Partner and Leader Personal Tax, PwC India

Single Window For All Aadhaar Linkages May Help

Even though Aadhaar is in the eye of a storm over privacy issues, government is keen to resolve them

Aadhaar was born in 2009, when the Unique Identification Authority of India (UIDAI) was established. At that time, no one could have imagined that nearly a decade later it would become a critical document of identity in our day-to-day life.

What is Aadhaar?

Aadhaar is a 12-digit unique identity number issued to an individual based on biometric and demographic data. It is covered under the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 (‘The Act’).

Who is eligible?

Every resident in India is entitled to obtain an Aadhaar ID by undergoing the process of enrolment. The term ‘resident’ under the Act means an individual who has resided in India for 182 days or more during the 12 months immediately preceding the date of application for enrolment. This means even foreign nationals can obtain an Aadhaar ID once they stay in India for 182 days within a span of 12 months.

Is it mandatory?

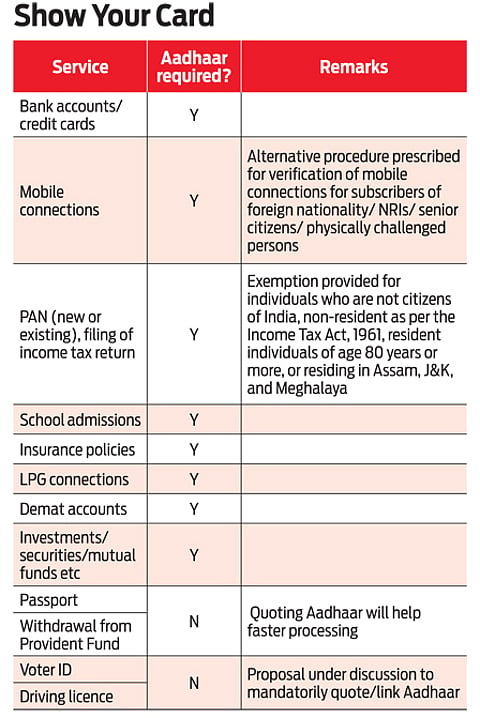

The Act merely provides as to who is entitled to obtain Aadhaar; it does not make it mandatory. However, various agencies (RBI, SEBI, tax authorities, DOT etc) have made it mandatory to quote/link one’s Aadhaar number, which in turn makes it compulsory for the individuals to obtain it. The table (See: Show your card) shows various significant transactions where one is required to quote their Aadhaar number.

Challenges and issues

The key stated objective for Aadhaar is to empower each resident in India with a unique identity and a digital platform to authenticate it anytime, anywhere. It aims to provide good governance, efficient, transparent, and targeted delivery of subsidies, benefits and services. The government had made Aadhaar mandatory to avail subsidies or benefits under its various welfare schemes. However, the honourable Supreme Court of India, in its interim order, clarified that governmental benefits cannot be denied to a resident for not having Aadhaar.

Additionally, there are other issues that are currently pending before the Court for consideration, such as pervasive violation of fundamental rights, integrity of the process and information. While the decision would surely come some day in the near future, the requirement of obtaining/linking of Aadhaar with bank accounts, PAN, mobile numbers and so on has not been put under abeyance. The extended deadline of March 31, 2018, is fast approaching and one really needs to prepare and comply with this requirement.

Insistence from the government on Aadhaar is well understood in light of its efforts to unearth and curb black money. Linkage through Aadhaar of your financial transactions and tax records will prevent evasion of taxes as tax authorities can easily identify your income/expenses and any taxes you paid. One may say this objective could have been achieved through PAN cards, but due to some individuals possessing multiple PANs, data analytics is hindered.

Foreign nationals and senior citizens initially faced a challenge in filing their tax returns due to Aadhaar requirement. The government later relaxed this requirement for foreign nationals, non-residents, those who are 80 years old or more, and those residing in Assam, J&K, and Meghalaya. Similarly, the ministry of communications in December 2017 provided alternative procedures for re-verification of mobile connections in respect of subscribers of foreign nationalities/NRIs etc. But the requirement to link their Indian bank accounts with Aadhaar doesn’t seem to have been relieved, which has put them in the category of individuals who compulsorily require Aadhaar. A clarification in this regard would further help foreign nationals.

Can someone who has not lived in India for more than 182 days in the preceding 12 months voluntarily apply for an Aadhaar number? If yes, the application form should not seek confirmation of this condition. In this instance, the government could consider providing the facility of issuing Aadhaar at its overseas high commissions and embassies. This way NRIs and foreign nationals who are visiting India can obtain Aadhaar easily without entering the country.

On the other hand, if the intent of the law is to issue Aadhaar only to those who have been in India for more than 182 days in the previous 12 months, NRIs or Indians settled abroad and returning permanently would have to wait for six months before they can apply!

Aadhaar has brought along its own set of confidentiality issues, technological errors, execution hassles, grievance redressal failures. Amidst many speculations about weakness of the UIDAI in protecting confidential data submitted by an individual at the time of applying for Aadhaar, the government rolled out a mechanism wherein the individual has an option to lock his/her biometrics on the portal, thereby preventing any misuse. Recently, an option to look at one’s Aadhaar history has been initiated on the portal – you can log in to your account using your Aadhaar number and check if your data has been used by anyone during a specific period.

One can expect things to get better as the government keeps resolving these challenges, but listing down the requirements of Aadhaar on one comprehensive communication channel would really help the public at large to smoothly comply with the requirements.

Disclaimer: The views expressed in the article are personal.