The euphoria around India’s merchandise exports growth, that was the hallmark of post-covid global economic recovery, has fizzled out. For the month of October, India’s merchandise exports have contracted by 16.5 per cent to $29.78 billion, according to the latest data released by the Ministry of Commerce. This is the first time that merchandise exports have contracted in two years on a year-on-year basis.

Despite Centre's Focus On Manufacturing, It's Services Exports That Defy Global Slowdown

In the April-October period this year, the services sector has grown at a healthy 31.43 per cent, while merchandise exports have grown by 12.5 per cent

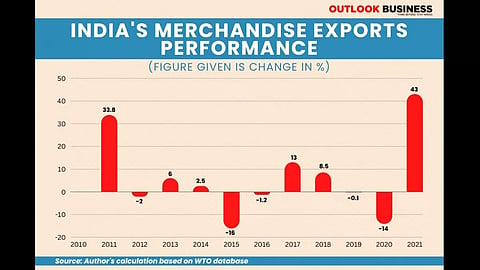

This contraction has been attributed to the weak global demand prevalent this year. In FY 2021-22, India had seen an all-time high annual merchandise exports of $417.81 billion which was an increase of 43.18 per cent over FY 2020-21.

Given the prognosis for the global economy from major international agencies, the situation is unlikely to improve in the coming months. The International Monetary Fund (IMF) has cut the global growth forecast to 3.2 per cent in 2022 and 2.7 per cent in 2023, which is a reduction from the 6 per cent growth in 2021. Naturally, this will have a bearing on the export figures of developing economies like India. Sunil Barthwal, Secretary of Commerce, in a press brief after releasing the latest data, cautioned that the dismal external environment could mean “tough times" for the economy.

With India’s extreme focus on promoting manufacturing in the country, through several supportive schemes under the Make In India mission, the realisation that merchandise exports continue to be the first casualty of a global slowdown can be a humbling experience for the Centre. But amidst this gloom, India has a silver lining to focus on- the performance of India's services sector.

For the month of October, the sector grew at an impressive rate of 40.3 per cent. If we take into account the April-October period for FY 2023, the services sector has grown at a healthy 31.43 per cent, compared to just 12.5 per cent growth registered by merchandise exports.

Although it is true that the value of merchandise exports is larger than services exports, the impressive performance of services sector exports is not a one-off phenomenon. Data for the last 12 years shows that India’s services exports have consistently done better than merchandise exports. The latter has been more susceptible to global vagaries.

During the given period, merchandise exports contracted five times whereas services exports witnessed de-growth only two times. The World Trade Organisation (WTO) figures also reveal that the annual average growth of services exports during the 2010-21 period has been 7 per cent as against the 5 per cent growth shown by the merchandise exports sector.

The merchandise sector generally receives a lot of attention because of its labour-intensive nature. Over the years, policymakers have been pushing the manufacturing sector to address the 'jobless-growth' crisis in India. Consequently, agendas such as ‘Make in India’ and ‘Aatmanirbhar Bharat’ have linked government schemes like Production Linked Incentive (PLI) with the growth of merchandise exports.

At the same time, no such schemes have been launched to promote the export of services. To gain a competitive edge in the global markets, experts believe India should address this gap. Former governor of the Reserve Bank of India has been aggressively suggesting Indian policymakers to not fall for the lure of promoting manufacturing sector over services. Much against the Centre’s push to make India a beneficiary of the West’s ‘China Plus One’ policy, Rajan’s contrarian view on the issue is: “The world does not need another China.”

Services Should Lead The Way

With a significant proportion of the global skilled workforce, India leads in specific services like telecommunications and other services based on information communication technology (ICT). Within the global economy, India’s share of merchandise exports is only 1.77 per cent while it is 4 per cent for services exports.

Aradhna Aggarwal, Professor at the Copenhagen Business School, Denmark, says, “India’s competitive advantage lies in skill-intensive tradable services and not in low-skill labour intensive manufacturing as the conventional wisdom would suggest. It is competitive advantage that matters for a nation’s export competitiveness and not the static comparative advantage which is determined by the natural endowments such as pool of labour.”

It is evident that India holds an advantage in services. It is usually the surplus from trade of services that offsets the country's large merchandise trade deficits. Therefore, it is important to find ways in which India can further leverage its strength in the export of services.

Devendra Kumar Pant, Chief Economist at India Ratings, says that the country should be focusing on capacity-building of the services exporters which would help in making them more competitive in the world market. He highlights that rupee depreciation has not helped exporters the way it should have, and suggests skill-upgradation and cost-reduction as important steps in furthering India's existing advantages in the sector.

While agreeing on the capacity-building aspect for the service exporters, Abhay Sinha, director-general of Services Export Promotion Council (SEPC), also draws attention to the need for developing the entire ecosystem in the value-chain. This would help in sales growth and enhancement of market share, he says.

“In terms of policy, now the government should move away from duty-credit scrip to hand-holding the sector,” Sinha adds. He is referring to the Service Exports from India Scheme (SEIS), under which eligible service categories are granted duty-credit scrips as benefits against the net foreign exchange they earned on exports.

Focus Areas

Services is a huge sector that is heavily dominated by IT (Information Technology) and ITeS (IT-enabled services). Together, they constitute nearly 50 per cent of the services exports. Within the tech services domain, there are some areas that have the potential to do better. This is because of the push for digitisation in the country. Some of these focus areas are fintech services, consultancy services, ‘manufacturing services’ and AVGC (Animation, Visual Effects, Gaming and Comics).

Manufacturing services are services sectors that have come up due to an increased reliance on services within manufacturing in the global value chains. These are in the form of branding, packaging and marketing, logistics, research and development (R&D) in patent development, etc. Professor Aggarwal expects that a focus on manufacturing services will act as a combined push to India's manufacturing and services sector.

At the same time, Abhay Sinha emphasises on skill-enhancement of paramedics and nurses, who are in huge demand in the countries like the United Kingdom (UK). He also mentions the challenges in the up-and-coming AVGC sector. “The government has positioned the country as the hub of content creation. However, certain gaps exist. For example, companies in AVCG sectors rely heavily on imported softwares which are very costly. In order to remain competitive, Indian companies seek support from government to offset the huge cost of such softwares,” he adds.

Recently, India overtook the UK to become the world's fifth largest economy. It is expected that by 2030, the country can become the third largest economy. To achieve such targets, India definitely has to re-think its export strategies. Acknowledging its advantages in the services sector and playing to its strengths should be the first step in this direction. With the right policies in place, services sector can help India achieve its 2030 target.