Having a retirement free from money woes isn’t necessarily about being a billionaire, but rather planning smartly to have no worries about money when you actually retire. No wonder retirement signifies a new chapter in your life; a new beginning that brings new freedom and opportunities to enjoy the undiscovered parts of life. By staying focused on building a retirement plan and identifying ways to sticking to the plan, you can put yourself in a better position to have a retirement that allows you to achieve your goals.

Planning for retirement

There are all sorts of issues you need to consider such as protection, when planning for your dream retirement

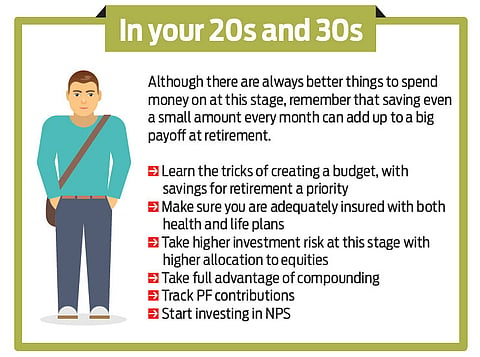

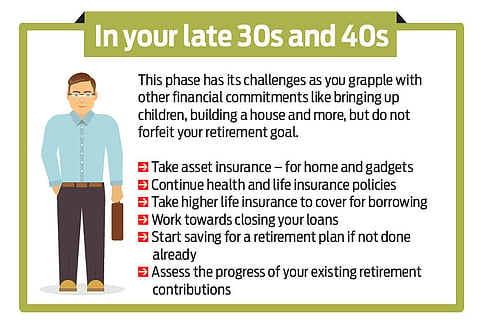

Most people in their 30s are not clear about their financial plan, forget retirement plans. So typically, one tends to put on hold any such plan by focusing on more pressing needs—buying a home or planning for their children’s future before thinking of retirement. “There are so many pressing financial needs; you have to strike a balance for all of it to come true and also have money to retire,” says Mumbai-based Mandar Bhatt, 53. As the only earning member in a family of four, his is a typical Indian household where needs always outweigh resources. Yet, with deft planning, he has a plan that he is putting to good use.

A point to ponder is the fact that unlike retirement, which needs to be self-funded, goals like buying a car, purchasing a home or even educating children can be managed by way of loans. When it comes to your retirement, it is for you to fend for yourself, with practically no other support.

Creating a retirement plan

We are now living in an era where financial uncertainties loom large— high market volatility, low interest rates and no defined benefit pension. It means the onus of saving for your retirement completely rests with you and no one else.

You have several different choices to save and invest your money for retirement. You don’t have to pick just one, and in fact, many people use a combination of different types of plans to achieve their retirement savings goals. There are numerous financial instruments, from the traditional bank deposits to those that are tailored towards retirement like the NPS, retirement-linked mutual funds and the provident fund. At a rudimentary level, all these are financial instruments that help you build a corpus that you can use when you retire.

“Broadly, like any financial plan, you have to put your money in a mix of assets—fixed return and market linked schemes” says 46-year-old Kolkata-based Arup Mitra. Mitra has parked his money into mutual funds, insurance, banks, and even stocks to manage his finances, including his retirement. There are financial instruments like the ubiquitous Employee Provident Fund (EPF) and the Public Provident Fund (PPF) which offer fixed returns on contributions towards retirement, and also market-linked products like the NPS, retirement options from life insurers and mutual funds.

Your choice of financial instruments depends a lot on your risk profile, which means you need to be careful to evaluate the risk adjusted returns from each investment product and its ability to help you achieve the target. The concept of risk-adjusted returns evaluates returns from different investment products on the basis of risks that are taken to achieve those returns. For most risk-averse Indians, the choice rests with the fixed return instruments, which address concerns over risks, but fail to achieve returns which can help build wealth in the long run.

Accumulation phase

Oft-missed but one very important financial instrument that you need as long as you live is health insurance. Unlike the flexibility of choosing other financial instruments targeted specially for retirement, health insurance is a must, irrespective of what your age or stage in life is. There is also tax exemption available under Section 80D on premiums paid up to Rs.30, 000 for senior citizens.

The first choice product to build a retirement corpus is the Employees’ Provident Fund or EPF. All establishments that employ 20 or more people have to offer this benefit to employees. The rate of return varies each year and is 8.75 per cent at present and up for review. EPF offers deduction up to Rs.1.5 lakh under Section 80C and the interest from EPF is tax free as well as the withdrawal, if held for five years or more. But, it is rare that one uses the EPF till retirement—shifting jobs as well as facility of partial withdrawals before retirement makes the EPF an emergency fund to dip into for most Indians; rather than something to depend on for retirement.

If you are not part of a formal employment to make contributions towards the EPF, then you have a closer cousin to consider—Public Provident Fund (PPF), which is also a government scheme under which you get an 8.75 per cent annual return. The minimum investment is Rs.500 in a year while the maximum is Rs.1.5 lakh which offers tax benefits under Section 80C. The money is locked for 15 years, with flexibility to extend the account and partial withdrawals from the seventh year.

“These days, companies also offer a choice by encouraging contributions to the NPS, instead of the EPF,” says Sumit Shukla, CEO, HDFC Pension Management Co. The National Pension System or NPS is a perfect retirement product open to all individuals across the country. Mandatory for government employees, the NPS also provides tax benefit in the form of deduction under Section 80C. The NPS, being market-linked with a choice of investment basket to pick from, is fast-emerging as an accumulation instrument worth considering. In fact, there is an additional Rs.50, 000 deductions to grab under Section 80CCD (1B) this financial year. The advantage with NPS is that the fund options within it allow you to choose a scheme that has varying equity exposure, which is in line with your risk tolerance. So, you could go from the very safe fixed return option to the one that has 50 per cent exposure to equities. With time, the choice of funds to invest in within the NPS will see additions, which could someday even touch 100 per cent into equities.

To make your retirement corpus meaningful, you need to invest in equity-linked instruments such as stocks and mutual funds. Although you can invest

in a plethora of mutual fund schemes and stocks, retirement-linked mutual funds are also finding takers now. “I clearly believe mutual funds play a very important role for the retirement planning because for the long term, both wealth creation and income generation are important,” explains Sundeep Sikka, CEO, Reliance Capital AMC. The low cost advantage of both mutual funds and the NPS make them one of the best retirement planning options. There are also life insurance plans that go into the accumulation phase of retirement plans. “There are traditional and unit-linked plans to accumulate for retirement, depending on your needs. Then there are whole-life insurance plans in which a person gets regular benefit after a certain period of the policy term till his death,” says Anuj Agarwal, MD and CEO, Bajaj Allianz Life Insurance.

Money flow in retirement

The best retirement plan is the one which starts paying you money the moment you stop working for money. Although there are several products that focus on the accumulation phase, there are very few financial instruments that take care of the payout phase or income flow in your retirement. One of the reasons for the popularity of products favouring accumulation is the available tax exemptions with them, unlike annuity, which is treated as income and taxed accordingly, when you start receiving it.

It, thus, becomes very important to make income in retirement tax efficient. There are several ways to do this—one way is to park your money in instruments that are tax free at the time of redemption, such as the EPF and the PPF. The other way out is to put money in financial instruments that can be used in a tax efficient manner in retirement, such as investment in stocks and mutual funds. These are so structured that you can redeem your investments after just one year of holding in equity and related schemes for long-term capital gains to kick-in, which is nil in their case.

There is also the systematic withdrawal option available when investing in mutual funds so that you can create an income stream depending on your needs. This way, you can create an income stream to meet your needs. “I have savings and investments in a mix of assets, which I know can be used depending on my needs when I retire,” explains Mitra. There are many who have two homes—one to live in and the other to live off. There are also ways in which you could structure investments in fixed return instruments like the NSC and even bank deposits to work as an income stream by timing their maturity.

From time to time, there are also infrastructure bonds issued by public sector enterprises that are available to investors, which suit the temperament of those who are retiring or have retired. These are favoured for their safety and marginally higher interest pay out than other prevailing fixed return instruments. Whatever be the way, remember that changing social norms are pointing more towards the need to be self-reliant during one’s sunset years. To do that, you need to not just start early, but also do so smartly by using a mix of financial instruments to maximise the outcome.