The Nifty Bank Index, the gauge of banking stocks on the National Stock Exchange (NSE), rallied to a record high on Thursday before succumbing to profit booking.

As Nifty Bank Index Surges To Record High, Here’s What Is Fuelling Banking Stocks’ Rally

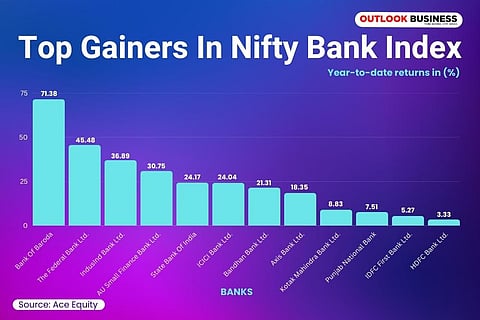

All 12 stocks in the Nifty Bank Index have given positive returns to investors since the start of the year

It has surged 3.5 per cent so far this week to hit a record high of 41,840. The measure has gone up 30 per cent since the 52-week low of 32,155 it had touched on March 8.

The gravity-defying rally in banking stocks comes on the back of strong credit and deposit growth and lower non-performing assets, say analysts.

Credit growth of commercial banks was at a near nine-year high of 15.5 per cent year on year (YoY) for the week ended August 26, latest data released by the Reserve Bank of India showed. It has been the highest since November 1, 2013, when it was recorded at 16.1 per cent.

In the current financial year, banks have extended Rs 5.66 trillion by way of loans, representing a growth of 4.8 per cent as compared to -0.5 per cent during the same period last year. Deposit growth was 9.5 per cent YoY, according to the data.

“Bank credit growth has been very good. Their NPAs are coming down and the quality of books is improving. The money, which was written off by banks, is coming back from asset reconstruction companies,” says Vijay Chopra of Enoch Ventures.

A turnaround in Indian companies’ capital expenditure cycle is also likely to give a boost to the lending activity, analysts add.

“Corporate earnings-to-GDP ratio is at its highest and strong corporate earnings indicate that banking should do well. Moreover, banks have also improved their loan disbursal processes and sensible loans are being disbursed,” Chopra adds. HDFC Bank is his top pick from the banking space.

Will It Continue?

All 12 stocks in the Nifty Bank Index have given positive returns to investors since the start of the year with Bank of Baroda surging a whopping 71 per cent, data from the NSE showed. Federal Bank, IndusInd Bank, AU Small Finance Bank, State Bank of India, ICICI Bank, Bandhan Bank and Axis Bank have also surged between 18 and 45 per cent.

Meanwhile, most banks have raised their growth guidance for FY23, factoring in a strong Q1 and improving growth impulses in their retail, small and medium enterprises and corporate portfolios. Within retail, mortgage growth remains healthy, while signs of pick up are visible in the otherwise lacklustre vehicle finance as well. Unsecured loan growth remains strong, led by cards and personal loans, given the strong underlying demand and banks turning pro risk due to improving asset quality, says brokerage firm Emkay.

The festive season is also expected to be reasonably strong for retail lending which, coupled with asset repricing, should support margins/core profitability, it adds.

“Sectors like banks are also immune to global shocks and high inflation. The banking sector has played an important role in the revival of economic activities in India, leading to a confidence boost in banking stocks. This rally in banking stocks is expected to continue, taking cues from the good credit quality and upcoming festive season, and foreign institutional investors’ buying,” says Ravi Singh, vice president and head of research, Share India Securities.

That said, Emkay says that funding as well as operational cost pressures of banks are on the rise but banks with the ability to pass on rate hikes/floating rate books and drive-up fees should be able to protect their core profitability. It also adds that for the valuations of banking stocks to go up, they need to sustain the credit growth momentum and deliver on core profitability.