The Indian markets have more than doubled from the bottom levels they reached during the Covid crisis in March 2020. Given the high recent returns, there is a natural temptation to book profits in the amount of the gains one has made in equities, and move them into safer debt funds.

What Happens When You Keep Booking Profits In Your Portfolio? Read Here To Find Out

The Indian equity market has bounced back from the bottom levels it had nosedived to in March 2020, and many have booked their profits and shifted them to safer debt funds. Should you do the same, or, is there a strategy that you should follow? Read here to find out the details

In fact, this is a very common behaviour exhibited by most of us at different points in our investment journey. We, as humans, tend to be risk-averse by nature. We prefer to protect ourselves against losses, more than we seek out gains. As a result, when our equity gains reach the desired level, we take out the profits regularly, leaving only the originally invested amount in equity.

At the outset, this seems like a win-win situation. If the market goes down, your profits are already safe. And if the market goes up, your capital is still at play.

But Does It Actually Work?

Let us take the example of a hypothetical investor who invested Rs. 10 lakh into Nifty 50 TRI. Whenever his portfolio returns reach a certain level, he takes the profits out (the gains over and above his original investment of Rs. 10 lakh) and deploys the same into debt. For example, whenever his portfolio value crosses Rs. 12 lakh (20 per cent gains), he transfers Rs. 2 lakh to debt, thus bringing down his equity allocation to Rs. 10 lakh.

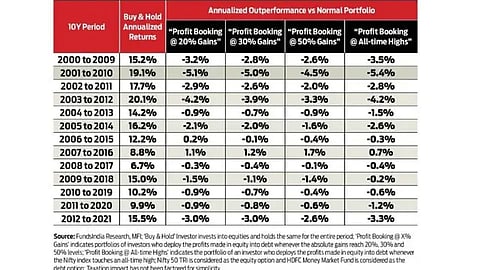

Now, let us check the performance of such a strategy (assuming absolute return thresholds of 20 per cent, 30 per cent and 50 per cent) over different 10-year timeframes. We can also include another profit-booking strategy where the equity gains are moved to debt whenever the markets reach their all-time highs.

Here are the results comparing the performance of profit booking strategies to a ‘buy and hold’ strategy.

The ‘Buy and Hold’ portfolio has predominantly delivered consistent outperformance over other profit-booking strategies. Even in those odd instances where the ‘Buy and Hold’ strategy underperformed a profit-booking strategy, the ‘Buy and Hold’ investor would have again outperformed, if he had simply extended the time frame by another 1-2 years.

The long-term evidence clearly indicates that you would have made a lot more money had you simply invested in equities and sat tight.

Why Do Such Profit-Booking Strategies Underperform?

In a profit-booking scenario, we keep on reducing the amount participating in equities. This, in turn, interrupts the power of compounding. As equity markets tend to do well over the long run, the reduced base impacts the upside we could have realised. In the perceived guise of protecting our short-term gains, we end up compromising on our long-term gains.

But this does not mean that you should never book your profits in equities. Profit booking can be an effective strategy when done for the right reasons.

1. When Rebalancing Your Portfolio: All of us have our preferred asset allocation. However, during phases of strong equity performance, your portfolio asset allocation will get skewed towards equity. When the current equity allocation exceeds your preferred allocation by more than five per cent, you can sell a portion of your equity investments and bring it down to your original asset allocation levels.

2. When Nearing Your Goals: As you near your financial goals, it is prudent to exit equity investments in a phased manner and deploy your money into shorter duration debt funds of high credit quality.

3. During Bubble Market Phases: When the markets are showing signs of a bubble (which we track using our Three Signal Framework and Bubble Zone Indicator), you can deploy a pre-decided portion of equity investments into Dynamic Asset Allocation Funds.

Summing It Up

When we book profits in equities unnecessarily, we often trade-off small, short-term losses for larger, longer-term losses. So, whenever you feel the need to protect your profits, simply remember: Compounding is free until you choose to pay for it!

The author is a senior research analyst at FundsIndia.com

(Disclaimer: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)