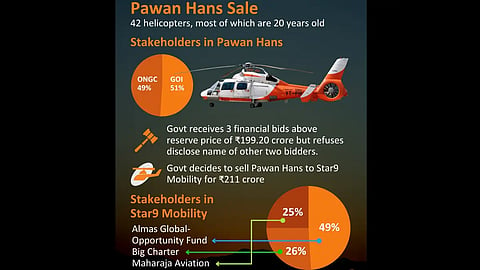

It was a fleeting moment in April this year when the Indian government was able to finalize the sale of its 51 per cent stake in Pawan Hans, after the three failed attempts in the past six years. Pawan Hans is a joint venture by the government of India and the state-owned ONGC which holds a 49 per cent stake in the company. The government had approved the sale of Pawan Hans to Star9 Mobility, a three-way consortium of Cayman Island-based Almas Global Opportunity Fund—a subsidiary of Dubai-based Almas Capital, Mumbai-based Big Charter Private Limited, and Delhi-based Maharaja Aviation Private Limited at a cost of Rs 211 crore, which is above the government’s quoted price of Rs 119 crore. However, an order by the National Company Law Tribunal (NCLT) alleging Almas Global Opportunity Fund of financial discrepancies in a previous bid has forced the government to halt the sale of the helicopter company.

What Led To The Brakes On Pawan Hans Sale For Fourth Time

Pawan Hans is a joint venture by the government of India and the state-owned ONGC which holds a 49 per cent stake in the company

NCLT and EMC Case

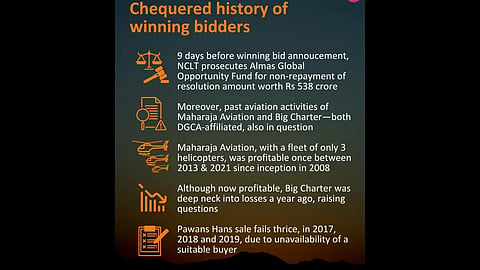

The NCLT on April 20 this year, passed an order for action against Almas Global Opportunity Fund in the insolvency case of Kolkata-based EMC Limited—a power transmission and distribution equipment company. According to reports, in 2018, EMC Limited filed for insolvency worth Rs 6,500 crore. In 2019, Almas Global emerged as the successful bidder of the company, after which a committee of creditors (CoC) led by the State Bank of India approved Almas Global to pay Rs 568 crore to the creditors of EMC Limited as part of the proposed resolution plan. However, Almas Group only paid Rs 30 crore as the bank guarantee, after which the CoC moved NCLT against Almas Global for non-repayment of the resolution amount.

As per Section 74 (3) of the insolvency code, a successful bidder is liable to a maximum of five years of imprisonment with a penalty of up to Rs 1 crore, if it fails on the repayment of the resolution amount.

Notably, the guidelines by the Department of Investment and Public Asset Management (DIPAM) also disqualify any group or entity, whose member company or director is facing a conviction in the court. Almas Group holds a 49 per cent stake in the six-month-old Star9 Mobility, followed by Maharaja Aviation which holds a 25 per cent stake, and Big Charter Private Limited, which holds a 26 per cent stake in Star9 Mobility.

However, the government announced Star9 Mobility as the successful bidder of Pawan Hans, nine days after NCLT passed its order in April.

Financial Crunch Of Big Charter and Maharaja Aviation

However, the issues do not pertain to the NCLT order against Almas Group. According to an investigation by a leading media organization, the past aviation activities of Maharaja Aviation and Big Charter—both DGCA-affiliated airline operators, are also in question. The report said that Maharaja Aviation which has a fleet of only three helicopters, had a profitable business only once between 2013 and 2021, since its inception in 2008. In March 2021, the assets of Maharaja Aviation were valued only at Rs 1.35 crore and the company’s borrowings stood at Rs 8.07 crore, thus making brows raise on the ability of the loss-making airline to operate a veteran like Pawan Hans.

Meanwhile, Big Charter Limited, which operates local airline Flybig, won a tender floated by the Meghalayan Government in 2020. The company which was founded in December 2014, by aviation veteran Captain Sanjay Madavia, had leased out a Bombardier Dash 8 q400 turbopop from SpiceJet for operations between Shillong and Delhi. However, as per the report, months later, SpiceJet discontinued its leasing contract with Big Charter for reasons unknown, which caused a political uproar with many leaders questioning the government’s contract with Big Charter, which then had no aircraft. Over the next few months following SpiceJet’s leasing incident, the airline faced a huge financial crunch with many of its employees, including the top management leaving the company. According to the report, the company reported a profit of little over Rs 1 lakh in FY2019-2020, which jumped to Rs 98 lakh in FY2020-21.

The loss-making company revived itself by further adding Twin Otter Series 400 aircraft from Canada’s de Havilland Air to its fleet according to the Ministry of Civil Aviation. Experts have raised questions about the onboarding process of such a large fleet by a company, which was deep neck into losses a year ago.

Apart from this, the political opposition has also raised questions about the anonymity of the other two bidders which the government refuses to reveal as well as the government’s decision not to merge Pawan Hans with ONGC.

A Disgruntled History Of Pawan Hans

Pawan Hans was incorporated in 1985, under the name Helicopter Corporation Of India. In 1987, it was renamed Pawan Hans. Pawan Hans, which has the largest fleet in Southeast Asia, with 42 helicopters, has most of its helicopters over 20 years old. Notably, five of its Dauphin N Helicopters, have been grounded for a long time, thus bringing down its operational fleet to 37 helicopters according to reports.

Owing to its age-old helicopters, the repair and maintenance of the fleet have become expensive. As a result, the government first decided to sell its stake in Pawan Hans in 2016. However, all the three previous attempts in 2017, 2018, and 2019 failed due to the unavailability of a suitable buyer, despite the government inviting expressions of interest.

Moreover, the company has not performed well over the past few years and has been incurring heavy losses beginning FY2019 worth Rs 70 crore. In FY2020, the company incurred a loss of 18.5 crores, whereas, in FY2021, it incurred a loss of Rs 17.6 crore. The sale of Pawan Hans is part of the government’s divestment plan.