It is common to come across Indians with all their investments predominantly in a single asset class. Then there are others who swear by gold or the fixed return instruments. The fascination for real estate runs deep among Indians because it is considered safe and secure. It is also perhaps one of the biggest financial decisions that Indians make. It is safe and nobody can run away with your house, is a familiar argument. Yes, everything is right about tangibility of real estate over other financial instruments.

REAL with REITs

REITs could just be the right way to investing in property, finally opening new vistas for investors

But, there are some factors that go against real estate: they call for huge financial commitments, they are illiquid and if one is not occupying the house they have bought, they run the risk of the asset not producing any monetary gains. Says Kush Shah, CEO, Uniworld: “The idea behind Uniworld comes from my own experiences and problems one faces when looking for investments in real estate. I will say that I filled the gaps that existed and offered an investment option that suits a wide section of people.”

Smart choice

Shah came up with an innovative idea of Uniworld, a 720 unit hostel in the ElectronicCity in Bengaluru, which offers accommodation to employees in the area looking for a comfortable, hygienic place to stay at affordable rates. “I found investing in this project very attractive. It serves the needs of those looking to stay close to work with the necessary amenities at an affordable price,” says Delhi-based social sector professional, Sonia Shrivastava. She is one among the 500 investors in this unique real estate investment idea.

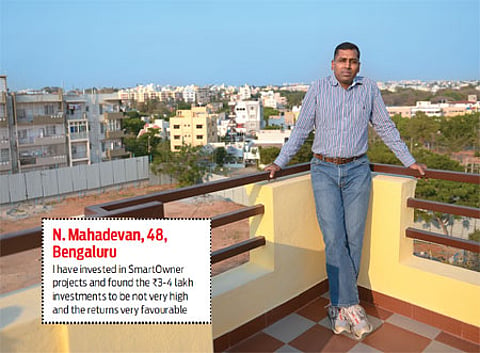

For Bengaluru based N. Mahadevan, being an old resident of the city allows him to know more about the prospects with real estate investments. “I do not have a lot of money to invest, so I look for small ticket-size opportunities like the ones offered by SmartOwner,” he says. SmartOwner is a concept, which gets into early stage investments in high-quality residential real estate projects after due diligence. They then offer investors a minimum sum running into a few lakhs to invest. The payoff? SmartOwner exits these projects within 2-3 years, as they come closer to closure, earning a significant return in the process.

Says Vikram Chari, Chairman and CEO, SmartOwner Services India: “We take an equity stake in the projects we get associated with. Ideally, we come on board taking over 30-40 per cent of the inventory with positions on the board of the project, which ensures the money is being used in the right manner.” Chari and his team are constantly looking for projects that meet their high standards and at a price that will earn their investors the maximum returns.

The kind of options that Uniworld and SmartOwner offer on residential projects has been available in commercial real estate for long. However, these come with very high minimum investments that run into several lakhs. Moreover, most of such projects work on a debt model, where as an investor you get a fixed return on your investment, which effectively means it, works like a fixed deposit. The advent of Real Estate Investment Trusts, or REITs, makes for a practical way for all investors to invest in large-scale, income-generating, professionally-managed companies that own commercial real estate.

Enter REITs

A REIT is a company that mainly owns and in most cases, operates income-producing real estate such as apartments, shopping centres, offices, hotels and warehouses. From its start in the 1960s in the US to its current position, the REITs market has come a long way (See: How REITs work). Another thing that REIT does is to bring in an element of regulation to the housing sector, because REITs will fall under the stock market regulator SEBI’s purview. A REIT is similar to the mutual funds where a pool of funds is raised from the investors and it issues units’ exchange. This pool of funds will be invested primarily into commercial properties.

According to SEBI, a REIT will be set up as a trust and will have parties such as a trustee (registered with SEBI), sponsor, manager and principal valuer with specific responsibilities. After the registration, the REIT would raise funds through an initial offer from investors and get listed. The minimum issue size of the initial offer has been specified at Rs.250 crore and the regulator has specified that the size of assets under the REITs should not be less than Rs.500 crore.

Further, the recent budget gave further push and boost to REITs. Says Rajesh Srinivasan, Partner, Deloitte Haskins & Sells LLP: “By allowing sponsors exiting at the time of listing be exempt from long-term capital gains on sale of these units and short-term capital gains taxed at the rate of 15 per cent, is a reprieve for promoters and sponsors.” However, these rates would be subject to payment of Securities Transaction Tax (STT). This concessional regime was available only to the trust and not to the sponsor. In order to promote sponsors, the finance minister has now seen a need to include them under this regime.