In times of grief, the last thing your beloved ones should worry about is money and their future financial stability. Life insurance is about caring for your loved ones and your responsibility to provide for those who depend on you. Whether you are single, married or have a family, life insurance can provide your family with a sum of money to pay for ongoing bills and other household costs, leaving you or your family with extra savings for other things in life while you are still around. Someone rightly said, in the end a purchase of life insurance is a purchase of peace of mind.

Ideally people should opt for life insurance in order to secure their family's financial future, yet chances of coming across people who have taken life insurance to save taxes or investments are fairly high. Although life insurance is one of the most powerful financial products, it has been perceived to be complex, mostly due to people mismatching the product benefits with their needs. There are several types of insurance policies ranging from pure protection, known as term plans, to those that can help you save and invest. Which is why when chosen correctly, it can turn out to be a strong financial tool to take on life's contingencies and not compromise financial goals for your dependents.

Save your dependents from financial perils

Insurance is not a tax saving instrument, nor a low premium a saving

Selecting a plan

The onus of making the right choice is on you, for which you need to understand how you can identify the kind of life insurance that can insulate your goals and your family from any shocks. Fundamentally, life insurance is for protection first and everything else later, which makes estimating the amount of life insurance cover that you need crucial. "Evaluate your savings and the corpus you have been able to create over time by way of provident fund, fixed deposits, life insurance and other savings. If you find that your minimum needs and liabilities are more than your assets, you need adequate insurance immediately to protect your family's well-being," says Kshitij Jain, MD and CEO, Exide Life Insurance.

There are several ways to arrive at the quantum of insurance you need. "Human Life Value (HLV) is the amount of cover that a person needs. It is determined by various factors-age, income, liabilities, expenses, future financial goals and life stage," says Sandeep Batra, executive director, ICICI Prudential Life Insurance. Besides HLV, you could use tools such as income replacement, expense replacement and goal replacement methods. Basically, you need to come up with a sum that should be sufficient for your dependents till the time they can manage on their own.

"Under expense and goal replacement method, insurance is taken in such a way that it provides for the spouse and the children (growing up and education) in case of the husband's death. So the age of the children and the wife need to be taken into consideration," says Suresh Sadagopan, founder, Ladder7 Financial Advisories. If all of this sounds too mumbo jumbo, you could hazard a guess based on any one of the rules of thumb.

"Someone below 40 years should have insurance cover of 20-30 times annual income, which could be 10-20 times for those above 40," explains Batra.

Mumbai-based Vishal Gada has understood the importance of adequate life insurance and arrived at his life cover based on a combination of methods. "I was very clear about my objective of buying life insurance and selected a Rs 1.35 crore term plan based on my lifestyle and risk exposure," explains Gada. Other than pure risk cover life insurance, there exist policies that can help you save and invest for future financial goals, with insurance as a back-up to meet those goals.

Take the case of Mumbai-based Atish Shroff. This private sector employee has two life insurance policies of the endowment variety. "The agent did explain the plan but I didn't know whether they were in line with my goals as they were purchased to save tax," says Shroff. He bought policies with the objective to save taxes rather than protection. His example is quite common as most tax-payers end up signing on the dotted lines in insurance contracts at the last minute to utilise tax breaks.

The popularity of endowment policies, which focused on paying the money back to the policyholder at fixed and frequent interval, had resulted in the primary need for insurance to take a backseat. Such policies provide a small life insurance cover and invest the premium into secure government and other approved securities to typically generate returns of around 5-7 per cent per annum. Then there are products that are investment oriented and are better known as Ulips or unit-linked insurance plans. Ulip is a life insurance product which provides risk cover along with investment options which allows one to club two objectives under a single product.

Smart strategy

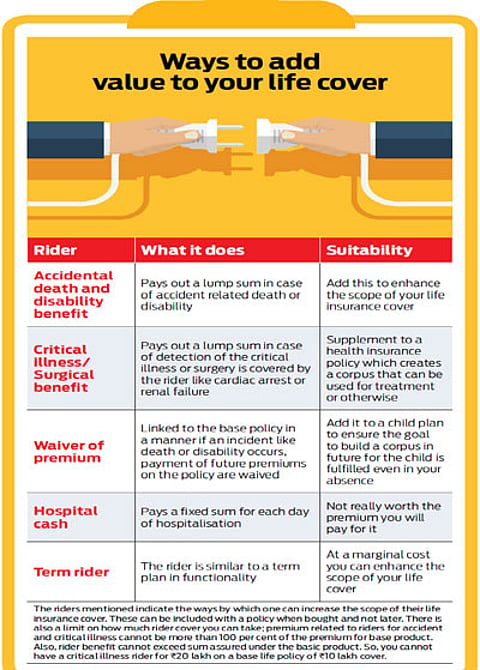

Like the pizza comes with toppings, so does your life insurance with additional embellishments known as riders. A rider is an add-on provision to a basic insurance policy that provides additional benefits to the policyholder at an additional cost. There are broadly three types of riders-health-related, waiver of premium and a fixed payout such as hospital cash (Read: Ways to add value to your life cover). You can choose from the available set to meet your needs at an additional amount.

However, the tenure of riders is concurrent with that of the life insurance policy. Should you feel the need to discontinue a life policy and shift to a more efficient product instead, the riders will cease to exist too. The convenience of paying the premium at one go remains the chief benefit of choosing them over standalone personal accident or critical illness covers for individuals without the time or inclination to keep track of multiple covers.

Deepak Mittal, MD and CEO, Edelweiss Tokio Life Insurance, says: "There is no 'one-size-fits-all' when it comes to life insurance. Each individual has different needs and thus, should select his/her life insurance cover accordingly." However, there is one rule that holds true for all insurance seekers-buy early to benefit from cheaper premiums throughout your life as premium figures will remain the same. For example, if a 35-year-old pays a premium of Rs 10,700 for a Rs1 crore term cover, a 30-year-old will be charged Rs 8,900 for the same cover for a 20-year policy tenure.

While there is no doubt on the role for endowment, Ulips and term plans depending on one's needs, on functionality front, there is nothing that compares to term plans. Term policies are pure risk covers-that is they do not 'return' any amount at maturity, but pay out the claim to nominees in the event of the policyholder's death. Such a structure makes term plans cost less compared to other policies across age groups. For example, if a 35-year old pays a premium of Rs 4,800 for a Rs 10 lakh term cover, the same in case of an endowment plan will work to Rs 50,000 for a 20-year policy tenure.

Life insurance is not a one-time exercise. Every change in life such as marriage or addition of children should prompt an insurance review and an enhancement in cover, if required. "As your financial liability or responsibility increases towards your family, you need to reassess and analyse the insurance needs keeping their growing requirements in mind," says Pankaj Mathpal, managing director, Optima Money Managers. You should also reconsider enhancing life insurance when you add liabilities, such as a home loan. In fact there are policies that cover a home loan outstanding so that your dependents do not face the double whammy of missing you and saddled with the home loan repayment.

Mumbai resident Vinay Takke (30), saw value in the proposition when he availed of a home loan of Rs 13 lakh. "I found the insurance cover useful as in the event of any untoward incident, my family will not have to shoulder the burden of the loan liability," he explains.

Interestingly, several home loan providers insist on the need for such a cover. Do not feel pleased with the lender for being generous in facilitating such a policy. Most often they do so to protect the loan than your life.

You could also save money on premiums by buying online, where the premiums are low, because of direct sale between you and the insurer, thereby cutting off intermediaries. The savings could be a good 15-20 per cent lower in case of term policies and not to forget the convenience. This route, however, is most suitable if you know precisely what you are looking for.

While there are several options to choose from when it comes to life insurance, do not be fixated with the premium outgo alone. Look for a policy with a superior claim settlement track record. "The comparison should be based on not just the premiums but also the financial stability and claim payment ratio of the company," advises G Murlidhar, MD, Kotak Life Insurance. Consider evaluating an insurer on parameters such as claims settlement ratio, turnaround-time for settling claims, on-boarding process and customer grievance ratio before you buy the life insurance policy.