Like most Indians, Chennai based Om Prakash has explored a fair bit of investment options. There are savings, insurance, real estate, land and even investments in stocks and mutual funds. What is evident from his finances is that he has not really thought it through for his finances to work optimally for him.

Make your money work

A few smart moves should help you get on track with your finances and bring you closer to your financial goals

It is interesting to note that he has understood that savings alone will not help him build up the desired corpus to reach his financial goals. Investments are necessary to make your otherwise idle savings grow to the desired corpus. Although he has made investments in stocks and mutual funds, but a look into the portfolio and you realise all these investments were done in a haphazard manner. The result: he has several overlaps in his investments, with some investments actually not aligning with his overall financial goals.

First steps

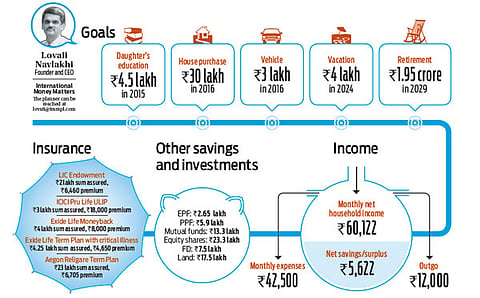

Our planner has helped Prakash think through what he financially wishes to achieve, which resulted in him listing out several financial goals including his retirement, education and marriage of his children, besides the usual purchase of home and vehicle. Prakash, after servicing his financial obligations is left with less than Rs.6,000 each month, which is understandable considering he is the sole bread earner in his house.

At the moment nearly 70 per cent of what he earns each month goes towards his household expenses. This is a relatively higher figure than one would be comfortable with. Prakash should prepare a monthly budget to keep track of where the money goes to be able to focus on how to optimise it. This exercise will achieve two things: he will have better control over his finances and he will be able to cut costs wherever he can to save more than what he doing at present.

Take control

One of the first steps the family should take is to ensure that the financial risks they are exposed to are controlled. What this means is that Prakash should take adequate life and health insurance cover. Considering his wife met with a major illness, he should look to create a corpus aside from medical insurance to meet emergencies.

The money maintained in the savings bank account should be gradually increased, with Rs.1 lakh always available, through a smart-linked account which will earn interest offered by FDs, but be liquid to be withdrawn when needed.

By rescaling some of his goals, including retirement, our planner has worked out a solution that will help the family achieve all their stated financial goals. At 45, he is in that phase of life when demands outweigh promises. Not that he needs to cut corners, but what he needs to ensure is that he avoids making any mistakes at this stage. Hence, it may be a better move to build his own house in the land that he owns than buying something new.

He should reduce the number of holdings in mutual funds in a way that he can manage them better. Not only will he save time, it will also ease him off any difficulties when exiting any of these investments.

With the blueprint of what he needs to do, from this point on, any modifications to his basic plan will be straightforward. The process of putting it all together will change some of his beliefs about managing money. To ensure that you stay on track with your finances, review your plan once a year. Money and household finances won’t be as scary when you break it down into manageable bits. If you truly commit, it will be a huge boon to your emotional and financial well-being.

Getting back on track

Emergencies

■ Considering the health risks that your wife is exposed to, you should have Rs.3.5 lakh easily accessible to meet about six month’s household expenses, including loan repayment.

■ Maintain the Rs.60,000 that you have in your bank without dipping into it

■ Use Rs.1 lakh from the bank FD to add to the emergency fund

Insurance

■ While you should continue with all the insurance policies that you have; you should also consider taking life insurance for your wife

■ Given the fact that your wife had a major brain surgery in 2012, it is recommended that you purchase independent health cover of Rs.5 lakh for yourself and your wife and individual health insurance of Rs.3 lakh for your two children

■ Additionally, purchase a Super Top Up of Rs.10 each for yourself and your wife. These are economical and widely available and should be added to ring fence the financial implications of your health related risks.

■ Continue the existing family floater for your wife

■ You need an additional Rs.10 lakh critical illness cover and a personal accident cover for the same sum

Corpus for medical expenses

■ It is a good move to consider creating a medical corpus to meet the healthcare needs of your aging parents and your wife

■ Your investments in equities will be useful to fund this goal

■ For any shortfall that you may have, it is suggested that you invest Rs.3,200 from this year in a diversified equity fund from the OLM Elite list of funds for conservative investors. These are funds that are not very volatile, have a proven track record and performance history, which should help in meeting your financial goals

Vehicle purchase

Your plan to buy a new vehicle this year for Rs.60,000 can be met from the money invested in mutual funds

Daughter's education

Use the mutual fund investments to meet this goal

House purchase

■ Our planner has revised the goal from Rs.60 lakh to Rs.30 lakh

■ You should use as much of your existing funds to furnish 70 per cent of the down payment, with the remaining coming from a home loan

■ The down payment can be routed from existing mutual funds, FDs and your equity investments

■ Alternately, you could consider building a house in the land that you own and bring down the cost to Rs.10 lakh for construction, which can be diverted from equity and mutual fund investments

Daughter’s marriage

This goal is 16 years in the future, you can start considering to save for it once your other financial goals are achieved

Vacation

■ Life cannot be only about work and other engagements, you do need some time off and it is encouraging to note that you have planned for a vacation

■ Our planner feels the vacation needs to be pushed by two years to 2024 due to the importance and urgency of other financial goals that you have set

■ You do not have any existing investments that can help meet this goal, it is recommended you start investing Rs.3,500 from this year to realise this goal in 2024

Son’s education

■ You can use the proceeds from the Ulip and LIC endowment plan proceeds to fund this goal

■ While you may not need a lot of money if your child manages to win a scholarship, you can start investing Rs.8,100 from this year towards this goal in 2026. With an 11-year time frame, you can bank on the power of compounding and long-term benefits of equities to invest in a diversified equity fund to achieve this goal

Retirement

■ Assuming you retire in 2029, based on your current expenses, you will need Rs.1.2 lakh each month. This may not be possible given your current finances and you will be better to rescale the expenses to be manageable within your existing cash flows

■ The rescaled sum works to Rs.80,000 every month from 2029, which works to Rs.35,000 in today’s value

■ In order to meet these inflationlinked expenses till your wife’s life expectancy of 85 years, a corpus of Rs.2.3 crore will be needed. Sale proceeds of the land that you have, your EPF and PPF contributions besides the ICICI Ulip will be useful to meet some part of this goal

■ To meet the deficit, you should start saving and investing Rs.4,700 from 2017 till such time that you retire

■ You can add more towards this goal as and when you have more money to ensure you have a financially secure life in retirement. .

Avoid over-diversification

Diversification is one of the basic tenets of investing and a simple idea. Shares in a company do well or badly depending on the economy and other market factors. For instance, the economy today favours companies in the financial services compared to say textiles. It is for this reason that one recommends investments in mutual funds, which automatically maintains a degree of diversification, which is professionally managed.

However, many investors tend to not understand this simplicity and complicate their portfolios by investing in several funds. One of the most commonly asked questions is: How many funds should I invest in to achieve right diversification?

While there is no one technique that suits all, investors will be better off investing in 3-4 diversified equity funds of different orientation. By orientation one means following an investment strategy that takes into account spread across sectors, market capitalisation and also styles of management.

In the case of Om Prakash he has invested in 17 different funds and 29 different stocks; something best avoided. Not only does this cause difficulty in maintaining and evaluating the performance of the investments, it also does not achieve much with overlap in exposure to stocks through direct investments and mutual funds. The lesson here is to invest in as many funds and stocks that one can manage and which follow an overall asset allocation.

Like we said, about four good funds is what one needs to achieve an ideal diversification. By trying to diversify further, one is not going to make much investment gains. The way out for Om Prakash is to consolidate his holdings to a manageable number, invest regularly and evaluate the performance of his investments at least once a year to ascertain its progress. This way, he will know better about his investments and also be able to exit under performers and stay invested with those that are faring well.