Lead manager Rohan Maru has close to 10 years of experience in the daily cash management and liquidity analysis of fixed-income funds. He has been managing this fund since September 2013. Co-manager Rahul Goswami oversees the investment process and contributes to a macroeconomic view. The team follows a comprehensive in-house investment approach that is driven by a seasoned group of investment and risk-management professionals.

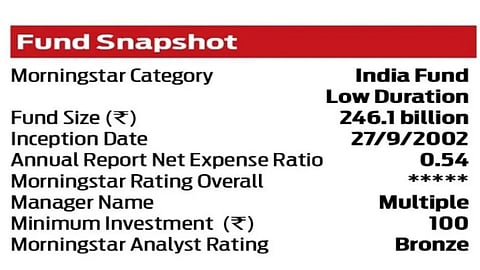

A Close Look At ICICI Prudential Savings Fund

According to Morning Star’s analysis, ICICI Prudential Savings Fund combines macroeconomic analyses of interest rate and yield curve along with credit research focusing on undervalued securities and sectors

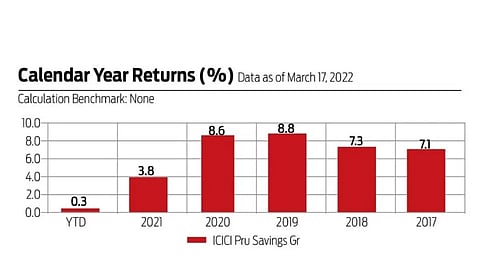

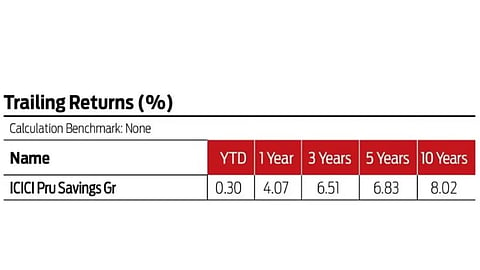

The fund employs an investment process that is focused on safety, liquidity, and returns. The managers seek to add value through security selection rather than making big adjustments to the fund's duration. They begin the process by combining both top-down macroeconomic analyses of the interest rate and yield curve, as well as bottom-up credit research focusing on undervalued securities and sectors. The investment committee approves the coverage list with a strong focus on company management and its track record, the financial strength of the promoter group, and corporate governance standards.

With the 2018 credit crisis, the fund house is more cognizant about the overall leverage of the promoter and will lend money only with a high share cover. Meetings with management are followed by quantitative analysis where the focus is to get a measure of the company's cash flow and relevant ratios--leverage, coverage, and solvency. The team also uses the ratings issued by the agencies and draws on the expertise of its equity counterparts. For this fund, the managers discuss quarterly strategies based on a combination of factors such as the macroeconomic scenario, liquidity conditions, spreads, and short-term influencing factors such as overnight rates, inflation, and money supply among others. This in turn determines the fund's asset allocation and maturity profile.

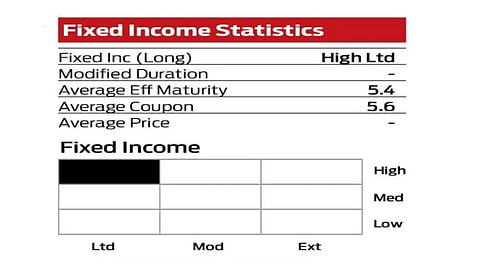

The managers focus on higher accrual income, while keeping a 75-80 per cent exposure in AAA-rated securities. The portfolio duration is maintained within six to 12 months, but the managers don't restrict themselves looking for tactical opportunities that can benefit from likely yield-curve movement. To enhance liquidity, they use a ladder approach, picking securities with varying maturities, giving the flexibility to alter duration based on the interest-rate view. The managers invest in sub-AAA-rated securities but largely those in which they have a strong comfort with company management.