Swarup Kumar Saha, managing director and chief executive officer (CEO) of Punjab & Sind Bank (PSB), is delighted that the bank has posted net profit of Rs 278.10 crore in Q2 FY2023, which is a 35.61 per cent quarter-on-quarter (Q-o-Q) and 27.51 per cent year-on-year (Y-o-Y) growth. This is a special achievement since the bank is still working hard to recover funds from large corporate defaulters like SREI Infrastructure Finance and SREI Equipment Finance.

Punjab & Sind Bank To Reduce Exposure To Corporate Lending In Its Bid To Improve Balance Sheet

The measures taken by PSB to address potential delinquency include renewed focus on retail, agriculture and MSME sectors while learning from past mistakes in the corporate sector

The CEO tells Outlook Business that while the public sector bank cannot undo the loans sanctioned in the past, it will continue addressing these legacy issues on an ongoing basis. For now, he is focusing on expanding the Punjab-based bank’s footprint across India, building up a larger bouquet of product offerings, and on the retail, agriculture and MSME (RAM) segment. Edited excerpts:

What is PSB's current loan business mix, and how much did each sector contribute in Q2?

PSB's overall retail, agriculture and MSME (RAM) as a percentage to gross advances stood at 51.45 per cent and corporate is at 5.5 per cent. And if you compare this with July-September 2021 quarter, it was just the reverse. Our priority has moved from the corporate to the RAM segment.

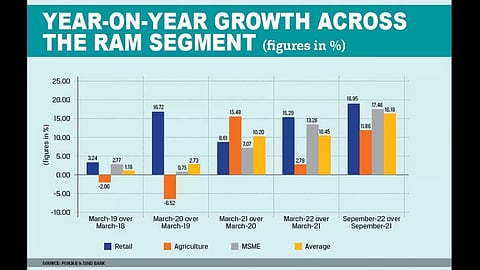

In terms of growth, the RAM collectively grew at 16.18 per cent, aided by retail growth of 18.95 per cent, agricultural growth of 11.8 per cent and MSME at 17.46 per cent. We have maintained future guidance on overall credit growth of 15 per cent. If you see our traction over the past two to three quarters: In March 2022, we were at 3.8 per cent Y-o-Y growth; we increased to 7.06 per cent in Q1 and are at 9.1 per cent in Q2.

We intend to improve our overall credit growth to 12 per cent by December 2022 and cross 15 per cent by March 2023. This will be aided by our RAM growth of 20 to 22 per cent and corporate growth of 7 to 8 per cent.

What necessitated the pivoting from the corporate to the RAM segment?

If you follow our bank's figures for the past four to five years, you will see that it had its share of problems from the corporate side and it went into a loss. March 2018 to March 2021 was a continuous loss process for PSB and capital was a constraint for the bank.

The government then had to pump in a significant amount of capital in 2020-21 and 2021-22. At that time, capital was scarce and the bank was unable to grow. During its strategic meetings, the board decided that having learnt our lessons in corporate credit, we should move more towards RAM. Their strategic vision was to have a 55:45 ratio, favouring the RAM segment.

Last year, thanks to the government, we got capital of Rs 4500 crore, which grossly strengthened our capital adequacy (CA). Currently, at 15.8 per cent in CA, we are well capitalised to take quality growth steps.

Moreover, there is a credit growth offtake in the market as MSMEs grow around 17 to 18 per cent. This allows us to venture into newer areas within the corporate segment like public sector banks, ethanol projects, energy and renewable companies and select Non-Banking Financial Companies (NBFCs). We will put our corporate guidance in this direction based on our risk appetite value and volume of exposure to avoid repeating our past mistakes.

We are taking selective exposure, so you will find a marginal tick in the Q2 corporate credit, at 2 per cent growth, which was growing on a negative trajectory in the last quarter.

The RAM segment is equally susceptible to market conditions. How will you mitigate your risks as you focus on this segment?

Ultimately, the bank is in the business of lending and any lending has risk attached to it. Now, SREI Infrastructure Finance and SREI Equipment Finance are corporate defaulters in PSB and we have over Rs 1400 crore exposure with these two accounts. Such instances can impact the balance sheet in a big way.

While there can be delinquencies in the RAM segment too, especially due to the ongoing economic situation, we are now primarily going after the salaried account holders in the retail segment. If I can push my salary account holders for cross selling, we will have the cashflow of a stable individual.

We introduced pre-approved personal loans in July 2022 and personal and home loans in Q2 have grown 100 per cent, which was possible because we got Rs 130 crore in the pre-approved loans. These loans were extended to existing account holder who have a history of banking with us. Since we have a track record of their salary rotation in the account, we can cull out the data and offer them these pre-approved loans. These individuals are less likely to default on their payments, normally.

So, if we have a proper underwriting system, we can take that into stride. Of course, any economic downturn will impact the banking system, but our risk will be spread across the number of customers.

Have you undertaken any structural changes to alleviate this risk?

Earlier, most loans, up to a certain level, were sanctioned at the branch level. So, if a customer walks into a branch and asked for a housing loan for Rs 20 lakh, the branch manager would approve that depending on their skill and underwriting capacity.

We need to segregate the sourcing and sanctioning of the loan to do quality credit business and growth. To address the issue of future delinquency, we have given branches sanctioning authority for small-value loans of up to Rs 10 lakh. Anything beyond that is sent to the back office, where the underwriting skill is much more competent with more skilled and experienced people involved.

Putting these risk management structures in place gives us the confidence that delinquency of loans sanctioned in the back-office system will be much lower than what was occurring at the branch level. The reason is that compliance and underwriting will be of higher standards.

How do you keep re-evaluating the mix for the RAM sector?

We do periodic reviews with the RAM segment. The history of delinquencies in PSB has been quite high. Our retail NPA (Non-Performing Assets) was at 5.74 per cent in September 2021, which is at 4.22 per cent now. The quantum of NPA has come down from Rs 609 crore to Rs 532 crore, so there is a sign of recovery.

In agriculture, the figures were 8.15 per cent last September to 7.70 this quarter, while it was 16 per cent for MSME and we are now at 10.97 per cent.

We have also automated the loan processing system so that the subjectivity of the underwriting officers is negated. Moreover, our risk management continuously assesses our portfolio and movement in delinquency in the RAM segment.

For now, there is some stress in the MSME segment, which was impacted during the pandemic. But it is manageable for PSB. Also, our recovery is increasing, having recovered around Rs 500 crore in Q2 2022 itself. And in October 2022, we recovered another Rs 200 crore. On an annual basis, we are looking at a recovery and upgradation of over Rs 2000 crore, of which we have already done Rs 700 crore. Some resolutions are likely to happen in the big-ticket accounts, so we are confident of achieving this annual target.

PSB's other income components have seen a 13 per cent sequential increase in Q2 2022. What do these constitute?

Because PSB lacked a sufficient bouquet of products to offer, its income was constrained. Typically, income comes from interest on advances, investments and a fee-income, which includes a bank's own products and those of the third party like insurance, wealth management, credit card or cross selling.

We have increased our commission exchange brokerage to a large extent, which is 52 per cent on a Q-o-Q basis and 17 per cent on a Y-o-Y basis. This occurred because we are focusing on third-party products also.

We told our two life insurance partners, SBI Life and LIC, that we need to increase our income, so they are also aggressively pushing business. We are opening up for a third partnership shortly, which will fuel competition and generate more revenue. PSB's overall core fee business is Rs 102 crore, but in the future, I am targeting Rs 100 crore only from the bank insurance business.

We are also launching a co-branding credit card and getting into wealth management and standalone health insurance business. We are now increasing the product bouquet, which PSB did not have earlier, and improving our products per customer. This will give the impetus to the core-fee income.

Many banks had revised their FD interest rates just before Diwali to offer a wider customer base. Is PSB hiking its FD rates now?

We must react very quickly to whatever happens on the assets or liabilities side. We have created a super senior category of 601 days with 7.85 per cent, which is probably the highest any bank currently offers in that category.

We have rejigged our interest rates and have taken another product for 300 days to tap new customers and stop the outflow of our customers to other banks.

The good thing for PSB is that though our rate of interest is increasing, I am still comfortable with around 25 per cent net interest income (NII) growth and our net interest margin (NIM) is at 3.06 per cent. So, as long as my returns are okay, I am happy to part with some of my interest with customers.

41 per cent of PSB's network is in Punjab and the state contributes around 22 per cent of total business. How will PSB expand its footprint to overcome the issue of business saturation and reduce the concentration of risk?

Given these figures, I must hold on to this significant area substantially and not ignore it. But we realise that we have to go into tier 2 and tier 3 cities with higher potential.

We have taken the board's approval for 50-odd branches and hope to open 25 in the current year in west, south, central and east India. We have identified the areas, the approvals are in, and we have opened two branches in Rajasthan and will open one in Bihar shortly.

As a regional player, how will you deal with competition as you expand outside Punjab, where other local competitors might have stronger recall with customers?

Before identifying a location, we conduct a survey to see how many branches are in the vicinity, the population, the average income, potential business in the short and midterm, the expected break-even, etc. We seek places where the break-even possibility is one year, though normally, a branch takes three years to turnaround, given the operational expenses.

Will you also leverage the success of products like the pre-approved loans to get a foothold in these new territories?

Absolutely. PSB's personal loan has grown 100 per cent Y-o-Y, aided by a pre-approved loans business of Rs 130 crore, because our base is small at Rs 440 crore.

We have tied up with Chandigarh's Municipal Corporation to open their salary accounts for their 10,100 employees. Similarly, we partnered with Lucknow Nagar Nigam opening 14,000 salary accounts for their staff. With salary accounts like these coming in from tier 2 and tier 3 cities, we can offer products like pre-approved loans to these customers based on their track records.

Moreover, the branch has no cost involved since everything is done at the headquarters. If a customer opens an account at Gandhinagar, based on their banking history, we can send him a pre-approved loan of up to Rs 5 lakh through our mobile app, which he can get within three clicks. We are making customer acquisition easier, too, with systems like online KYC with video, which will be launched shortly.

How many app downloads do you have?

We launched the app in March 2022, and have approximately 2 lakh downloads, with a base of 58 lakh non-PSB customers. We are targeting 10 lakh downloads by the end of this financial year.