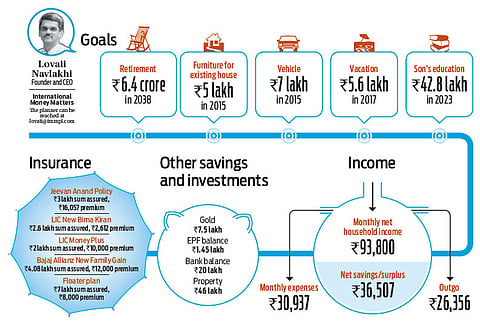

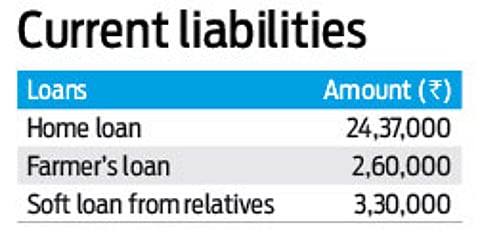

Pune-based 34-year old Girish Sonar is in a position to achieve all his financial goals if he starts acting on them right away. Along with wife Prajakata who is expecting a second child soon, son Om and mother Sunanda, the family resides in their own home in Pune. Girish works as an assistant software consultant and the family lives very much within its means, with the propensity to save a significant portion of what Girish earns and his mother receives as pension. Like several Indian families, real estate forms a significant part of their assets with two plots, a house that is let out in their home town and the house where they reside. However, what can harm his and the family's future is the fact that he has plenty of idle cash in his bank, which is not being meaningfully deployed. They have also borrowed more money than they need to. For instance, they have investments in gold worth Rs. 7.5 Lakh, but nearly half of it is mortgaged. He also has a couple of soft loans from relatives. He has an outstanding home loan of Rs. 24 lakh, a gold loan of Rs. 2.6 Lakh and a soft loan of Rs. 3.3 Lakh. Servicing loans can be expensive, especially when he sits on a bank balance of Rs. 20 Lakh, which could be better deployed to reduce his liabilities.

Get smart with money

The virtues of zero financial liability cannot be more emphasised. You have money in the bank, deploy it meaningfully

Fiscally fit

Girish is also under insured with inadequate life and health insurance. Given the fact that he is the sole earning member, he should buy adequate insurance cover. He has age on his side and should consider increasing his asset allocation significantly to equities. The allocation to debt, including the real estate holdings, account for more than 60 per cent of his assets, which he should consider reducing. By using his current bank balance, he can conveniently start reducing his liabilities and the monthly savings that the family has can be deployed in funds from the OLM Elite list. In fact, given the higher deduction limit this year onwards, Girish will do well to utilize any additional sum that he has to save taxes to deploy in ELSS funds to get the necessary exposure to equities and also earn tax benefits. Once the loans, other than the one on the home they reside in, are closed in 2017, there will be a surplus that Girish can utilize to achieve his other financial goals. Our planner has structured the plan in such a manner that there are no revisions in the goal sums or the years in which the family plans to experience their goals. This leaves Girish and his family in an easy and desirable situation. The lesson for Girish is to spare time understanding his finances. Such an act would give him the necessary insight into how much he owns and where the money is deployed and, in turn, reduce idle money and give room for it to be used productively. With a second child coming into their lives, the couple should consider the new beginning as an ominous sign to rethink their financial plans and stick to them with discipline.

A plan to act on

Emergency funds

■ Start by maintaining 6 months monthly expenses including premium and EMI outgo with Rs 3.43 Lakh as the existing bank balance

■ Maintain Rs 5 Lakh in an FD towards emergencies

Loan repayment

■ Recommend closure of the two soft loans by 2017, partly utilizing bank balance

■ Exit from LIC Money Plus by surrendering it and the proceeds can be used to pay the gold loan

Insurance

■ You are under insured and have policies that are not pure life insurance

■ Surrender LIC Money Plus and continue the other policies

■ Increase your life insurance by taking a policy with sum assured Rs. 3.4 crore to maintain your family's financial health

■ Take a critical illness cover for Rs.10 Lakh for yourself and your wife

■ Take a health insurance cover for Rs. 5 Lakh for yourself and your wife

■ Take accident insurance covers for Rs. 10 Lakh for yourself and your wife

■ Use your office provided health insurance for your mother

Home furnishing

■ It is recommended that you utilize part of the existing bank balance to meet this goal

Vehicle purchase

■ Use some of your bank balance to fund the down payment of Rs. 3.5 Lakh

■ Raise the remaining through a 5-year auto loan

■ Auto loan at 12 per cent interest works to an EMI of Rs. 7,785 for 5 years

Vacation

■ The goal can be partly funded through the bank balance while it is recommended to start a monthly SIP of Rs. 8,400 until the goal is achieved in 2017

Om’s education

■ You can sell the plot of land you own, which is assumed to be worth Rs. 5.5 Lakh

■ Additional sum can be arranged from the maturity proceeds of Bajaj New Family Gain plan

■ Any deficit that you face can be plugged from the recommended monthly investment of Rs.24, 653 based on 50 per cent equity allocation

Second child’s education

■ It is estimated that you will need Rs. 1.04 crore for this goal

■ Do review this goal after a few years post birth of the second child and a few years before you will actually need the money

■ The plot in Nasik can be earmarked to meet future education expenses

■ Ideally, you should consider selling the plot a couple of years before you actually need the money

Retirement

■ You will need Rs. 1.71 lakh a month from 2038 onwards, which is Rs. 45,000 in today’s value

■ We have assumed both your life expectancy at 90 years

■ You will need a corpus of Rs.644 crore to lead a comfortable life in retirement

■ The current EPF balance and the corpus accumulated through future contributions have been earmarked to this goal

■ Any surplus from sale of the Nasik plot after using the same for children’s education will also fund your retirement

Children’s marriage

■ You will need Rs. 64.37 lakh for this goal after your retire

■ Planning for this goal is good as it gives you an idea of how much you will need but with the goal more than 20 years away, review the value closer to the goal

■ The proceeds from insurance policies will also add to the fulfillment of this goal

■ Start an SIP of Rs.69,500 from 2020 till retirement, ideally

■ Start with what you can manage and gradually increase the amount over time