The discussions around using credit cards over apps and cash is very understandable in the current scenario. However, if you thought that using a credit card did not cost you as long as you paid the dues in time, think again. According to the Reserve Bank of India (RBI)’s data on card statistics, the Y-o-Y growth in the total amount of transactions was 29 per cent in August 2016 against August 2015. The total value of transactions on credit cards was at Rs 26,052 crore in August 2016. This data shows how credit cards have made life convenient.

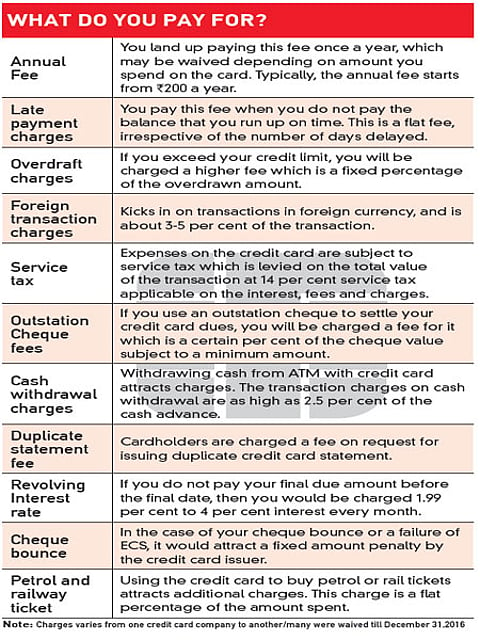

These eleven charges and fees can spike your credit card bills significantly

Although credit cards are convenient to use, there are costs that you cannot ignore

These eleven charges and fees can spike your credit card bills significantly

Advertisement

But credit cards have various charges; fees associated with them if not understood well can lead you in to a debt trap. So before you go on a swiping rampage, just check for the costs associated when using the card as mentioned in the credit card statement that you receive every month or the documents that detail the terms of usage when you receive the card for the first time. Read the adjacent table to understand different charges and fees.