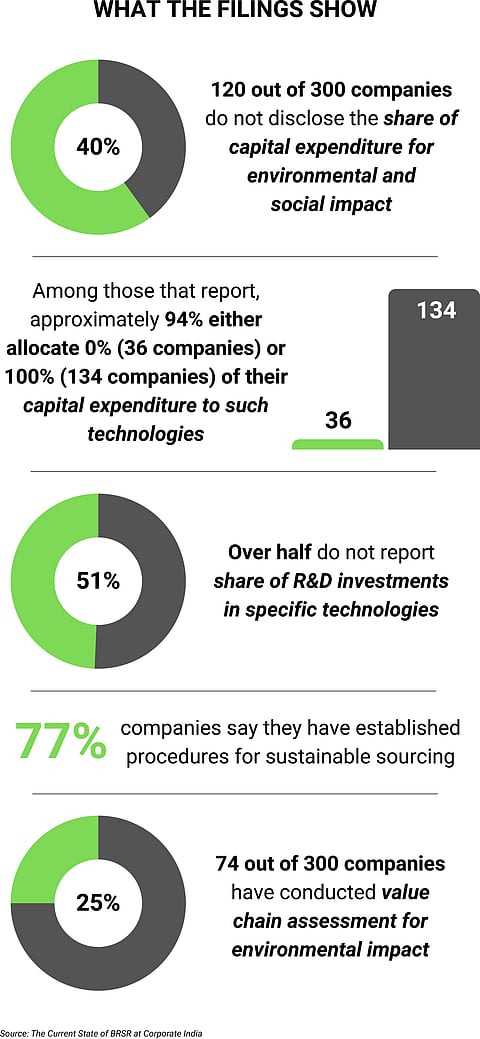

Just around half of the top 1,000 publicly listed companies are reporting their research and development (R&D) spends on their Business Responsibility and Sustainability Reporting (BRSR) filings, and only a quarter conducted a value chain assessment for environmental impact according to a survey of around 300 companies.

India’s Top Companies Are Still Struggling To Report Green Investments

Reporting on R&D spends and environmental impact assessment of value chain partners remains weak

The survey was conducted by the non-profit CFA Institute, the National Stock Exchange (NSE) and the CFA Society India.

Comparing BRSR data between financial years 2022 and 2023, the survey found the share of companies reporting 100% of their R&D investments declined from 19.1% in financial year 2022 to 17.6% in financial year 2023.

The number of companies, in the sample of 300 companies, increased marginally, from 47% in the 2022 financial year to 51% in the 2023 financial year, the survey found.

Green Expense Reporting

When it comes to capital investments in specific technologies to improve environmental and social impact, the proportion of companies reporting this data has gone up from 56% in the financial year 2022 to 60% in the financial year 2023.

Among companies that reported on this parameter, approximately three-fourths indicated that around 100% of their capex is directed towards such technologies in the 2023 financial year. The BRSR format requires companies to disclose the percentage of their R&D investment and capital expenditure towards technologies aimed at enhancing environmental and social impact.

Around 230 companies—77% of the sample—had set procedures for sustainable sourcing, the survey found. But reporting value chain assessments of environmental impact remains a weak link, as only 25% companies were found to have done the same.

Locating the Weak Link

Companies have done a fair job in reporting their scope–1 (emissions generated within the premises of a company) and scope–2 (emissions from imports such as coal). The survey found that 94% companies (282 of 300) reported their scope–1 and scope–2 emissions for the 2023 financial year, up marginally from 281 companies in the financial year 2022.

The reporting of scope–3 (emissions from customers and the supply chain) remains relatively low, with less than 40% of companies reporting this information in the financial year 2023.

Two-thirds of surveyed companies reported sourcing from micro, small and medium enterprises (MSMEs). Average sourcing rose from 19% in the 2022 financial year to 22% in 2023. More than half of surveyed companies reported sourcing from within the district or neighbouring districts, with average sourcing from these areas being around 40% in both years.

Need Clear and Simple Numbers

The survey has recommended more transparency and consistency in BRSR filings and standardisation of reporting units, customisation of materiality requirements by sectors and industries, specifying underlying data based on derived information to cut down on ambiguity. The survey says BRSR data needs to be simplified without compromising on quality.

It further says that the relevance of BRSR parameters should be aligned with specific characteristics of each sector and industry. “Certain parameters may not be universally applicable,” notes the survey. Clarity in units of measure and reporting annual instead of monthly data are among other recommendations.