India’s GDP Forecast Lowered

Short Stories: All That Happened in the Business Universe Last Month

Goldman Sachs lowered its growth forecast for India, Adani sold partial stakes in Ambuja Cements and Sebi banned Anil Ambani from the securities market

Goldman Sachs has lowered India’s growth forecast by 20 basis points for the current year and the next. It expects the country’s economy to grow at 6.7% in 2024 and 6.4% in 2025. The investment bank cited a significant contraction in government expenditure—35% YoY during Q1 of FY25—as the main factor.

Adani Sells Stake in Ambuja Cements

Holderind Investments, an Adani group-promoted entity, divested almost 2.8% stake in Ambuja Cements for Rs 4,250 crore on a block deal on NSE. The stake offloaded was picked by a number of investors including GQG Partners, which purchased shares amounting to a 1.78% stake.

Repo Rate Unchanged

RBI decided to keep the repo rate unchanged at 6.5% for the ninth consecutive time. It also retained real GDP growth estimates for FY25 at 7.2% and CPI inflation projection at 4.5%. The decision was made to ensure that inflation remains within the target range while also remaining vigilant amid supply side shocks in food items.

Sebi Rap on Anil Ambani

Sebi has barred Anil Ambani and 24 others from the securities market for five years. They have been charged with siphoning off funds. Ambani was fined Rs 25 crore and restrained from being associated with the securities market.

SBI, PNB Under Scanner

Karnataka had stopped all transactions with SBI and PNB citing financial irregularities and unauthorised transactions involving state funds. The state alleged that SBI and PNB misused fixed deposits of Karnataka State Pollution Control Board and Karnataka Industrial Area Development Board respectively. The banks requested time to resolve the issue. The government has halted proceedings.

Ola on the Slow Lane

Ola Electric made a tepid debut at the bourses when it listed early last month. The issue was subscribed just over 4 times at an issue price of Rs 76. Ola Electric’s IPO was open for bidding from August 2–6 with a price range of Rs 72–76. It raised Rs 6,145.56 crore, including Rs 5,500 crore from new shares and an offer-for-sale of up to 8,49,41,997 shares. Ola fared better with time; its share price doubled to a peak of Rs 157.4 on August 20. Since then, the share price plunged 19.38% to Rs 127 as on August 23.

Mahindra’s Gold Star 650 Vrooms in

Mahindra has launched the iconic BSA Gold Star 650 in India at a price starting from Rs 2.99 lakh. With its entry, the 650cc two-wheeler space will heat up. Gold Star 650 will directly take on sector leader Royal Enfield Interceptor 650, which starts at Rs 3.03 lakh. The motorcycle has been on sale in the European markets since 2021.

CCI Warning to RIL-Disney

Competition Commission of India is concerned that the entity created by the RIL-Disney merger will have a monopoly on cricket broadcast rights, hurting advertisers. With an $8.5bn merger deal, nearly a third of TV viewing, half of OTT streaming and almost all of the cricket broadcast space falls into the hands of the combine.

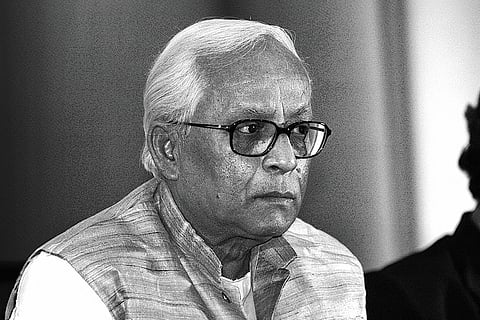

The Comrade Who Embraced Change

Buddhadeb Bhattacharya, former CM of West Bengal and the state’s most industry-friendly leader in decades, died on August 8 at the age of 80. He assumed office at a time when the state was reeling from industrial decline. Bhattacharya sought to revitalise Bengal’s economy by courting industry. He crafted Bengal’s first IT policy. Despite his efforts, his tenure was marred by controversy, most notably the fierce opposition to a Tata Motors plant in Singur and a chemical plant in Nandigram, which galvanised dissent and led to his electoral defeat in 2011.