While it’s important to teach children about saving and spending money wisely, there are no fixed rules or methods. However, parents should follow a balanced and systematic approach, says Priya Nair

Catch Them Young

While it’s important to teach children about saving and spending money wisely, there are no fixed rules or methods.

Old habits die hard. And when it comes to money, what we learn about it in childhood has a deep bearing on our relationship with it in our adult life. Most parents today unflinchingly expose their children to the power of spending, but keep other important aspects like earning and saving for adulthood. This creates an unrealistic impression in the minds of young children, who believe that money is something that magically comes out of ATMs.

Financially savvy parents tend to teach their children important aspects of money – including earning and saving from an early age – using innovative techniques. For instance, renowned financial advisor Gaurav Mashruwala started inculcating financial awareness in his daughter Sanaa when she was very young. He helped her understand the power of saving and building a corpus through a transparent chocolate bank – each time Sanaa took chocolates out of the ‘bank’, she saw the stock deplete. Today, as a 16-year-old, she’s the family bookkeeper when they travel. She maintains an expense diary that helps her track her outflows and inflows (pocket money).

Most of us had a piggy bank while growing up and the financial discipline (or the lack of it) that we displayed then shows up even in our adult life. It is for this reason that some people like to live on borrowed money while others are more prudent. Outlook Money spoke to some families to see what they are doing right and what they can do differently. Some parents feel that instead of giving money to children, setting an example by leading a disciplined and frugal life is the right way to teach them the value of money. Some parents reward children with cash or treats for good behaviour to teach them concepts like earning and saving.

However, as the psychologist we spoke to says, there is no one right or wrong. These life lessons have to be taught. What route parents choose to follow would depend on their comfort and individual preferences.

The Carrot-and-Stick Approach

Parents’ attitudes towards money inevitably have a deep influence on their children. But there are questions galore – would a tight-fisted parent end up raising a mean child? Will someone who spends money lavishly raise a spendthrift child? Most people tend to leave important money lessons for much later, but specialists believe that need not be the case.

If parents keep relating everything to money, that message will travel to the child, points out Dr Niranjana Gokarn, a family and child welfare counsellor and retired professor from Tata Institute of Social Sciences. “The child sees what is happening and then does, rather than being told what to do. Some kind of discipline, for wanting things, must develop from a very young age. And that can develop only if parents live like that,” she says.

Most financial institutions claim that millennials and young adults only believe in spending and are not at all interested in saving, largely because the focus today is on living the good life. We live in a world of instant gratification and people are not averse to enjoying life on borrowed money. It is for this reason that financial literacy should start very early on. Amrit Rai, a six-year-old boy in Mumbai, gets

rewarded for his good behaviour and is currently saving to buy a remote-controlled rocket. His piggy bank is a ‘special box’ where he collects money. He has over `2000 in it but wants to save more because he does not know how much his rocket will cost.

Amrit’s ‘good behaviour’ includes helping his mother tidy up the house, completing his homework and doing lessons by himself, or at times just behaving himself in public. Money is deducted if Amrit misbehaves – for instance, if he doesn’t finish his food or refuses to obey his mother. It is to build a sense of independence in Amrit that his mother Anuradha Rai started rewarding him for good behaviour. And taking away money is to let him know that it’s the result of his bad behaviour. “I reward him when he does things on his own without our prompting. This encourages him to do things better than he normally does. He knows that only then will he get rewarded. I’m building up his expectations, but he should realise that this is how it will be when he grows up. He should do work exceptionally well in order to get rewarded,” says Rai.

The family is saving for Amrit’s higher studies based on his current school fees. They also save for their annual vacations. Rai is also particular about saving for buying anything expensive, such as an iPhone. “We don’t pay any EMIs, other than on our home. I don’t allow my husband to use his credit card recklessly. I insist that he saves money to upgrade his iPhone,” she says.

Leading By Example

According to Manikaran Singal, founder and Chief Financial Planner at Good Moneying Financial Solutions, children learn by observation and imitation. So parents need to be careful how they behave with money. “How you handle cash, how you make payments when you go out for eating or shopping, how you decide what to buy and what to leave, the discussions between you and your spouse – all these will definitely impact the minds of children who will be listening. They will indirectly imbibe that in their own money behaviour,” he says.

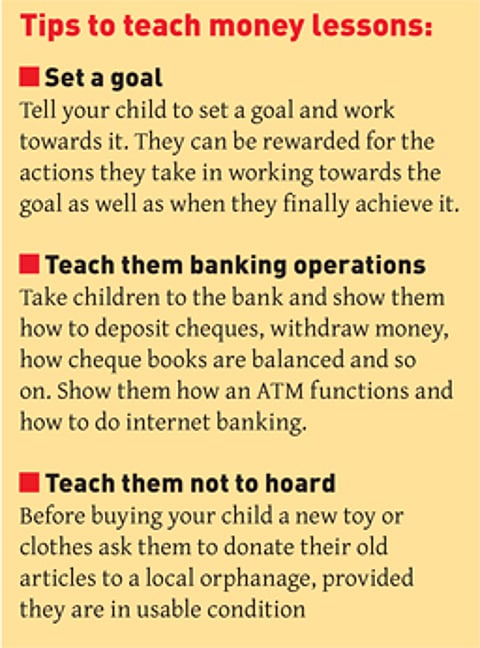

Teaching children about money can start early, even at ages as young as six or seven. Give them a money box or piggy bank and encourage them to start collecting small amounts over a period of time in order to buy something later, because this can also be a lesson in saving and investing. Later, when they are 12 years or older, parents could open independent bank accounts for them.

Referring to Amrit’s special money box, Singal says, “It looks like a good arrangement. However, there’s a probability that the child might start expecting a reward for every good deed he does. A lot of things for which he’s getting rewarded are part of standard expected behaviour in Indian society. So rewarding him with money for these might entail a small chance of developing the wrong mindset. Saving money for buying things later is a good way to teach. It can also be taken from his pocket money. He can use savings from his pocket money to buy toys or other small things that he wants.”

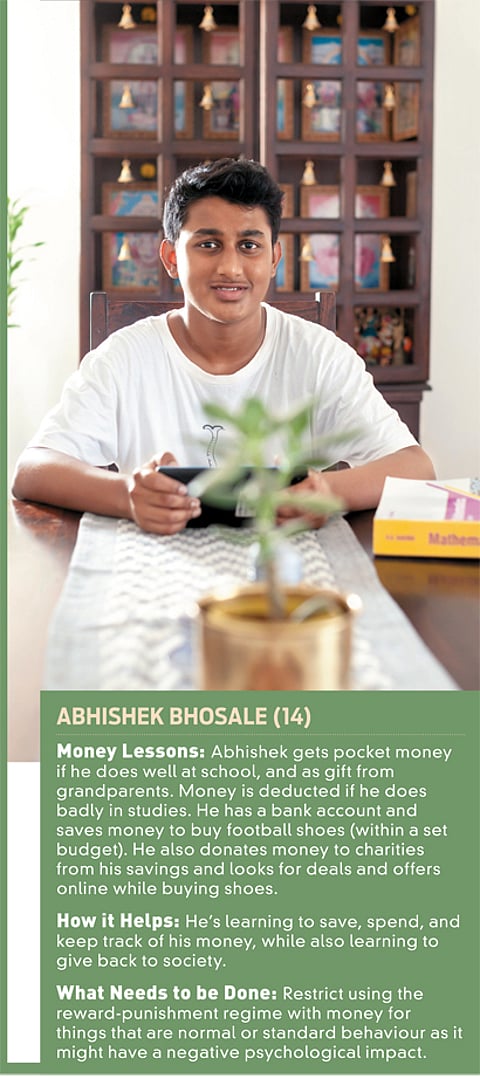

Teach the Art of Saving, Not Stinginess

Just like Amrit saves money in his special box, 14-year-old Abhishek Bhosale used to save money in his mother’s old purse till recently. While some parents are overgenerous with their children out of a sense of guilt, others go to the other extreme when it comes to saving and cutting back on treats. Abhishek’s mother shows him how much he’s earned for his good behaviour and what’s deducted for bad behaviour or for doing badly in school. Recently his parents opened a bank account for him. Now the money gets deposited in his account and Abhishek regularly checks the balance in his passbook. The family is saving for his higher education through mutual funds, and also encourages him to invest any extra money in his account in mutual funds. “By opening his account we wanted to show him how the value of money can increase when it is invested, which doesn’t happen when it’s kept at home,” says his mother Kalaivani Atul.

Parents typically give Abhishek `500 for good behaviour. He also gets money from his grandparents when he visits them during holidays. He spends the money on football shoes and other sports equipment. Since his parents will not let him splurge on expensive brands, he goes online to check for good deals and also visits several stores till he gets the best pair he can afford. “I save for two to three months and then buy. If I go to McDonald’s I don’t spend more than `500. I’m not allowed to spend more than `6000-7000 for a pair of shoes. Recently I saw a pair of Adidas shoes online. But I also found a similar pair in a local store that I got for a good price. Next I want an electronic skateboard and I’m saving for that,” he says. Similaly, he also helped his father get a good deal on the latest iPhone. For his birthday, his parents took him and his friends out to lunch. At that time Abhishek had insisted they eat at McDonald’s and not at the Chinese restaurant his mother had in mind, to save money.

“He’s quite conscious about spending. I had to explain that since we invited his friends we should consider what everyone would like to eat. In fact, I’ve decided I will give him my money only after my death. I’m worried he may not take care of me,” says his mother. But she agrees that Abhishek is ready to donate to charities run by their housing society and willing to pay from his pocket. So, her fears of him being money-minded may not be entirely valid.

Dr Gokarn says, “Valuing a thing because it is useful to you, therefore spending more money on it and less on another is a good thing. It is a good value to learn. But constantly looking for cheaper things is eventually a very tiring thing to live with as you grow up. Only if parents make children stingy will they grow up to be stingy.”

Importance of Earning and Saving

Parents need to lay the foundation of a value system about money. Helping children learn the importance of earning money (through chores given to them), tracking money earned, and outgoing expenses (for their wish list items) is a good way to lay the foundation. Seventeen-year-old Swaraj Raviraj and his 13-year-old sister Shravyaa do not get regular pocket money. But they do get money for going out with friends to lunch or dinner or to the movies. They also get some money during Christmas to spend on gifts either for themselves or for friends.

While they are allowed to go the restaurant or movie of their choice, they have to give their mother Mini Raviraj details of how much they spend and on what. Raviraj says, “I don’t stop them from spending money, but they must tell me where and how much they spend. I also encourage them to save money by taking the bus instead of hailing a cab. At times they have been late for school and I have refused to call for a cab, instead telling them to go by bus,” she says.

As a result, if Swaraj takes the cab to school because he’s running late, he makes it a point to take the bus back home. Another saving tip the kids follow is to try out recipes of food they eat outside with friends. “Sometimes a restaurant we go to has good food, but is very expensive. So we try to make the same food at home. In fact I make lot of milkshakes at home,” says Swaraj. “Usually I get `600-700 if I’m going to a small restaurant and `1000 if it’s a high-end place. I try not to exceed this. Since I like going to Comic Con, I get `2000-3000 for that. And I bring back a gift for my mother.”

Shravyaa loves shopping for clothes and accessories, but only goes with her mother. She selects clothes of her choice, but is careful not to exceed `1000-1500 at one go. There have been instances when she has left clothing items at the cash counter because she overshot her budget.

Mini Raviraj’s biggest concern about giving money to her kids is that they may misuse it. “I don’t want them to be influenced by their peers and overspend. That’s why I haven’t given them an ATM card yet. But next year when Swaraj shifts to hostel I shall open an account and put a limited amount in it for his use,” she says.

Amit Kukreja, Founder, WealthBeing Advisors, feels that while Raviraj’s fears are valid, in this case neither party is inculcating the sense of saving and delaying gratification. Ideally, Raviraj should involve the children in household activities to build life skills and reward them financially for their contribution. However, he cautions, “They must watch out for one pattern; that not every activity or task given to the kids will earn money, otherwise kids will become too focused on money to do the tasks at home.”

Too Much Discipline Isn’t Healthy

A disciplined and frugal lifestyle is a good way to teach children the value of money, but it’s possible to overdo it. This kind of behaviour will not help build financial independence. Fourteen-year-old Somin Shah loves to play video games, but his mother Poonam Shah permits him to buy only one new game a year – that too, costing not more than `1000. He gets money only to go to his tuition classes or to eat in the school canteen occasionally. Other than that he gets no pocket money. The family restricts going to the movies and eating out to once a month. So far Somin has never gone to a bank by himself or operated his own bank account. But Shah plans to introduce him to banking soon and teach him how to use an ATM.

Teaching Children to Handle Money

To an extent it’s important to teach kids about handling money as it imparts a sense of independence. As children develop their reading, writing, and mathematical skills, money management tasks can be handed to them to track their expenses, say experts.

“They need not be involved in the household financial planning until they are at least 16. Our school curricula unfortunately do not cover any topics on personal finance – earning, saving, spending, investing, inflation, rate of interest etc. So the onus lies more on parents to teach them early based on their capacity to understand and follow the advice,” says Kukreja.

Dr Gokarn says, “What kind of pleasure you seek out of money will depend on how you have learned to use it; where you will use it more and where you will use it less – more on movies or clothes for someone who does not have it, and so on. Parents have to introduce these values gradually.”

priya@outlookindia.com

Paving The Way For Your Child’s Future

Education costs are rising rapidly and would be a substantial amount by the time your kid is 18 years. Planning early is key, says Anagh Pal

The first day of college will be one of the most memorable days of your child’s life. But as a parent you will obviously not want to worry about how to fund the expense. In a worst-case scenario, your child may not be able to take up a course of their choice owing to lack of funds.

Education costs are rising rapidly and estimates indicate that at 10 per cent it is higher than general inflation. Under these conditions an engineering degree that costs `10 lakh today could cost you over `40 lakh 15 years from now, and a MBA course that costs `20 lakh today could cost over `80 lakh. And this would be just the course fees.

For parents, their children’s future – especially planning their higher education – is a very important financial goal to which a lot of emotion is attached. “Many would put their retirement plans behind and focus on creating a sizeable corpus for their children. In our country, one’s future mostly rests on what they study, which is why parents feel it is very important that they save for their child’s future,” says Amit Suri, Director and CEO, AUM Wealth Management. Rather than putting away money with no clear idea of the goal in mind, it is crucial that parents have a plan in place to meet their children’s educational expenses.

Knowing how much to save

“A big challenge when planning for an education corpus is the difficulty of arriving at a fixed sum that one would need,” says Suri. Since every child is different, so is their desire to study and pursue education of their choice later in life. Given these unique individual needs, most parents will find it difficult to calculate how much they need to save. “My advice is to make a start, even if it is with small sums. You can then add to the investments over time as your child grows and there’s some clarity on the field that they may end up choosing,” Suri adds. This said, parents can calculate a ballpark figure and start investing diligently.

Start early

As with any other investment, time is a key factor. The longer you put off planning for college (maybe because of other reasons like investing in a house, or a car, or a foreign trip) the more difficult it becomes. “Today, one needs to start planning for the educational needs of the child just after the child is born. Only then will one be able to build a corpus sufficient to properly fund their education,” says Suresh Sadagopan, Founder, Ladder 7 Financial Advisories.

Invest in equities

With a long investment horizon of over 10 years, investing mostly in equities is crucial as market volatilities balance out over a period of time. Investing only in debt products will not give the returns required to create a desired corpus. “Mutual funds offer a wide variety of funds to choose from – equity, debt, hybrid. One can invest mostly in equity funds if one is starting early on with investments for the education of the child. If the parents are risk-averse, they can tone down the equity exposure somewhat,” says Sadagopan.

The good news is that education loans are available and parents should encourage their children to take loans to fund a part of their education. “This inculcates responsibility in the child and also takes away some pressure from the parent. Also, the child can take advantage of the interest amount of the education loan and deduct that and get a tax advantage when they start earning,” says Sadagopan. So plan ahead. Your child’s future is in your hands.

A Bank Account For Juniors

Banks offer specially designed children’s savings accounts that give them a head start on the concept of saving and managing money. Anagh Pal takes a look at what’s on offer

You might have had a piggy bank when you were little, and so would your kid. As she grew up you would have asked her to save some of her pocket money and also put any cash she received as gifts into her piggy bank so she could buy something later.

These simple exercises would hopefully have introduced your child to the concept of money and the importance of savings from a very early age.

Kids’ Own Bank Account

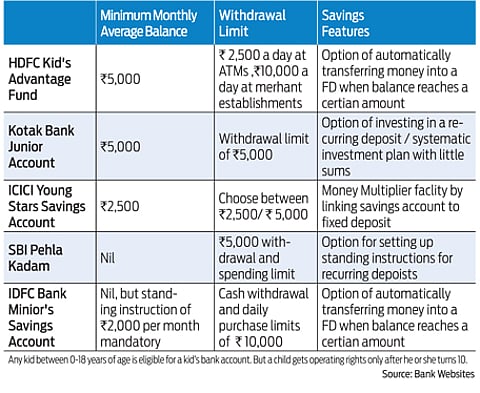

When your child turns ten it’s the right time to open a bank account for her. Though savings accounts for children can be opened for anyone below 18, banks allow self-operated accounts for minors from the early age of ten.

A children’s bank account works like any other, but with some unique features. Children over the age of 10 are given a personalised debit card, which they can use to withdraw money at different ATMs. The debit card and cheque book are issued in the name of the child, which not only gives her a sense of financial responsibility but also teaches her the basics of banking.

Parents can transfer the pocket money every month to their child’s bank account through standing instructions. “Our experience has shown us that when children have their own bank account, it gives them first-hand exposure to money and instils the savings habit in them early in life,” says Ambuj Chandna, Senior Executive Vice President and Head – Retail Liabilities, Investment & Payment Products, Kotak Mahindra Bank.

Encouraging Kids to Save

Even small amounts of money invested on a regular basis would encourage kids to save. “An early introduction to the benefits of savings and investment will help kids in managing their finances better,” says Chandna.

Many banks have the option of converting excess funds into a fixed deposit once the balance in an account crosses a certain amount. Banks will also allow you to contribute a certain amount every month, starting from sums as small as `1,000, to recurring deposit accounts or for SIPs in mutual fund investments.

“The child can watch her pocket money grow and allocate the savings towards achieving different goals. Setting goals teaches kids the value of money and encourages them to budget for things they want. This gives them a reason to save,” says S Sampathkumar, Senior Executive Vice President, HDFC Bank.

What’s more, banks waive minimum balance requirements when savings or investments are made through such an account. It’s time your child learned the basics of financial planning. This will surely help her manage money better in the future.

Mutual Funds: The Way To Go

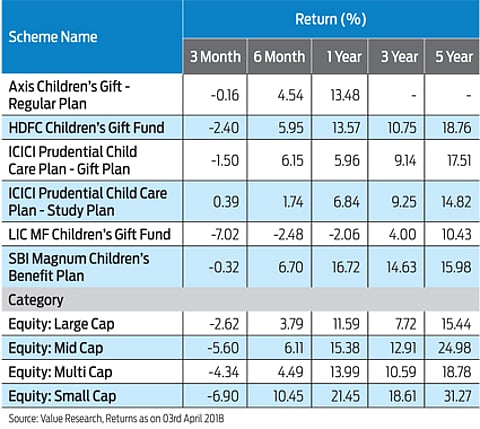

Mutual fund companies offer specifically designed child plans to meet future financial requirements for your child. Outlook Money takes a look at what’s on offer.

When creating a corpus to fulfil the financial needs of education and marriage of your child, mutual funds are the best bet. “Mutual funds indeed emerge as an excellent choice for the fulfilment of your financial goals of education and marriage of kids as they enable you to save consistently through Systematic Investment Plans (SIPs) and come with a potential of higher returns as professional fund managers manage the funds,” says Sundeep Sikka, ED and CEO, Reliance Nippon Life Asset Management Limited.

There are several child plans in the market which are specifically designed for investors who want to set aside money to meet the future needs of their children. Here is how they work.

Investment mix

These funds would invest in a mix of equity and fixed returns.. “The ICICI Prudential Child Care fund uses in-house asset allocation model to maintain an effective equity investment level, which would endeavour to be in the range of 65-100 per cent. The scheme looks to invest in a blend of large, mid and small-cap stocks while the debt component will be invested in debt securities and money market instruments.,” says Raghav Iyengar, EVP & Head - Retail & Institutional Business, ICICI Prudential AMC.

Lock-in period

These funds also come with a lock-in period which ensures that the parents have a discipline in investing in the fund and the child has access to it for his or her needs when required. Says Chandresh Nigam, MD & CEO, Axis Mutual Fund , “The Axis Children’s Gift Fund has a lock-in such that the money that is set aside will only be available for redemption at the end of 3 years or when the minor crosses the age of 18 - whichever is later. This lock in period will further extend to 5 years to align with SEBI guidelines.” Further being an open ended fund, it is not necessary that the corpus that is accumulated in this fund be spent only at age 18 but rather there is a flexibility that it can be used as per the actual needs at any later date.

Should you invest

These mutual fund schemes are no different in design than any other mutual fund scheme and generic open-ended mutual funds can be used for the same purpose too. “Somehow the mere mention to the word ‘child’ in a financial instrument drives people to stay disciplined with investments and also check their habit of redemptions on flimsy grounds. The performance of some of these funds has also been good to suit first-time investors,” says Amit Suri, director and CEO, AUM Wealth Management.

Invest regularly to secure your child’s future.

Protect Your Child’s Future

Child-specific plans offered by life insurance companies not only help build a corpus for children’s future needs, they also come with protection features that will cover parents

Life goals such as children’s education and marriage will be foremost on every parent’s mind. There are several investment avenues to choose from for this purpose. A child life insurance plan is one of them.

“While such a plan ensures a constant growth in your investment over a chosen period, it also provides financial security through life insurance coverage for your children’s goals, even if you are not around,” says Kshitij Jain, MD and CEO, Exide Life Insurance.

These plans also come with a ‘waiver of premium’ feature. “If a parent is setting aside some money for the future of the child and has opted for a child Unit Linked Insurance Plan (ULIP), product, which usually comes with a waiver of premium feature, the insurance company will continue to fund the future premium towards meeting the goal in case of death of the parent.” says Subhrajit Mukhopadhyay, Chief & Appointed Actuary, Edelweiss Tokio Life Insurance.

Traditional Plans and ULIPs

Life insurance companies provide both traditional and ULIPs. The former come with guaranteed payouts, where you can either opt for a lump sum payout at maturity or periodic payouts based on a percentage of the sum assured. However, considering the low returns, such a plan may not be sufficient to build the required corpus for your child.

In case of ULIPs, returns are market-linked. “ULIPs offer an opportunity to build wealth over the long term by benefiting from the growing market potential. They also offer a choice of fund options ranging from equity to debt, keeping in mind different risk appetites,” says Jain. While some life insurance companies offer child-specific ULIP plans, many offer ULIP plans where the parent can opt for a specific ‘child’ benefit.

Plan Ahead

To determine the premium to be paid to create an amount required to fulfil your child’s education goal, you should have an idea of the amount required (keeping inflation in mind), be aware after how many years the money is required, and know the expected rate of return.

“By keeping the above-mentioned points in mind and doing a reverse calculation, one can determine the approximate amount required to be invested either monthly or annually,” says Jain. Websites of life insurance companies will have calculators to help you do this.

Opt or Not?

Benefits of a child ULIP can be achieved by a term insurance and investing appropriately in mutual funds and other investment options. “However, if someone wants an all-in-one product that manages all these, a child ULIP can be considered,” says Suresh Sadagopan, founder, Ladder 7 Financial Advisories.

“One of the advantages is that one need not be very financially savvy to navigate his investments. In case of unbundling, one has to ensure that the fund is managed exactly the way it should be and earmarked for each and every goal and one has to keep on adjusting and rebalancing. In case of a ULIP, one can opt for passive investment strategy” says Mukhopadhyay.

As a parent, it is your duty to invest in and protect your child’s future. Proper planning will always stand you in good stead.

Raising Money-Savvy Kids

Ideally we should be telling our bank how much money we have, instead of the bank informing us of the account balance

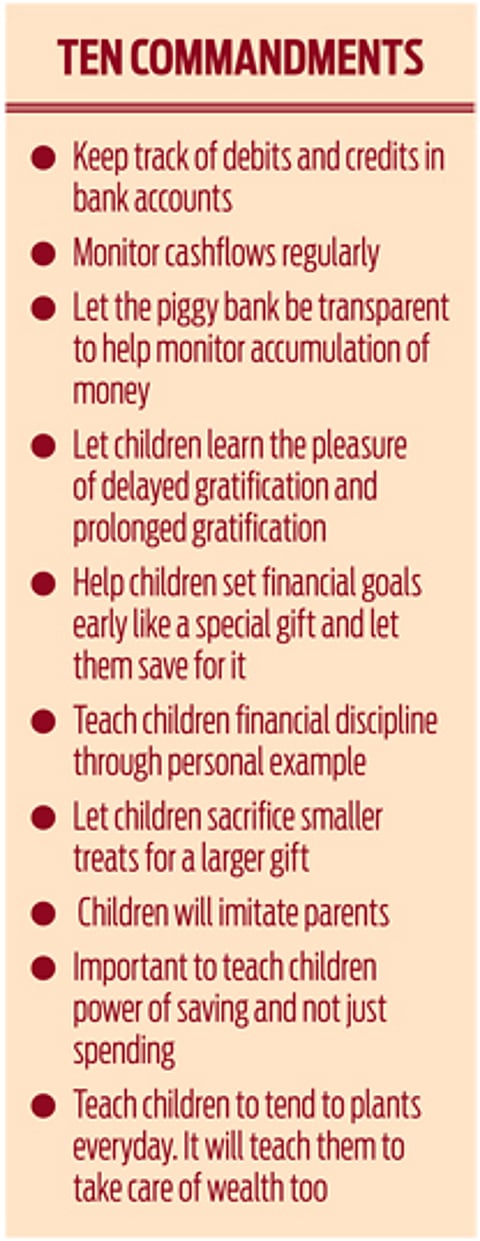

Wealth creation is a habit and, therefore, it needs to be inculcated in children from an early age. The faster it is ingrained, the easier it is to make it a way of life. We don’t have to wait for kids to become adults to teach them money lessons. The later you do it, the more difficult it will be to form good financial habits.

My daughter Sanaa is 16 now and she tracks her expenses and saves money for future purchases from her pocket money. She also handles her own banking. She has started writing her bank passbook more recently but we ensured that she went to the bank to get the family’s bank passbooks updated from the time she was 12 years of age.

Most of us don’t know how much money we have in the bank. It is the bank that tells us how much money we have, in the form of statements and text messages. However, in reality it is us who should be telling the bank how much money we have. Keeping a parallel track on debits and credits is of crucial importance. Over a longer period of time, this will help in knowing the cashflows throughout the year. What this would do is to make us more aware of inflows and outflows, such that in case of something going amiss, we would notice it.

So, from a very early age, my daughter has been conscious of her priorities and focused on optimum utilisation of her resources, which is her pocket money. For example, there have been instances when she would go out for coffee with friends but skip the coffee just to save money. Last year we had planned a trip to England, and she walked in scorching April heat while returning from her tuitions just to save money. She saved `17,500 over eight months. She had decided what she wanted to purchase while abroad and had started dreaming about it.

The moment we start dreaming about something, we start getting inner happiness. The longer we do it the more prolonged will be the happiness. If we decide to travel to Switzerland after six months, we start planning for the trip by talking to friends and visiting websites. All this gives us a thrill. Even when we sacrifice immediate expenses, it doesn’t pinch us at all. This is because we have a future materialistic desire fulfilled. It is like giving a bribe to our own self. Therefore, without spending on a trip to Switzerland, we get excited, which is prolonged gratification. Any kind of saving or investing with a financial goal in mind gives prolonged gratification, unlike a random goal or savings.

Sanaa’s money training started the day she was given money to spend in school. When she asked us for money that she could spend at the school canteen, she was asked to make a note of it. Now, whenever the family goes on vacation, she’s the official book keeper. Parents today are exposing children to the power of spending money but are failing in their responsibility towards giving a complete picture – which includes earning, saving, and investing.

As an only child, Sanaa has been told that she can pursue a career of her choice. But she will have to learn book-keeping, accounts, and concepts of capital markets if she wants to inherit wealth. Alternatively, she has been told that the basic needs of food, clothing, and shelter would be taken care of and rest of the wealth would be returned back to society from where it has come.

There are a few things we have been practising with our daughter from an early age. When she was very young, we made her sow seeds in a pot and she was expected to water the plant regularly. Over a period of time she saw the seeds sprouting into plants. Firstly, this is a good habit in all aspects. From the perspective of money training it will help explain the concept of nurturing wealth.

Other than this, we also gave her a chocolate bank when she was younger. It was akin to a piggy bank. She learned to deposit the chocolates in the bank, from which she could eat chocolates twice a week. Each time a chocolate was deposited in the bank she saw the pile build up – and reduce in number whenever she withdrew. This helped her learn the importance of inflows and outflows.

We also gave her two piggy banks. In one bank she deposited currency notes that she received from elders on auspicious occasions. This piggy bank was shaped like a bus. The logic was that the bus was going to the bank. Therefore, all currency notes in her piggy bank would eventually go to her bank account. Another piggy bank was a transparent glass jar. She deposited her coins in it. Next to the jar there was a picture of an object – usually a toy that she wanted to purchase out of her savings. This was to help her set financial goals. Since the piggy bank was transparent, she could see the pile of coins increase when she deposited money, and see it reduce when she took money out of it.

She was born on December 18th. Therefore, every month on the 18th she got to purchase a gift of her choice. There was no other buying throughout the month. This brought in discipline. In case she wanted a larger gift, she had to miss her regular gifts for a couple of months. This taught her the concept of delayed gratification.

All kids wish to imitate their parents, so it is of crucial importance how adults behave. She has over the years observed me and my wife write our daily expenses, and she does the same. We must practise what we preach, or else conflicting messages are sent out. If you’re not financially disciplined, don’t expect your children to be money-savvy. Therefore if you do not write the family budget or stay disciplined with savings, your child will not develop the habit.

Gaurav Mashruwala

Financial Planner and Author of Yogic Wealth

Deepali Sen Founder, Srujan Financial Advisers LLP Author of Why Greed is Great

Teaching Kids how to Spend and Save Effectively

Kids must learn to strike a balance regarding money and reach an understanding between its use and conservation

For me, the following three quotes sum up the essence of making kids money-conscious.

“Within the child lies the fate of our future.” –Maria Montessori

“What we instil in our children will be the foundation upon which they build their future.”

–Steve Maraboli

“If a person gets his attitude towards money straight, it will help straighten out almost every other area in his life.”

–Billy Graham

Money is a powerful tool. It’s power in its most raw form — one that needs to be understood and, eventually, used effectively for self and society.

The respect for money, its value in our lives, and the right attitude towards it has to be inculcated in kids sooner rather than later. While we may not want our kids to become bean counters, money-minded, or overcautious, we would definitely want them to be aware of the cons of spending – or saving – too much. It’s vital that they learn to strike a balance regarding money and reach an understanding between its use and conservation, and this would call for appropriate nurturing.

The good news is that kids are far more perceptive and intelligent than we may want to give them credit for. They witness the acquisition and use of money from the day they are born. We work and get paid; spend the money for our needs (goods and services); invest for tomorrow (generate money from money); take loans; and help others financially as and when needed.

Then, isn’t educating kids about money just a case of joining the dots? Decoding the dynamics of money, its sources, and its uses provide kids with a perspective on the cycle of karma early in life. It helps them understand that money is not an entitlement; it’s something one gets in lieu of giving something in return.

Ideally, we should create our own informal curriculum for kids of various age groups. The objective should be to emphasise on the intuitive part when they are really young, and move to the mathematical, ethical, and practical parts as they grow older.

Kids under five

1 How do we earn money? The fact that when we give something we get something in return.

2 Dignity of labour – While various jobs may pay differently, each has an equally important role to play and we need to respect people from all strata of society.

Kids will imbibe all this better if narrated in the form of stories.

Kids aged 6-10

1 Uses of money – What can it buy?

2 Money can’t buy everything – Love, respect, and trust need to be earned.

3 Contingency funds – We need to keep money aside for a rainy day.

4 Budgeting pocket money – Money comes in like a tortoise and goes away like a hare.

Kids above 10

1 Role of banks.

2 How money fuels growth and development.

3 Importance of loans and charity, and the difference between the two.

4 How inflation erodes our wealth and, therefore, time value of money.

5 Why savings are needed, and how they are different from investments.

6 The need to have money for today as well as tomorrow.

7 The importance of investing right; of striking the right balance between risk and returns. No pain, no gain.

The RBI recently allowed 10-year-olds to open and operate bank accounts on their own. This has helped provide an institutional framework for the popular practice of pocket money.

It’s equally important for kids to understand the spiritual aspects of money. Why do we have both wealth and poverty? Or the fact that wealth lies in ideas, and that we can attract it through our thoughts. We become in life what we see ourselves as. Have-nots may never become haves if they stay preconditioned to their current reality, and keep lacking the belief, the gumption, the aspiration, and the execution skills needed to make it work.

Lata Dyaram, PhD Associate Professor, Department of Management Studies, IIT Chennai

Shaping the Right Attitude Towards Money

We can’t ignore the fact that we are a product of our parents’ approach towards money, in either embracing or rejecting it

All of us would love to teach our kids the value of money and ways to save and invest, but how many of us hold money as a topic of conversation with our kids? As we all have to deal with money throughout our lives, parents must give their children a head start in money lessons.

In the times we live in, where kids have more ways of spending money than saving it, it may be necessary for parents, schools, and banks to step into a more proactive role. Here, we shall highlight some perspectives keeping the role of parents as the focal point.

An emotional approach

Most money matters are attitudinal and emotional than financial. If we start pondering on where our attitudes come from, we can learn to deal logically with money than emotionally. While some can’t cling on to money and trap themselves in deep debt, others compulsively wrestle over every rupee they need to spend. We can’t ignore the fact that we are a product of our parents’ approach towards money, in either embracing or rejecting it.

Most parents knowingly or unknowingly pass on their functional or dysfunctional money habits to their children. Most hesitate to talk to their kids about money simply because they do not want their kids to worry about it. However, being realistic about the financial situation will only help save them from discontentment in the long run. Children learn a great deal on how to handle money by watching their parents.

Starting early

Regardless of a family’s economic situation, it’s important that children understand the value of money from an early age. While it is fine to incentivise children’s achievements (good grades, doing chores, etc.), pocket money must be offered with necessary guidance and their expenses must be monitored. It is also important to allow them to waste a little; as such mistakes will help them to learn budgeting. Treating money as a commodity will help combat indulgence. Make them aware that, just like food, money doesn’t have to be consumed all at once – they should use some and save some.

It’s also crucial to understand money from a temporal angle to stay relevant in these modern times. While our parents might have hung on to every rupee, it’s important to realise that not all spending is irresponsible in these days of instant gratification. For example, at one end, gifting is a known expression of love and care for family and friends. However, there are many who expend monetarily to express their love. Soon, this may make kids equate money with love.

Conversely, there are cases where we do not spend money but choose to spend quality time in making some things from scratch for kids and forego opportunities to bond. These often send confusing messages to children. To the extent that it acts as an exchange for what we need today and tomorrow, money becomes valuable. Once this is learnt, it becomes easy to invest in/exchange what we truly need today and figure out ways to meet our future needs.

Exposure to reality

Wealthy parents can expose their children to the have-nots and the harsh realities of life in some form or the other to nurture the value of giving, sharing, and a sense of responsibility. Involving kids in the process of giving will work well. They will not only learn the importance of giving, but also understand how to do some due diligence before giving money away. As children get older, gradually involving them more in financial decisions will prepare them for their lives ahead. This signals to them what can be achieved through a combination of investing, earning, and saving.

No matter how much we are taught as kids, there is much about money and its handling that we have to understand on our own.