The sudden price rise in air tickets for both domestic as well as international travel in the past few months may not be the result of ‘dynamic pricing’. The price hike, which is not only affecting frequent flyers but more importantly the tourism sector on a whole, may be the result of cartelization in the aviation industry. Angry tourism experts have alleged that aviation companies may have colluded to fix high prices.

Are Indian Airlines Gaming Customers To Charge High Price For Air Travel?

Steep price hike by all private airlines indicates a joint effort by the industry to recover Covid losses, say experts

The price of almost every domestic air route is witnessing an increase of 50 to 100 percent per person as compared to the prevailing prices in February this year.

Take the case of a Delhi to Mumbai flight, tickets for which were available between Rs 4,000 to 4,500 in February. Now, Airlines are charging upwards of Rs 8,000 for the same route.

The same is the case with a Delhi to Chennai flight where the increase appears to be over 100 percent. Travel agents say that routes which are not very busy, are also witnessing a sharp rise in airfares.

The trend has left agents and tourism experts surprised because July-September is considered off-season and except for a few routes such as Delhi-Mumbai, the majority of destinations don’t experience high demand.

This is also obvious considering the current passenger load factor (PLF) of all airlines. It fluctuates between 70 to 85 percent, which suggests that most flights have 15 to 30 percent of seats vacant.

Even Indigo’s CEO, Ronojoy Dutta, while announcing the company’s Q1 result on August 3 said that the company’s financial performance in the second quarter (July-September) will be challenged by weak seasonality.

“Clearly, this is cartelization. How can companies increase fares in the domestic market in the absence of high demand? Had the PLF been above 95 percent, we would have still understood. But that’s not the case,” Subhash Goyal, Chairman of the Expert Committee – Aviation, Tourism and Hospitality, Indian Chamber of Commerce and Industry (ICCI), said.

Goyal, who is also a member of the National Advisory Council of the Ministry of Tourism, says that when ticket prices are high, the tourism industry is the worst impacted because people postpone all their vacation plans.

“Which is why I have been demanding a cap on airfare by the Ministry of Civil Aviation or the Directorate General of Civil Aviation (DGCA),” Goyal argued, adding, “Even high demand doesn’t justify a steep increase in fare. Some of the international destinations like Delhi to Canada have become unaffordable as ticket prices have grown more than double.”

Senior officials of a few private airlines, who spoke to Outlook Business on the condition of anonymity, agree with Goyal and say that possibilities of cartelization cannot be ruled out.

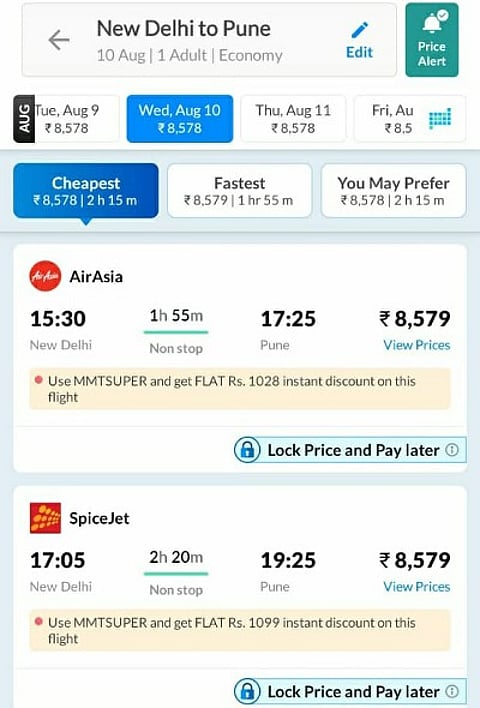

They also question the uniform ticket prices of all the airlines on several routes. For instance, three low-cost carriers namely IndiGo, SpiceJet, and Go First are offering tickets for New Delhi to Mumbai flight on August 10 at Rs 8,579 on the Make My Trip website. Vistara, which is a full-service carrier, is charging Rs 1 less, ie, 8,578 and Air India offers it at Rs 8,580.

“Uniform fares are signs of no competition,” a senior aviation professional, associated with a private airline said.

The allegation of cartelisation is not new to the aviation sector. On a few occasions in the past, cases have been filed with the Competition Commission of India (CCI) about cartelization being prevalent in the sector.

In 2013, the Express Industry Council of India filed a case against Jet Airways, IndiGo, SpiceJet, Air India, and Go Airlines (now Go First) with CCI alleging that they were hand-in-glove in fixing fuel surcharge (FSC) rates for cargo transportation.

The CCI had fined Jet Airways, IndiGo, and SpiceJet for acting “in parallel and colluded in fixing of FSC rates.” The two other airlines, Air India and Go Airlines were given a clean chit as there was no proof of collusion against them.

In another case in 2016, an advocate Shikha Roy filed a case in the CCI that there was a steep and simultaneous increase in the ticket prices of Jet Airways, SpiceJet, and IndiGo in February 2016 when the Jat agitation had started. She alleged that the price appreciation was due to cartelisation among these three airlines.

“…the Commission was of the opinion that there exists a prima facie case for the investigation by the Office of the Director General (DG) in the matter with regard to alleged cartelization by the airline companies viz. Jet Airways, SpiceJet, IndiGo, GoAir, and Air India during the Jat Agitation,” the CCI order read.

However, the investigation carried out by the DGCA didn’t find any evidence of collusive behavior or agreement between the companies.

“There is no evidence on record to establish cartel amongst the airlines during the period of Jat Agitation, i.e. 18th to 23rd February 2016, and having examined the material on record, the Commission finds no reason to differ with the findings recorded by the DG,” the CCI concluded in its order.

Queries sent to aviation companies by Outlook Business against the allegation raised by the tourism industry went unanswered.

Jitender Bhargava, Former Executive Director of Air India, rubbished the claim saying, “There is no cartelization. It is called dynamic pricing and matching the fare that exists in the market. There is nothing wrong with it. Every industry does that.”