year my aunt was busy shuttling from one jewellery shop to another to find that perfect piece of shiny golden necklace. I have my doubts if she spent even half of that time and energy in finding a ‘suitable’ bride. Joking apart, my aunt is one among millions of Indians who have been obsessing over gold and just can’t get enough of bling. The massive societal and cultural empathy that we Indians have built up for gold over centuries – one cannot envision of not buying gold, come what may.

When is the right time to invest in gold fund?

Keeping physical gold is a fool’s game; invest in gold fund when the need for its consumption is at a later date

Why invest in gold?

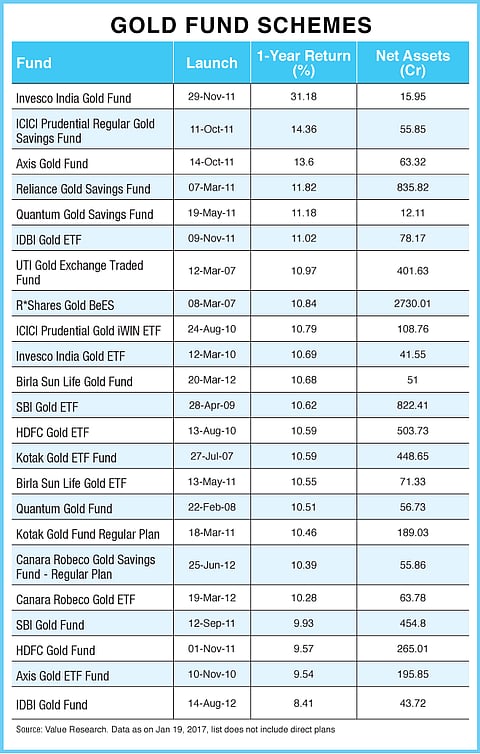

Unlike other asset classes like equities, which does better than inflation and builds wealth in the long run, there is no way you can earn dividends when you put your money in physical gold and neither is there any interest. However, if you are one among those millions of Indians who are suffering from what I call it- the ‘gold’ syndrome, where one cannot imagine of not buying gold as a matter of tradition, a far wiser way to invest in the yellow metal is in the form of paper, that is, through gold funds or in gold ETF or even the gold bond.

These funds can easily be bought and sold and there would be no problems in liquidating your gold investments. Customarily, in India, investments in gold are in the form of jewellery and you face a significant loss of value as a lot of your purchase price goes towards design and making charges. With gold funds there are no losses in terms of design and making charges and to top it all you will not have to worry over the safekeeping of physical gold.

However, investing in gold funds should not be driven by the price of gold. We believe investing in gold funds is convenient compared to the gold ETFs, but should be done only by those who see the need for consumption of gold at a later date. Gold funds are convenient as you do not need a demat account to invest in them unlike the gold ETFs. Likewise, the liquidity is higher with gold funds when compared to the gold ETF.

As for investing in these funds; you should do so if you have children and plan to gift them jewellery when they get married. In case you do buy jewellery, you risk the jewellery to go out of fashion and also worry over its safekeeping. However, if you do invest in gold funds, you can redeem the monies when you need it and buy what you want on that given day to meet your child’s needs and taste instead of stocking of physical gold.

Not only will your investments benefit from value appreciation over time, it will be safer than keeping it in physical form. Moreover, when you actually need the gold to convert it into jewellery, you will have the advantage of doing so by exercising the fashion trends of that day.