The Reserve Bank of India (RBI) has fixed the price for premature redemption of Series III of the SGB 2016-17 series of sovereign gold bonds (SGB) scheme at Rs 5,115 per unit.

SGB 2016-17 Series III Up For Early Redemption On May 17; Know The Tax Implication

With Series III of Sovereign Gold Bond 2016-17’s interest payment date being May 17, it’s time to consider redemption from the point of view of taxation .

This series of SGB was issued on November 17, 2016 and carried an annual interest rate of 2.5 per cent to be paid semi-annually. The date of payment of this interest for this particular bond is May 17, 2022.

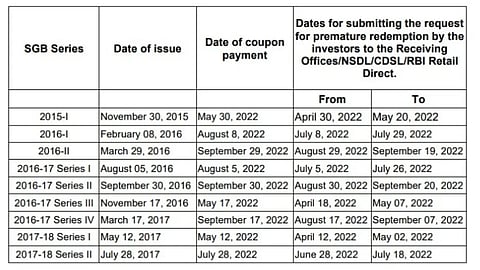

Another series, 2017-18 Series I, had its redemption request in May. The dates for that were from April 12 to May 2, 2022.

Whether you opt for premature redemption or hold till maturity, different taxes will apply. Therefore, consider this factor when making the decision.

However, the time for premature redemptions has passed for this series. According to the RBI circular, premature redemption orders have to be placed before the interest rate payment of a series. The redemption period for this particular SGB (Series III of SGB 2016-17) was from April 18 till May 7, 2022.

This presents two cases: you have placed the premature redemption request in time or that time has passed and you continue to hold these bonds.

Case 1: You Have Successfully Placed Redemption Request

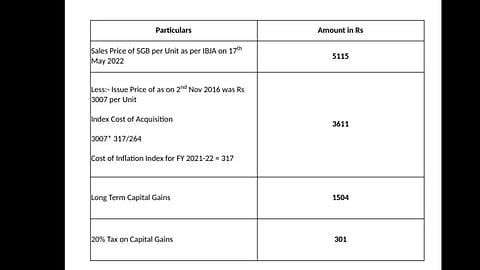

RBI has decided the redemption price at Rs 5,115 per one unit. The redemption price of SGB will be based on the simple average of the closing price of gold of 999 purity of the week (Monday-Friday) preceding the date of redemption as published by the India Bullion and Jewellers Association Ltd (IBJA).

Therefore, “the redemption price for the second premature redemption due on May 17, 2022, shall be Rs 5,115 per unit of SGB based on the simple average of the closing price of gold for the week ending May 09-13, 2022,” according to the Press release by RBI.

Tax Treatment: Since this SGB’s tenure is eight years but you are prematurely redeeming after five years, a long-term capital gains (LTCG) tax of 20 per cent with indexation benefit will apply. If you decide to not opt for the indexation benefit, then a 10 per cent tax will be applicable.

"If someone wishes to redeem this SGB, the LTCG per unit will be Rs 1,504. So, the LTCG tax (20 per cent) would be Rs 301 per unit. Indexation benefit has been calculated on the basis of Cost of Inflation Index taken as 317, which is for FY22. Cost of Inflation Index for FY23 is yet to be notified," explains Deepak Jain, CEO, TaxManager, a tax filing portal.

Case 2: You Continue To Hold The Bonds

If you have not placed a premature redemption request for this series, then you will get an interest payment on May 17, 2022.

Tax Treatment: The interest earned will be taxable as income from other sources, and tax deducted at source (TDS) will not apply.

Are SGBs For You?

SGBs are a way to buy gold as part of a long-term asset allocation strategy, says Col. Sanjeev Govila (Retd.), who runs the Sebi-registered financial advisory firm, Hum Fauji Initiative. Apart from capital appreciation, this investment avenue also gives 2.5 per cent annual interest. “The SGB 2016-17 Series III bonds have given very good returns of about 13.5 per cent annualized, including the interest earned,” he says.

While an investor can prematurely withdraw from the investment, given the current uncertainty due to inflation stickiness and GDP growth outlook, one can consider holding on to these SGBs.