Hyderabad-based couple Nagamalleswara Rao (30) and wife Krishna Tejaare (26) plan to start a family soon. But foremost of all, they have made the right move by listing out their financial goals. Rao works as a product assurance engineer with technology major Cognizant while his wife is a deputy manager at Mishra Dhatu Nigam, a Mini Ratna company that manufactures a wide range of advanced metals and alloys. The couple has parents as dependents and, at present, live in a rented accommodation. They plan to move to a house of their own next year for which they are looking at a home loan to supplement their own contribution by way of downpayment.

A couple of good decisions

It’s not always possible to realise your goals when you want them, but with some deft financial handling, you can achieve them in due course.

Like most young couples, these two also have many desires, which they have listed among their future goals. At the same time, they face issues of being short on money to realise their financial ambitions right away. For instance, there is no harm in planning ahead about their children’s future financial needs. But doing so, when they are yet to have a child, is getting carried away too far. No wonder, our planner has rescaled some goals while he has accommodated the financial needs they need to cope with once they have children, especially for their education.

Lessons to learn

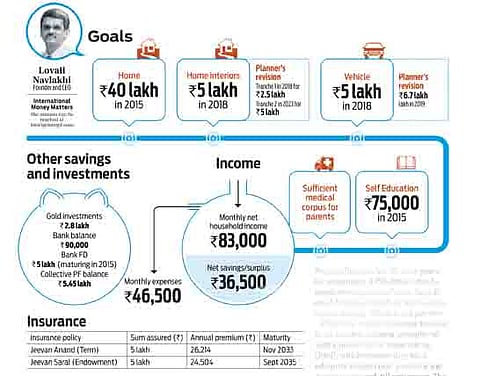

The Raos are under-insured, with all their savings confined only to the mandatory pension and deposits in bank. But their biggest strength stems from the fact that so far they have no financial liabilities in the form of loans. That said, they have not started planning for their retirement, too. So, they need to make some changes to their financial planning now and not stretch things further.

Nagamalleswara has 30 more years for retirement. If Rs. 35,000 is what he needs now to run his home, he will need Rs. 2 lakh a month in 2044, adjusting an average inflation of 6 per cent.

Where the couple has some benefits is the fact that Krishna is employed with a public sector undertaking (PSU), which ensures they have adequate health cover provided she continues to work till retirement. The government employment will also take care of contributions towards pension that qualify for tax savings.

With some tweaks to their current finances, the two should be able to achieve all their financial goals.

Future sense for Raos

Emergency funds

- Maintain Rs. 90,000 bank balance towards contingency fund

- Increase the same from next year to bring it to three months’ expenses

Insurance

- Life cover of Rs. 2 crore each over time

- They should take individual health insurance cover for Rs. 5 lakh each instead of a family floater

- Consider a basic health insurance for Rs. 2 lakh for parents and add a top-up of Rs. 10 lakh for each of them to enhance the cover

Start investing

- Follow a 50:50 allocation of equity and debt to realise financial goals

House purchase (2015)

- Pay 22.75 per cent as downpayment and the rest as a 20-year home loan

- Use the existing Employees’ Provident Fund (EPF) and FD to make the downpayment

Self education

- Use a portion of the FD for this

Maternity expenses

- Invest Rs. 2,166 a month from now till 2016 in some debt funds for a corpus

House interiors

Fund this goal over two tranches

Tranche 1: Monthly investment of Rs. 8,665 from 2014 to 2016 in debt fund and continue to hold the same earning of at least 7 per cent on this corpus till year of requirement in 2018.

Tranche 2: Monthly investment of Rs. 12,504 from 2020 to 2023 in debt fund is recommended

Purchase of vehicle

- Postpone this goal to 2019 due to cash flow constraints

- Start monthly systematic investment plan (SIPs) of Rs. 9,087 for a year from 2015 to cover the downpayment and hold the same in debt funds till 2019 when you can buy the car

Vacations

Monthly SIP of Rs. 2,083 from 2014, growing at 6 per cent annually till retirement in liquid funds

Retirement

- In order to meet these inflation linked expenses till Krishna’s life expectancy of 76 years, a corpus of Rs. 6.3 crore is required

- Income from Krishna for four years post retirement has also been included to fund the retirement goal

- Monthly SIP of Rs. 7,704 from 2024 till retirement to meet any deficit, which needs to be stepped up 15 per cent annually in diversified equity funds

- Their voluntary contribution towards pension is Rs. 5,000, which is recommended to be reduced and instead be diverted towards more liquid assets.

Preparing for young ones

Children’s high school

- Monthly investment of Rs. 3,248 from 2023 to 2031 and Rs. 1,557 from 2031 to 2032 in diversified equity fund is recommended for both the children they plan to have

Children’s graduation

Child 1

- Maturity proceeds of LIC Jeevan Anand to be set aside for first year of graduation

- Maturity proceeds of LIC Jeevan Saral recommended to be set aside for this purpose

- Monthly SIP of Rs. 1,482 from 2023 till 2034 in diversified equity funds

Child 2

- Balance of LIC Jeevan Anand maturity proceeds is earmarked for this goal

- Monthly investments of Rs. 2,462 from 2023 till 2036 in diversified equity funds

- Monthly investments of Rs. 2,359 from 2023 till 2037 in diversified equity funds

Post graduation and marriage

- Monthly SIP of Rs. 18,416 to be stepped up by 15% annually from 2023 till 2038 is needed