The Indian equity markets managed to break their five-week losing streak amid heightened volatility for the week ended May 20. The S&P BSE Sensex rose 2.9 per cent while the broader Nifty 50 index advanced 3 per cent. During the week, benchmarks witnessed wild swings on Thursday and Friday. On Thursday indexes fell 2.5 per cent owing to the weekly expiry of index futures and options contracts but staged a strong bounce back on Friday.

Dalal Street Week Ahead: Markets To Remain Volatile, Nifty Seen In Range Of 15,700-16,400, Say Analysts

On Thursday indexes fell 2.5 per cent owing to the weekly expiry of index futures and options contracts but staged a strong bounce back on Friday.

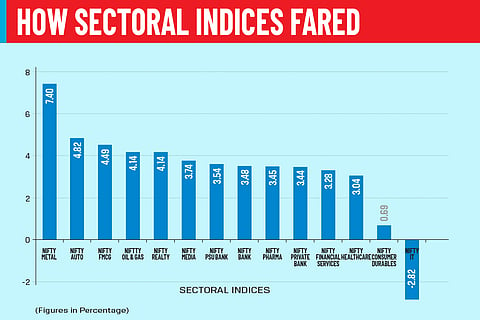

During the week buying was visible across sectors as all the sector gauges compiled by the National S

tock Exchange, barring the index of IT shares, ended higher led by the Nifty Metal index's over 7 per cent gain. Nifty Auto, FMCG, Oil & Gas, Realty, Media, PSU Bank and Bank indices also surged between 3.5-5 per cent.

The Road Ahead

Analysts expect the markets to remain volatile owing to the monthly expiry of stock futures and options contracts, minutes of the FOMC meeting on May 25 amid fears of stagflation for global markets.

"The inflation and slowdown in the global economy mean stagflation is a key concern for the global equity markets therefore we are seeing relentless selling by FIIs however Indian markets are in a better position due to support from domestic investors," Santosh Meena, head of research at Swastika Investmart told Outlook Business.

On the global front, traders will watch out for the minutes of the FOMC meeting which will be released on May 25 for future course of interest rates which will be an important trigger.

Nifty and Bank Nifty Trading Strategies

Nifty is likely to trade in a band of 15,700 on the downside and 16,400 on the upside.

"If Nifty manages to sustain above 16,400 level then we can expect a short-covering rally towards 16,700/16,900 levels on the flipside if it slips below 15,700 then selling pressure may get extension towards 15,500/15,000 levels," said Meena.

Among the sectoral indices, defensive like FMCG and pharma looks poised to surge further while others may continue to trade mix, Ajit Mishra of Religare Securities said.

He also expects choppiness in the markets to continue due to the scheduled monthly expiry. Besides, the monsoon-related updates will also be in focus.

Meanwhile, Bank Nifty is respecting the support level of 33,000 while 34,800 is acting as a hurdle for the 12-member banking index, analysts added.

"If Bank Nifty manages to take out 34,800 level then we can expect a short-covering rally towards 35,500 however if it slips below 33,000 level then it may head towards 32,000," Meena said.

Traders should keep a cautiously bullish stance for the coming week as long as the Nifty does not break below 15,700 levels, Yesha Shah, head of equity research at Samco Securities advises investors.

"Despite the rebound, we feel the market has not reached its bottom, since price patterns on the Nifty show that the uptrend has been significantly harmed. Similarly, a Head and Shoulder breakdown has been seen on the weekly chart of the S&P 500 index. Having said this, a short-term rebound cannot be ruled out and at this point it is unclear if the bounce will be a relief rally or the start of a fresh bullish surge," Shah said.

Earnings To Watch

Divis Laboratories, SAIL, Adani Ports, Grasim, Coal India, Zee Entertainment, GAIL and JSW Steel will report their March quarter earnings during the week.