Mumbai, February 13: Insurance Regulatory and Development Authority of India, IRDAI has amended the definition of pre-existing diseases (PED). The regulator advised all insurers and Third-Party Administrators (TPAs), wherever applicable to make changes and ensure compliance with immediate effect.

IRDAI Modifies Pre-existing Diseases In Health Insurance

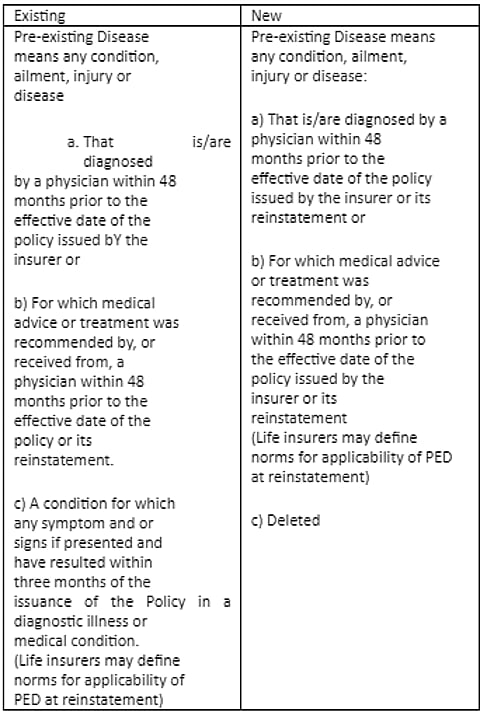

As per IRDAI’s latest guidelines on the definition of PED (not applicable for overseas travel insurance)

Source: IRDAI

What is PED?

According to IRDAI, pre-existing diseases have been defined as “any condition, ailment or injury or related condition(s) for which the insured had signs or symptoms, and/or was diagnosed, received medical advice or treatment within 48 months prior to the first policy issued by the insurer.”

In health insurance, insurers have the right to reject a claim under the pre-existing illnesses clause. Health insurance providers offer coverage of a limited range of pre-existing diseases however, it varies from insurer to insurer. Insurers offer coverage of pre-existing diseases with a waiting period of 24 months to 48 months.

A condition for which any symptoms and or signs if presented and have resulted within three months of the issuance of the policy in a diagnostic illness or medical condition has been deleted under the new guidelines.

Industry experts believe that the new guidelines of pre-existing diseases would reduce the rejection of claim as insurers cannot reject a claim if the policyholders develop conditions within three months of buying the health insurance plan.