Term plan is among the least complicated life insurance policies. The insured’s family receives a lump sum amount, called the sum assured in the event of the death of the insured. Otherwise, they offer no returns, i.e., they do not mix insurance with savings, unlike most insurance plans. This makes term plans the most easily comparable form of life insurance products and also a highly commoditised category within life insurance policies. Term plans, if bought online, cost even cheaper as they do not involve any intermediaries on the sale.

Attractive returns

The return on premium term plans find takers because money comes back at the end of tenure

Says 33-year-old Ritesh Jain from Gurgaon, who recently bought a term plan; “I paid an annual premium of Rs.12,000 for a Rs.65 lakh sum assured plan, which I took to de-risk the home loan I had taken.” He is not alone. Their popularity is on the rise and most people have realized the value of this insurance policy for its simple structure. Adds Jain: “I took this policy because I wanted something that was not expensive.”

Twist in the tale

While insurers do see merit in offering term plans in both online and offline formats, some have realized the importance of tapping into the Indian psyche of attachment to returns and moneyback at the end of the policy tenure. Says Sanjiv Bajaj, MD, Bajaj Capital, “The popularity of endowment type plans which pay off the policyholder survival benefits, has found insurers offering a term plan that returns premium on survival. The return of premium (ROP) term plans return the premium back to the policyholder if they survive the policy tenure.

Most ROP plans offer guaranteed returns on the premium paid (excluding extra premiums and rider premiums, if any) along with ROP option. Plus, one can also add riders to make it a complete protection plan which can be relied upon in case of unfortunate extremities of life. Adds Bajaj, “For many people there is comfort that they do not lose premium paid over the years when going in with this variant of term plan.” ROP plans also offer tax benefits under Section 80C and 10 (10D) of Income Tax Act, 1961.

Does it add up?

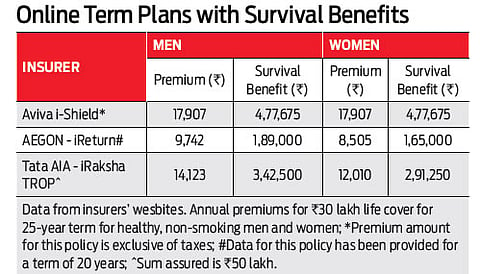

Many insurers see opportunity in offering such plans, but very few offer them online (See Online Term Plans With Survival Benefits). One of the reasons why few insurers offer this variant online is because the costing of such a policy is not attractive enough for them. At the same time, agents manage to do a better job in pushing such policies; they manage to play to the policyholder’s mindset of looking for survival benefits when buying insurance.

Purely going by the math, ROP plans do not stand a chance compared to pure term plans, because of the premiums paid on such policies is definitely higher than those for a pure term plan. Says Jain, “I bought an ROP plan because I was looking at getting at least something back than nothing at all at the end of the policy tenure.”Jain also has a pure life term plan of Rs.50 lakh cover, which he bought four years ago. But the premium on that is lower compared to an ROP plan.

The higher premiums aside, even if one takes the survival benefits into account, the returns hardly match even the bank savings rates. Yet, there is a pull for such plans and more so from the tier-II and tier-III locations. Adds Bajaj: “People in smaller cities do see value of term plans, but they are yet to fully accept a policy that does not pay survivor benefits. These plans are an alternative for people who look for a maturity benefit, too.” While there is no better alternative to a plain vanilla term plan, there is room for ROP plans, which should be considered only for the return of premiums than considering returns. No doubt, the returns on such plans are hardly worth speaking about, but the fact that these do provide an alternative to meet policyholder needs by way of returning premiums on survival is what they should be viewed with.

Technically, an ROP term plan is a non-participating term assurance plan, which means it’s futile to compare the premium returned on survival with returns earned with any other instrument. Such policies work on a level premium format, which means that the premium remains constant throughout the policy tenure; unless the policy lapses. Basically, the policy is suitable for those who are young, need insurance cover, and are confident to survive the policy tenure.

So, if you are one of those people who loves to get back money, however, miniscule it is, this is a policy to consider, because at the base, it is a pure term plan and definitely more cost effective than endowment type of plans. It could also be the first of term plans that you could buy before understanding their working and going in for a pure term plan that costs much less.