In a bid to help young professionals tide over the month-end blues, a clutch of companies are offering quick loans online for short durations at 24-36 per cent per annum interest rates, finds Anagh Pal

CASH CRUNCH? NOW BORROW AGAINST YOUR SALARY

In a bid to help young professionals tide over the month-end blues, a clutch of companies are offering quick loans

All of us at some point would have faced a cash crunch, especially towards the end of the month. This could be due to several reasons—a medical emergency, car breakdown or a sudden plan for a friend’s bachelor trip. While that puts us in urgent need of cash, it could still be few days before the salary is credited.

Or let us take another scenario. Your SIPs (systematic investment plan) and EMIs (equated monthly installments) would normally be due at the start of the month. But, your salary is delayed from normal and will only come in a week later. Again, you need some cash, could be for a short period of time, but you need it immediately. What do you do in the above situations?

Way out

Today, for many young working Indians borrowing money from parents is generally the last resort. Friends can help, but they too could be in a similar situation. You may ask your employer for advance salary, but your employer may not have such a policy in place. This is one need that new age financial technology (fintech) companies are looking to address through a loan product known as ‘salary advance’. Most of these companies tie up with RBI-registered NBFCs to extend such loans.

Despite good planning, a salaried class person may face a financial challenge, especially during the middle of the month owing to some unforeseen situation. In such a case, requesting advance salary from your employer is one fitting way out. However, less than two per cent companies in India provide advance salary support to their employees.

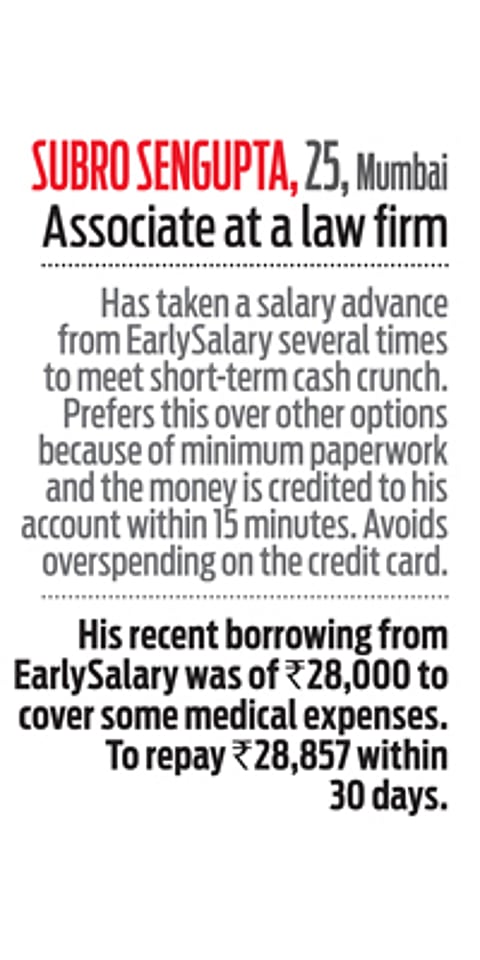

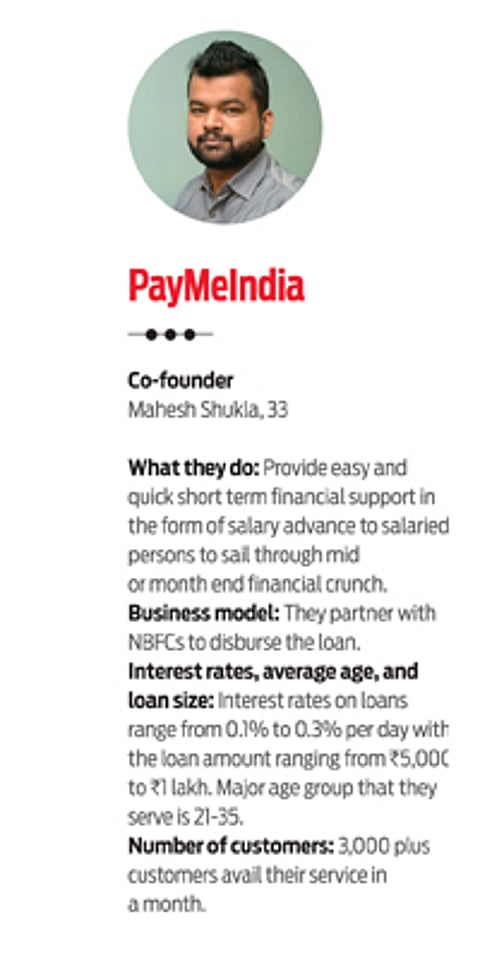

For those who run out of cash at the end of the month, there is help at hand. A handful of companies like EarlySalary, PayMeIndia among others offer instant loans to professionals for a short duration that helps people tide over the immediate cash crunch. Mahesh Shukla, co-founder and CEO of PayMeIndia, a fintech company, says that in the scenarios where salaries are delayed or people have run out of money, a salary advance comes in handy.

Fintech companies are also seeing an opportunity because banks don’t cater to this need. A salary advance loan is a quick solution to help avoid the embarrassment of asking someone for money. It’s a new and hassle-free way to get your salary just when you need it, that too within minutes. “Banks would require you to have a strong CIBIL score to be able to borrow. Moreover, banks will provide you with personal loan schemes for around `3 lakh for a time period of 36 months rather than short-term loans like `20,000 for 10 days till the next salary day,” says Akshay Mehrotra, co-founder and CEO, EarlySalary.com, a fintech company, which focuses on providing salary advance options.

What also makes this a strong business proposition is that employers are tying up with Fintech companies to offer salary advance options to their employees; an association that benefits all parties. Mehrotra claims to have associated with 150 companies for providing salary advance, “We have tie-ups with various companies including large IT companies like KPIT, and e-commerce companies

like Flipkart to offer instant loans to employees. One of the most interesting tie-up includes the one with Enrich Salon as the hair stylists were never able to borrow with such ease from a regular financial institution.”

If a company is associated with EarlySalary, the eligibility criterion is relaxed; there is no restriction for minimum salary of `20,000 per month or minimum three month’s salary credit. Employees of these companies get an edge over others as they can borrow large amount and pay-back in EMIs for specific problems like house deposits, medical emergencies, school fees payment, etc, along with reduced interest rates. One also gets options for interest free online shopping on EMIs. Employers on the other hand benefit by not having to worry about setting an internal process that extends salary advances around the clock. These fintech companies also free the employer from liability in case of non–payment. Elaborating on the merits of these tie-ups Shukla says: “The employees get dynamic credit limit and quick credit into their account, if their company is listed with us. Additionally, the charges are quite low for such customers. For advance salary support, we have tied up with some leading BPOs and a company, which provides manpower to various industries, and are working towards adding more companies to the list.” The tie-ups, hence, are a win-win proposition for both the employees and the employers.

Simple borrowing process

The best bit about salary advance is the simple process and that the money is credited to your account almost instantly. This is possible because of the technology that these loan providers run in the background. Apart from the CIBIL score and repayment track record of customers, these companies also consider a social score, which is derived from tracking digital footprints of the customers from their social media accounts, mainly Facebook. “We have built a social media-based decision making system, which uses complex machine algorithms to help us take faster decisions and give out the loan in minutes. We consider non-traditional data adding a layer, which further gives confidence to lend to a young customer when Credit Bureau like CIBIL/Equifax data is not available or inaccurate for lending or creditworthiness,” says Mehrotra.

Cashkumar, a peer-to-peer lending company gives salary advances only to existing borrowers who have taken a short-term loan from them. “We thought of the product when some borrowers would call us to say they might delay an EMI as their salary was not credited yet. It was a difficult situation because even with intent to pay, the borrower would have defaulted and borne penalties. Obviously, they would not have funds to meet other expenses too. So instead of undergoing this we thought the borrower could just take a small loan of `10,000 and pay back soon as salary was credited. It is not something which is given every month and only approved in the time of need,” says Dhiren Makhija, co-founder, Cashkumar.

A word of caution

As attractive as borrowing may seem from these platforms due to their user-oriented interfaces and processes, do not plunge into a borrowing spree just because the service comes in handy and offers flexible re-payment options. Remember, that a salary advance is still a loan and you need to pay it back with interest as soon as you receive your salary. So, if you have taken a salary advance of `20,000 this month, your effective salary next month will be `20,000 less. Says Chenthil Iyer, CEO, Horus Financial Consultants and author of Everyone has an Eye on Your Wallet! Do You?, “Anyone going for a salary advance loan should really think why one’s expenses are more than the income. If it is due to some temporary emergencies, it is alright to borrow, but care should be taken to create one’s own emergency reserves instead of having to depend on such loans. A conscious budgeting exercise can also help one prevent needing such expensive loans.”

Another important thing to consider when taking salary advance loan is how it will affect your credit score. If you take a salary advance and pay it back on time, it will facilitate building a healthy credit score, especially if you are new to credit and do not have any credit history. “We feed data on loan performance back to all four credit bureaus each month helping form users’ credit scores, which would help them get access to other formats of credit instruments like home, personal, and car loans,” says Mehrotra. But for reasons mentioned above, while salary advance may come in handy during a cash requirement, it is best not to make a habit of it.

Remember the time when one had to stand by the roadside and flag down a cab? Then entered technology and changed it all. It is the same for your finances. If used wisely, a salary advance will help you tide over end of the month financial shortage.

anagh@outlookindia.com